- Ah, Bitcoin, that capricious creature, now grappling with a formidable resistance at $102,350, while a cozy support lurks around $96,147, like a loyal dog waiting for its master.

- Market sentiment, that fickle mistress, remains in a state of delicate equilibrium as transaction volume wanes, hinting at a tempest of short-term volatility just around the corner.

Our dear Bitcoin [BTC] has recently reclaimed a critical support zone, nestled snugly between $96,475 and $99,360, as if it were a cat finding the sunniest spot in the room, signaling a potential bullish momentum that could make even the most stoic investor raise an eyebrow.

At the time of this scribbling, Bitcoin’s price was a tantalizing $98,079.85, reflecting a modest 0.91% drop over the past 24 hours—oh, the drama! 🎭

Despite this minor hiccup, Bitcoin’s overall momentum remains as robust as a bear in hibernation, especially with the tantalizing $102,350–$103,900 supply wall looming like a mirage in the desert. Should Bitcoin breach this level, we might just witness the next act in its bullish opera.

What does Bitcoin’s chart reveal?

The illustrious king coin’s price chart reveals an incoming inverted head and shoulder pattern, a bullish signal that whispers sweet nothings to the hopeful. The price has been consolidating between $96,147 and $102,806, forming a critical resistance zone that could make even the most seasoned traders break into a sweat.

Bitcoin is currently testing this zone, and if it manages to hold above $96,147, it could very well break through the $102,350–$103,900 region, striding confidently towards $104,000 like a peacock flaunting its feathers.

Moreover, the Relative Strength Index (RSI) was at a rather unremarkable 44.45 at press time, indicating that BTC is inching closer to oversold conditions—oh, the irony! 🥴

Thus, Bitcoin may experience a short-term pullback or a delightful consolidation before gathering enough strength to shatter the $102,350 supply wall like a piñata at a birthday party.

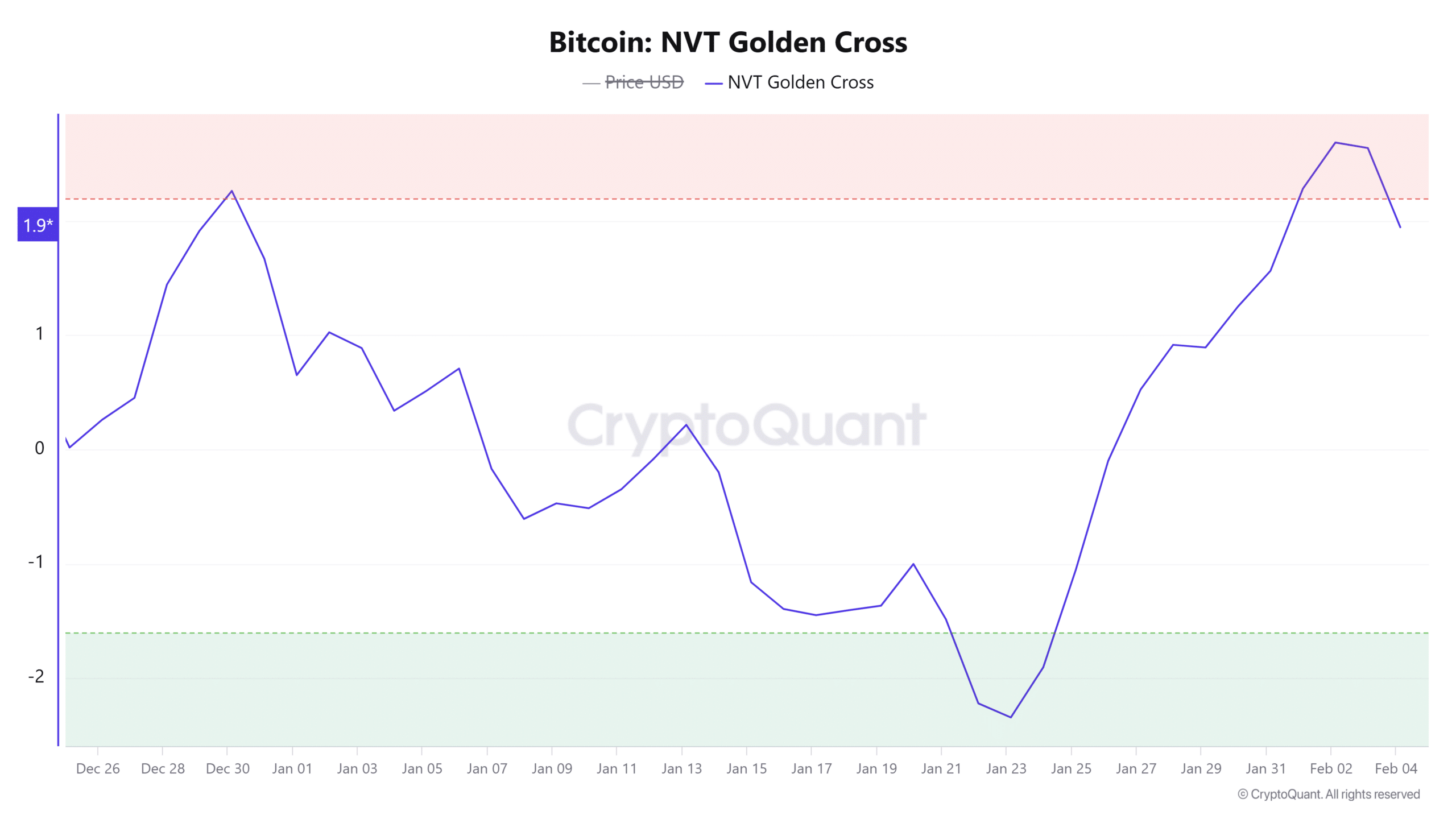

What is the NVT Golden Cross telling us?

The NVT Golden Cross indicator, that enigmatic oracle measuring Bitcoin’s network value to transaction volume, revealed a 24-hour percentage change of -23.09%. A decline in transaction volume relative to BTC’s price increase suggests that the rally may not be fully supported by network activity—like a party without music. 🎶

Although BTC remains bullish, the lack of sufficient transaction volume could signal that the rally may lose steam, much like a balloon slowly deflating.

Therefore, if transaction volume does not pick up soon, Bitcoin may experience a brief pullback before resuming its upward trend, akin to a sprinter pausing for breath before the final lap.

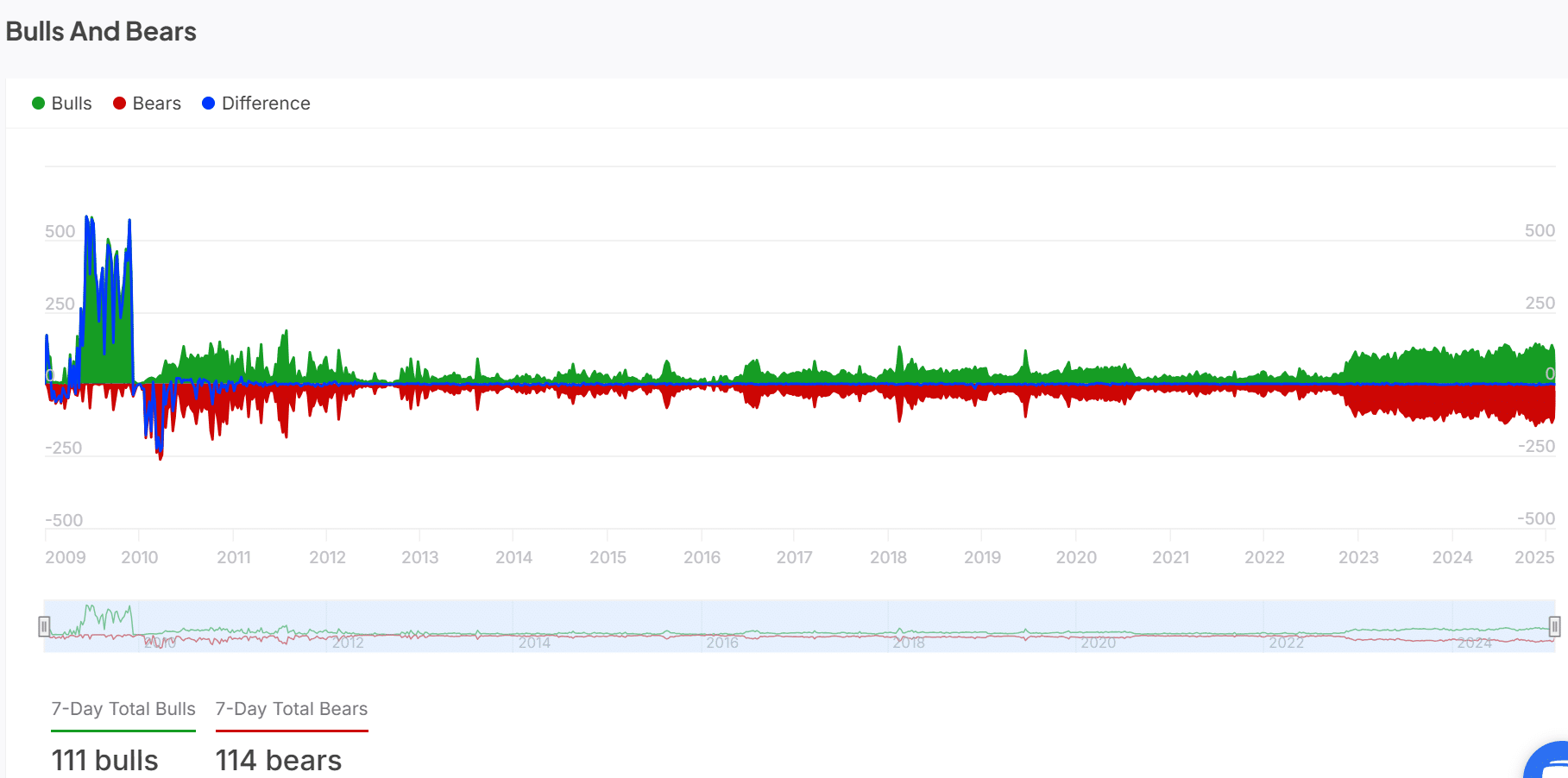

Bulls vs. bears: Who has the upper hand?

Market sentiment reveals a fierce contest between bulls and bears, with 111 bulls squaring off against 114 bears in the past week. The market sentiment remains as balanced as a tightrope walker on a windy day.

Despite some bullish outlooks, bear pressure persists, signaling that BTC could face resistance as it approaches the $102,350 supply wall, like a knight facing a dragon.

The outcome of this tug-of-war between the bulls and bears will likely determine whether Bitcoin can break through this resistance and continue its ascent, or if it will be sent back to the drawing board.

Long vs. short positions: What are traders expecting?

Bitcoin’s Long/Short Ratio reveals that more traders are betting against further price increases. At

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Moana 3: Release Date, Plot, and What to Expect

- How to Get to Frostcrag Spire in Oblivion Remastered

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Doctor Doom’s Unexpected Foe: The Dark Dimension’s Ultimate Challenge Revealed!

2025-02-05 13:16