- Well, folks, BTC‘s taken a little tumble—down by 0.88%, stuck in a merry-go-round of price range.

- Is the market’s price bottom still playing hide and seek? The Long/Short Ratio says, “Not today!”

As the week unfurled like a well-trodden blanket, the crypto market danced in volatile splendor. Both Bitcoin and its slap-happy altcoin buddies oscillated in a frenzy, with Bitcoin’s[BTC] price flitting between $94k and $100k like a moth to a flame.

In these swirling winds of speculation, many a weary investor scratched their head, pondering whether the crypto market had finally found its bottom—or if it simply misplaced it under the couch.

Why, oh why, hasn’t the market found its bottom?

According to the wise sages at Alphractal, the elusive market bottom remains unseen, its shadowy presence indicated by a Long/Short Ratio crossover. Past whispers of market wisdom tell us that bottoms typically appear when Bitcoin’s Long/Short ratio decides to mingle with the Average Long/Short Ratio of altcoins.

When this dramatic crossover occurs, it’s like watching a high school prom—suddenly, investors fancy Bitcoin over the less popular altcoins.

As of this very moment, our dear BTC’s Long/Short Ratio rests at a cozy 1.48, while the altcoin brigade boasts a raucous 2.55. No crossover in sight since September 2024—oh, what a tragic love story!

With no melding, it’s clear as day: investors still fancy altcoins more than they do Bitcoin—sorry, BTC.

The tale the charts spin

Even with altcoins basking in the limelight, Bitcoin holders remain as optimistic as a cat in a sunbeam.

Current market conditions paint a picture of Bitcoin rising, but don’t forget the frequent corrections, like a merry-go-round that never quite stops spinning.

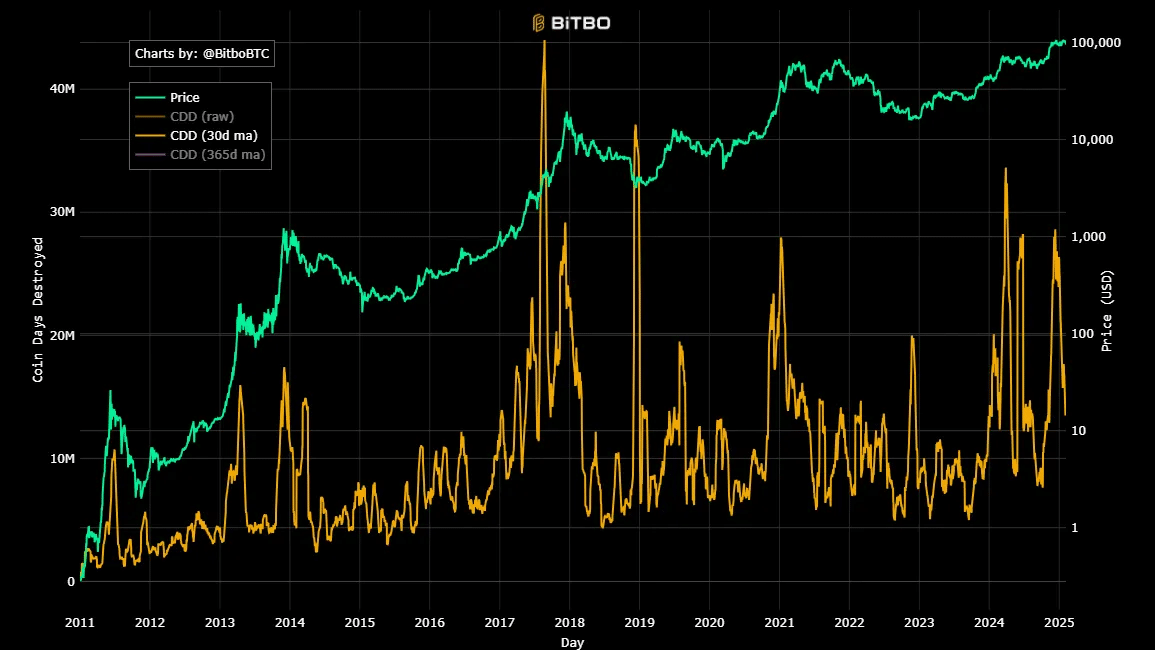

AMBCrypto has sniffed out some bullish vibes among the Bitcoin crowd, as Bitcoin’s CDD has taken a sharp nosedive this past week. When the Coin Days Destroyed go down, it means long-term holders are sticking to their beloved BTC like a toddler to a stuffed animal.

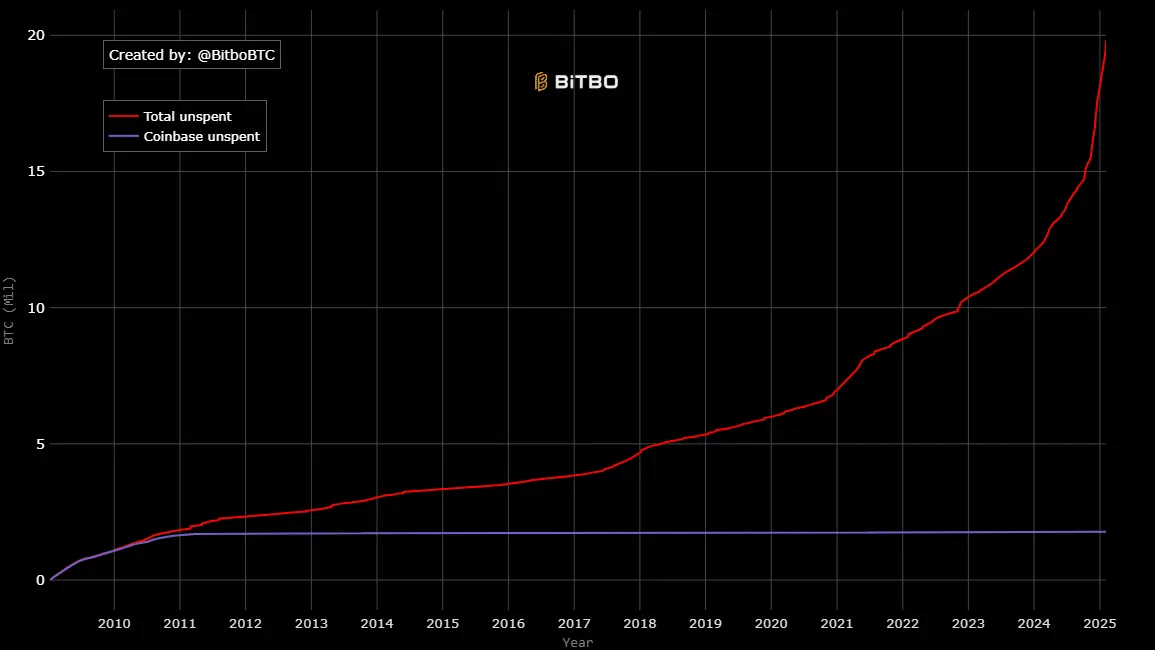

These minute sentiments are echoed by a nice little spike in total unspent dormant coins—spiking up to 18.1 million. This charming rise indicates that LTHs refuse to part with their precious BTC.

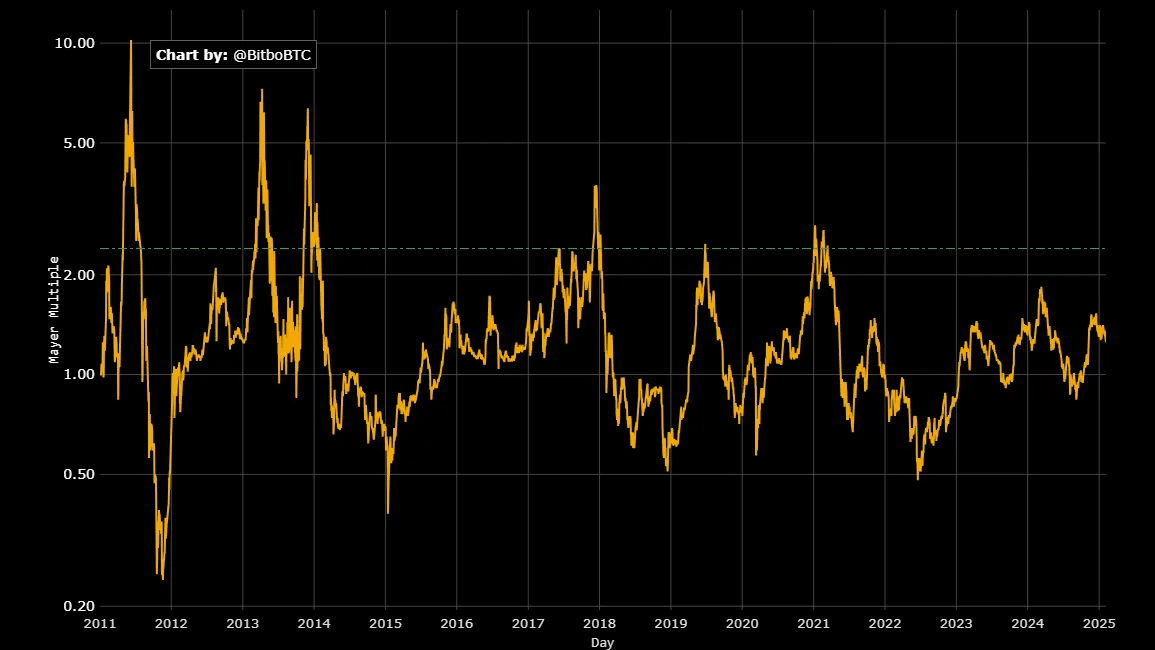

And let’s not forget Bitcoin’s Mayer Multiple, which has dipped to a modest 1.25. Historically speaking, we’d be shaking our heads at BTC trading above 40%—not today, my friend!

At 1.25, it suggests Bitcoin is still lounging 25% above its 200DMA, whispering sweet nothings of bullish momentum. And in past cycles, bull markets truly let loose when they’re nestled between 1.2 and 1.5. Even now, BTC has plenty of room to shimmy upward.

So here we stand—still on the hunt for the bottom, with the top teasing us in the distance. The crypto market seems ready to play hopscotch with the rising prices, interspersed with those pesky corrections.

In the end, the long-term Bitcoin believers remain hopeful, expecting their precious to climb back to $99,500 and maybe even hurdle over that cheeky $100k again.

– Read Bitcoin (BTC) Price Prediction 2025-26

Yet, with a recent dip, if the macro skies remain gray and unpredictable, we might just see BTC dance back down to $94k. Poor altcoins will continue their sideways shuffle, waiting for buyers to re-emerge like kids spotting the ice cream truck.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- How to Get to Frostcrag Spire in Oblivion Remastered

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Doctor Doom’s Unexpected Foe: The Dark Dimension’s Ultimate Challenge Revealed!

- tWitch’s Legacy Sparks Family Feud: Mom vs. Widow in Explosive Claims

2025-02-05 14:21