As I sat by the window, sipping my tea and staring out at the gloomy Russian landscape, I couldn’t help but think of the TRON network and its recent USDT minting activities. It’s a bit like watching a train chug along the tracks, isn’t it? You’re not quite sure where it’s headed, but you can’t look away.

It seems that USDT minting on TRON has been on the rise, nearing an all-time high. But, much like the Russian winter, TRX‘s movement has been rather…uninspired. Whale and retail investor activity has dropped, leaving one to wonder if the market is simply going through the motions.

But, as I always say, “The sea is calm, but the depths are treacherous.” And indeed, despite the lackluster activity, TRX has managed to gain 1.49% over the last 24 hours. A small victory, perhaps, but a victory nonetheless.

Now, I know what you’re thinking. “What’s behind this surge in USDT minting?” Ah, my friend, it’s quite simple really. The demand for stablecoins is on the rise, and TRON is reaping the benefits. But, as we all know, the market is a cruel mistress. She can turn on you at any moment, leaving you high and dry.

And speaking of which, the current supply of USDT on TRON is approaching its previous high. A sign of strong demand, perhaps, but also a warning sign. After all, as the great Russian proverb goes, “A fish is caught not by the hook, but by the bait.”

But I digress. The real question on everyone’s mind is, what’s next for TRX? Will it continue to rise, or will it succumb to the bearish trend? Ah, my friend, only time will tell.

As I always say, “The future is a mist that slowly clears.” And indeed, the charts seem to be indicating a potential major price shift. But, as we all know, the market is full of surprises.

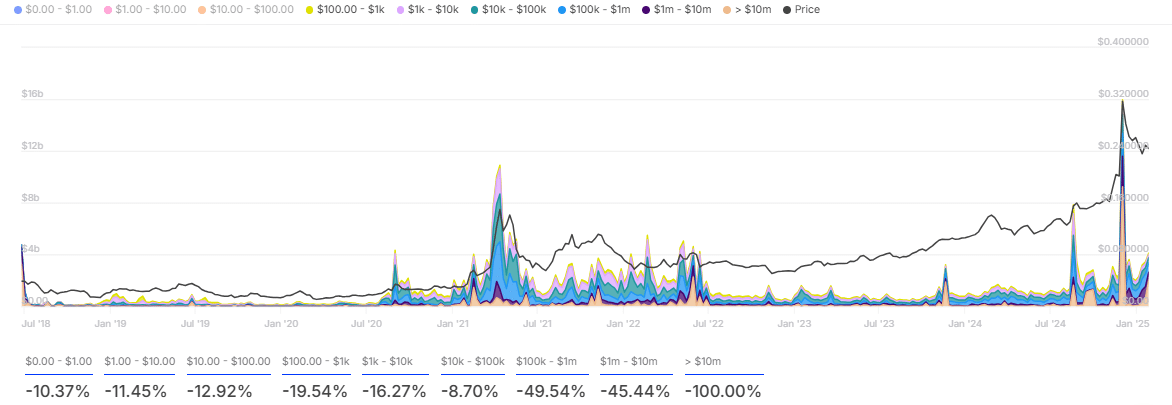

According to IntoTheBlock’s data, retail addresses holding between $10,000 and $100,000 saw an 8.7% decline in transaction activity. Whales, specifically those holding between $100,000 and $1 million and $1 million to $10 million, declined by 49.54% and 45.44%, respectively, over the last 24 hours.

A decline among these cohorts, which typically play a major role in price movement, is a sign of reduced interest and weak conviction to buy the asset. Ah, but as I always say, “The absence of evidence is not evidence of absence.”

And so, we wait. We wait for the market to reveal its secrets, for the charts to clear up, and for the future to unfold. Ah, but as I always say, “The waiting is the hardest part.”

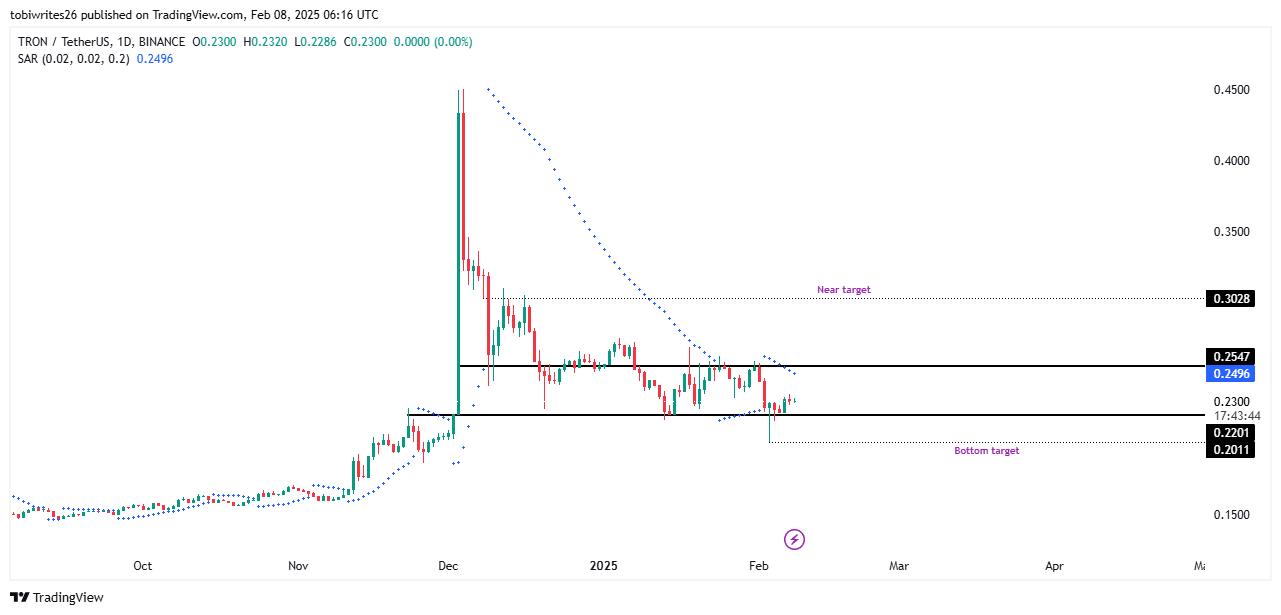

TRX, at press time, was consolidating within a defined range on the chart between $0.2201 and $0.2547. This move might precede a potential major price shift, with an upper target of $0.30 and a lower target of $0.20.

A closer look into this range revealed that TRX has just reacted off a support level and trended higher. However, momentum might be weak as the candle formations appeared somewhat fragile.

Additionally, the Parabolic SAR hinted at a possible decline as the dotted markers were positioned above the price candles.

If the bearish trend fully materializes, there may be two points of interest. The first would the support level at $0.2201, which could trigger a rebound. However, failure to hold this level may result in a drop to $0.20.

And so, we wait. We wait for the market to reveal its

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-02-08 16:10