- Ah, the TD Sequential, that wise oracle of the digital realm, which so astutely foretold the zenith of Bitcoin on the 21st of January, now beckons us with a siren’s call—a buy signal gracing the daily chart.

- After Bitcoin, in its whimsical dance, swept away liquidity beneath the $95K mark, it now sets its sights on the tantalizing heights above $98K, as the great whales indulge in their feast at $97K.

In the grand theater of Bitcoin [BTC], the TD Sequential indicator, that sage of market movements, proclaimed a peak on the 21st of January 2025, at the lofty price of $103,000. Following this glorious ascent, the price of Bitcoin, like a wayward traveler, took a notable tumble, thus reinforcing the predictive prowess of our dear TD Sequential.

Recently, this venerable indicator has issued a buy signal, with Bitcoin’s price hovering around $96,214, as if to say, “Dear investors, now might be the time to dip your toes into this turbulent sea.”

This signal hints at the possibility of a market bottom, a moment ripe for those brave enough to consider entering this unpredictable arena.

Indeed, the presence of a buy signal after a decline suggests that the relentless selling pressure may be waning, and a reversal could be just around the corner, or perhaps just a mirage in the desert of speculation.

Yet, should this buy signal fail to ignite a sustained buying frenzy, Bitcoin may find itself testing lower support levels, perhaps around the recent lows of $94,400. Such a descent would align with the TD Sequential’s pattern of identifying pivotal points, but instead of a triumphant rally, it could herald further declines, much like a tragic hero meeting their fate.

Thus, while the current buy signal presents a potentially bullish scenario for Bitcoin, investors must tread carefully, like a cat on a hot tin roof. They should weigh the possibility of a rebound towards the illustrious $100,000 against the specter of a continued downtrend should the signal fail to manifest into tangible buying momentum.

Whales Awaken: Dormant Giants Stir as BTC Eyes Higher Waters

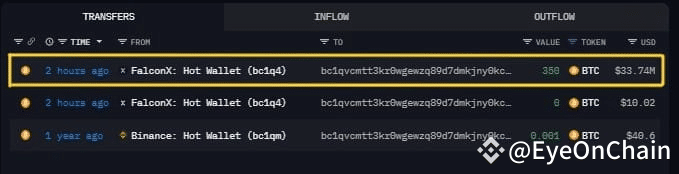

In a curious turn of events, a dormant whale wallet, cryptically named “bc1qv…,” has withdrawn a staggering 350 BTC, valued at a princely $33.97 million, from FalconX at the price of $97,053 per BTC. Such a substantial purchase by a major player could herald potential upward momentum, or perhaps just a whale’s whimsy.

However, should the market sentiment fail to align with the whale’s grand strategy, we might witness a cascade of sell-offs, as others, fearing a peak, decide to cash out, leaving the market in a state of disarray.

Following the sweep of liquidity below $95K, Bitcoin appears poised to test the higher realms, particularly around $98K. This move supports a potential continuation, provided BTC can maintain its footing above these critical liquidity thresholds, much like a tightrope walker balancing precariously.

Typically, overcoming such zones can catalyze further buying interest, potentially pushing prices upwards, like a balloon rising to the heavens. Conversely, should BTC fail to breach the $98K liquidity zone, it could signal a lack of buying pressure, leading to yet another retracement, much to the chagrin of hopeful investors.

Lastly, according to the astute analyst Benjamin Cowen on X, the Total On-Chain Risk indicator suggests that Bitcoin’s peak may not yet have been reached. The metric currently displays levels that are not typical of a market top, implying a potential for a further rally, or perhaps just a mirage in the desert of speculation.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

Conversely, should the risk indicator begin to show values associated with previous market tops, it could signal that the

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Elden Ring Nightreign Recluse guide and abilities explained

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2025-02-10 18:19