Solana [SOL], the world’s fifth-largest cryptocurrency by market cap, is poised for an upside rally due to bullish price action and increasing interest from traders and investors. 🚀

However, overall sentiment in the cryptocurrency market is unpredictable, with major cryptocurrencies like Bitcoin [BTC] and Ethereum [ETH] continuing to struggle.

Bullish on-chain metrics

Despite the market’s ups and downs, traders and investors have shown strong interest in SOL, as on-chain analytics firm Coinglass revealed.

The Spot Inflow/Outflow indicated that exchanges witnessed a significant outflow of $60 million worth of SOL, suggesting potential accumulation that could create buying pressure and drive a price rally.

This substantial outflow further suggested that long-term holders were capitalizing on the current market sentiment to accumulate the token and take advantage of the price drop.

In addition to the rising interest from long-term holders, Binance traders were going wild, with the majority taking long positions.

Data from Binance’s SOL/USDT Long/Short Ratio was 3.35 at press time, indicating strong bullish sentiment among traders.

According to the data, 77% of top SOL traders on Binance took long positions, while 23% held short positions at press time.

When traders and investors show strong interest in a token, it often leads to impressive results, as experts and enthusiasts expect.

Solana price action and upcoming level

At press time, SOL was trading near $204.65 after a modest 1% upside momentum in the past 24 hours.

During the same period, strong interest from investors and traders drove its trading volume up by 45% compared to the previous day.

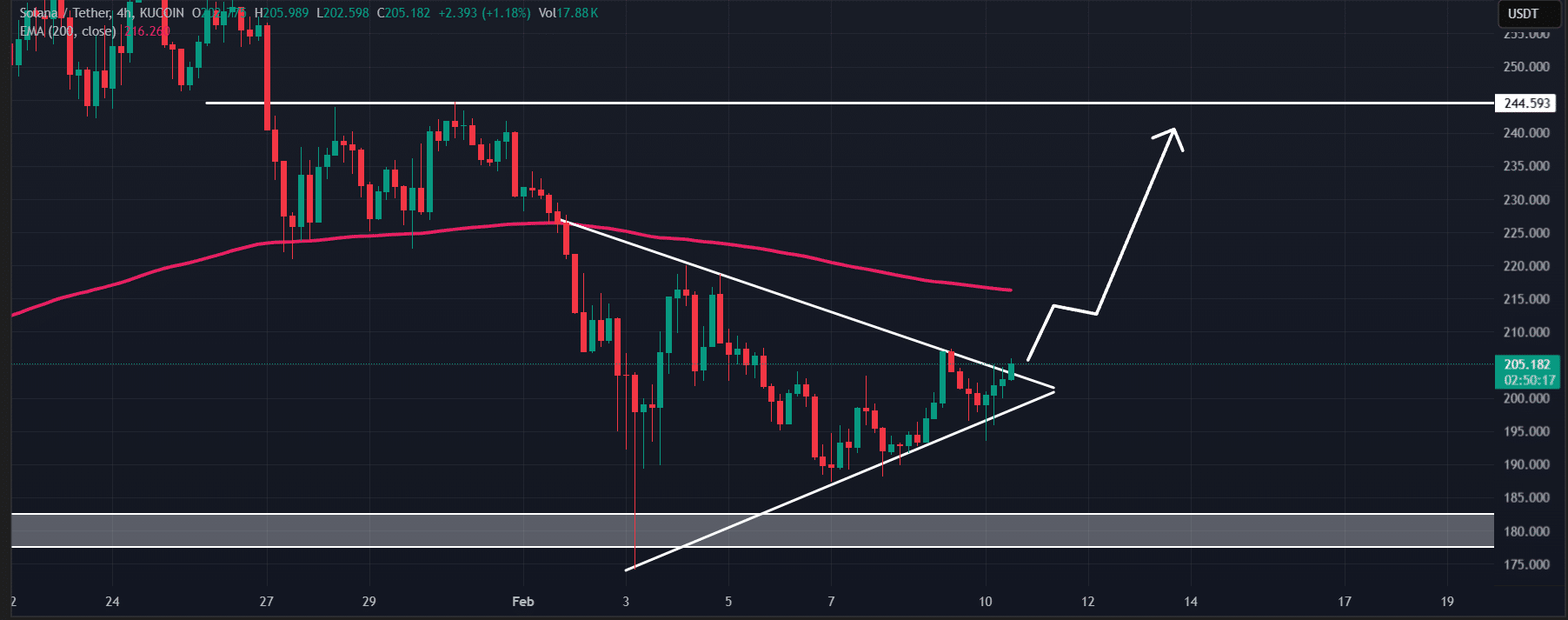

According to AMBCrypto’s technical analysis, SOL has broken out from a symmetrical triangle price action pattern in the four-hour timeframe.

However, the breakout will only be considered successful if SOL’s four-hour candle closes above the $207 mark.

Read Solana’s [SOL] Price Prediction 2025–2026

Based on historical price patterns, if SOL successfully closes above $207, there is a strong possibility it could rally 17% to reach the $243 mark in the coming days.

At the time of writing, SOL was trading below the 200 Exponential Moving Average (EMA) — thus, the asset was in a downtrend.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-02-11 04:11