- Well, it seems the Market Value to Realized Value (MVRV) ratio is whispering sweet nothings about a historic pattern repeat for Ethereum.

- And lo and behold, a dwindling supply of ETH on exchanges, coupled with a buying frenzy, might just be the secret sauce for this rally.

Ethereum, that slippery little rascal, is clawing its way back to market strength after a month-long tumble of 16.81%. In the last 24 hours, it has managed to puff up by a delightful 2.87%, strutting its stuff at a price of $2,718.88. Not too shabby, eh? 😏

On-chain metrics are revealing a veritable gold rush of buying, especially from our good ol’ U.S. retail investors. When you mix that with historic patterns, it’s like a recipe for a bullish soufflé! 🍰

Historic pattern taking shape

One astute crypto analyst, with a nose for patterns, has noted that Ethereum’s Market Value to Realized Value (MVRV-z) score on Glassnode is shaping up like a familiar old friend before a major rally. It’s like déjà vu, but with more zeros! 💸

The MVRV-z score is a handy little tool that helps us spot when an asset is feeling a bit too full of itself or perhaps a tad undervalued, based on its chart position.

According to our analyst buddy:

“Ethereum is yet to enter a bull market this cycle.”

This conclusion is drawn from the past, where ETH has danced in the green zone before taking off like a rocket. 🚀 With ETH recently frolicking in this zone and starting to climb, historical trends are waving their arms, suggesting a potential for a long, joyous rally.

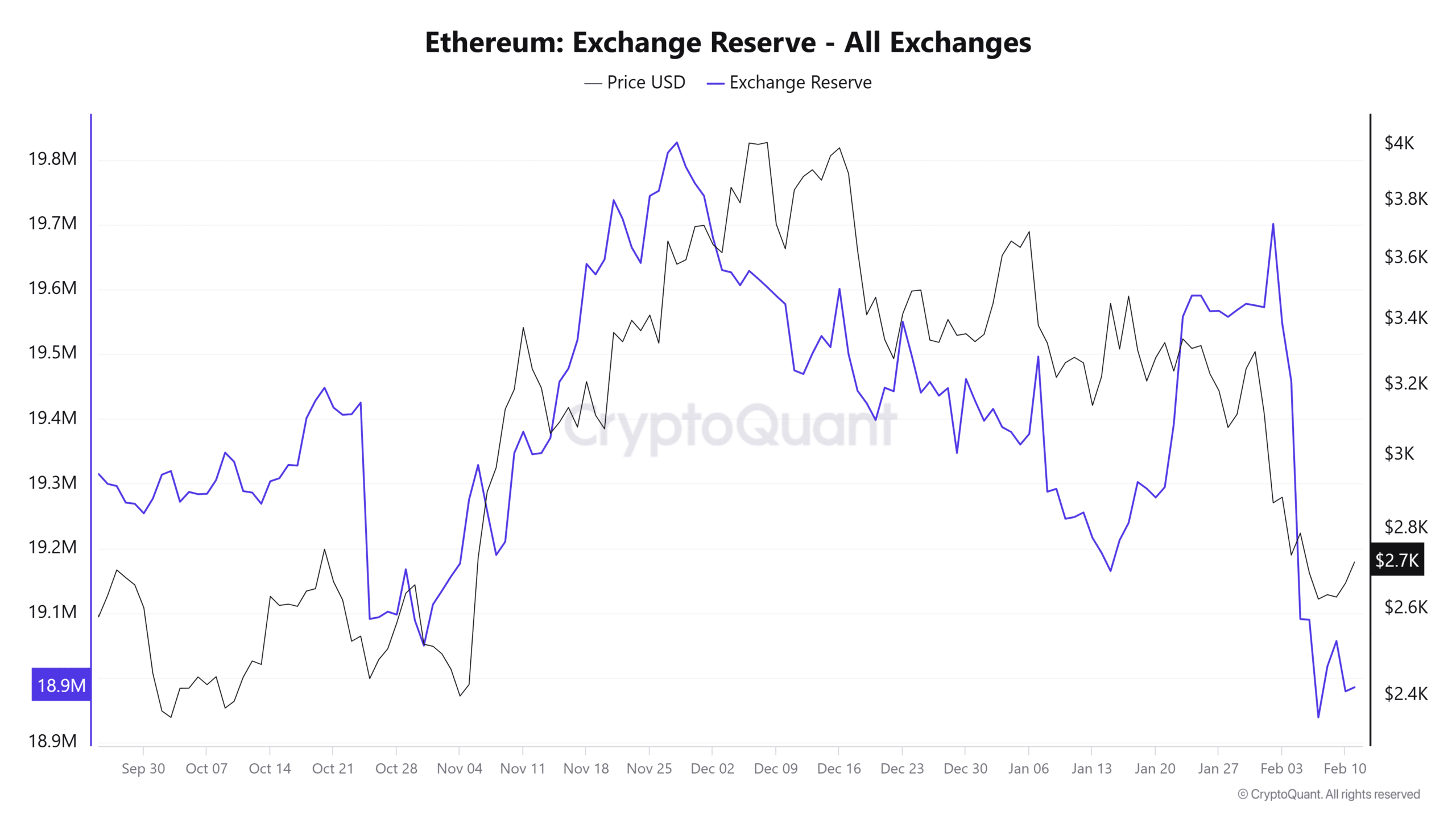

Supply decreases as retail investors buy

CryptoQuant data is showing a sad little decline in ETH exchange reserves. From the 2nd of February to now, the available ETH on exchanges has plummeted by about 714,129. It’s like watching a magician make coins disappear! 🎩✨

This significant drop hints at a growing appetite among investors who are snatching up ETH in bulk and stashing it away in their private wallets. Smart cookies, those! 🍪

Exchange Reserves measure how much of an asset is lounging around on cryptocurrency exchanges.

AMBCrypto has traced this recent demand back to our U.S. retail investors, as revealed by the Coinbase Premium Index. This index is like a gossip column for buying and selling activity on Coinbase compared to Binance.

A positive reading means U.S. investors are accumulating like squirrels before winter. The current index value is sitting pretty at 0.0255 in the green region. 🌳

If these U.S. investors keep up their buying spree alongside other market participants, ETH’s price might just keep climbing like a cat up a tree!

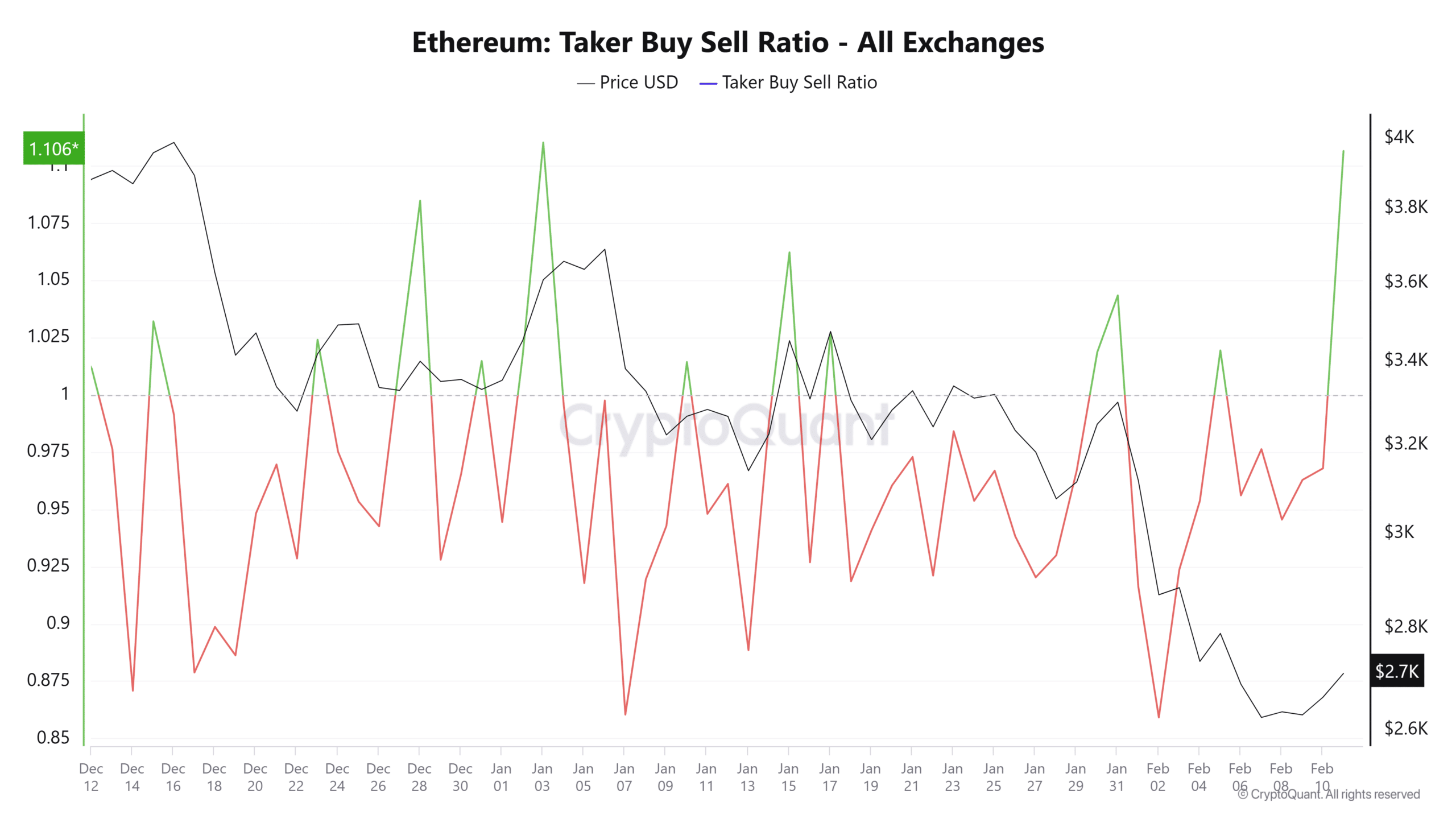

Buying volume surge

The Taker Buy Sell Ratio has jumped from 0.967 the previous day to a high of 1.084 — a level we haven’t seen since the 3rd of January. It’s like a party where everyone’s showing up to buy! 🎉

When this ratio is above 1, it signals that buying activity in the derivatives market is outpacing selling, which is like music to a bull’s ears! 🎶

Read Ethereum’s [ETH] Price Prediction 2025–2026

With U.S. investors diving

Read More

- OM/USD

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Solo Leveling Season 3: What You NEED to Know!

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Moo Deng’s Adorable Encounter with White Lotus Stars Will Melt Your Heart!

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

2025-02-11 15:06