- Ah, Ethereum, the eternal optimist, is just beginning to mimic its 2021 escapade.

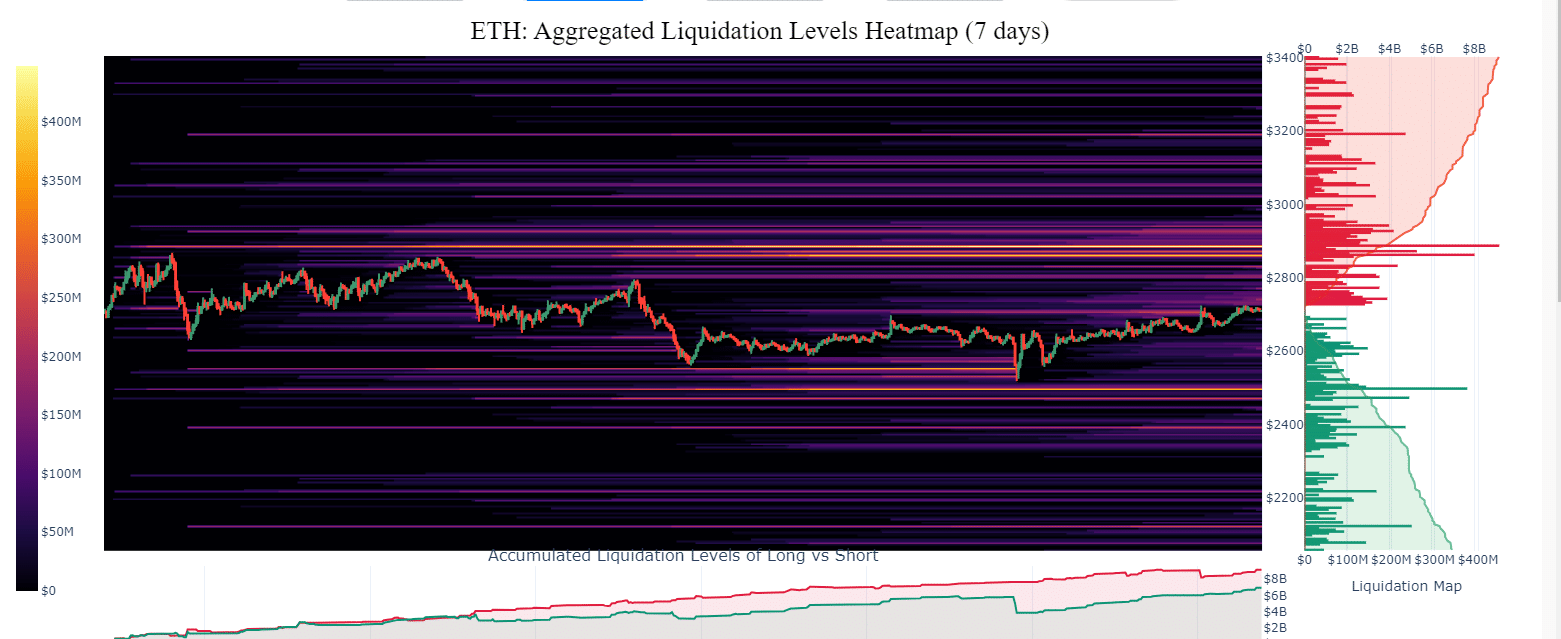

- Short-term liquidity zones have emerged at $2.8K — $3K and $2.5K, as the Futures market takes a breather from its selling spree.

In the grand tapestry of time, Ethereum’s [ETH] charts from 2021 and 2025 weave a story that tickles the imagination. Back in 2021, ETH soared like a bird released from its cage, leaping from the depths of sub-$500 to a dizzying height of around $4,500. 🦅

This meteoric ascent was not just a fluke; it was a symphony of breakout notes following a long, drawn-out consolidation that began in the twilight of 2020.

Now, as we fast-forward to 2025, the echoes of that pattern resonate, with ETH currently lounging around $2,000 after a rather dramatic fall from grace. Talk about a rollercoaster! 🎢

The 2021 rise was ignited when ETH clung to support near $500, leading to a surge in buying enthusiasm and bullish vibes, ultimately catapulting prices to new heights. Can you feel the excitement? 😏

In 2025, ETH has shown a stubborn resilience at a key support level above $2500, mirroring the early days of its 2021 journey. If it decides to play nice and follow the script, we might just see it reach a staggering $26,000 by the end of 2026. But hey, no pressure! 😅

On the flip side, if Ethereum can’t hold onto that $2,000 support, it might just signal a waning buyer momentum, leading to a downward spiral. Yikes! 😱

Investors, take heed! We must weigh the possibility of a bullish encore from 2021 against the looming specter of decline that could thwart our dreams of grandeur.

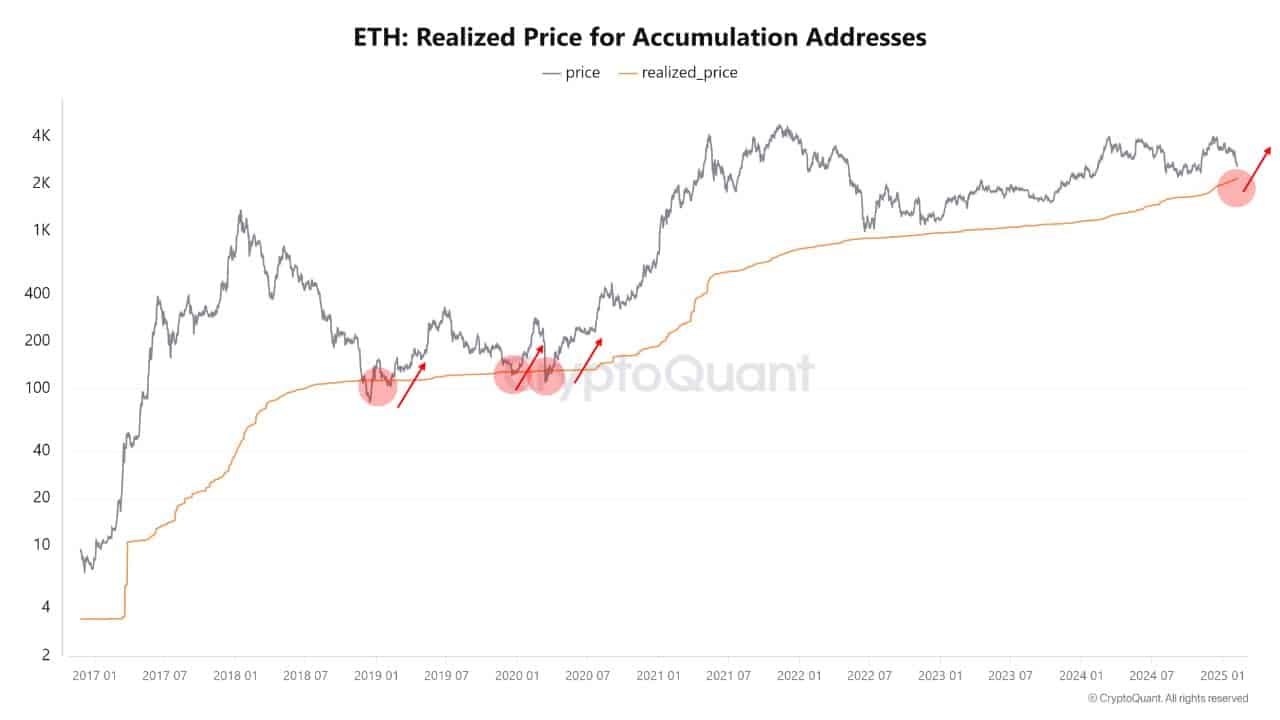

Permanent holders rise as selling pressure declines

With ETH strutting its stuff and hinting at a repeat of its 2021 glory, its realized price of $2.2k is playing coy, sitting well below the market price of $2.6k. Undervaluation, anyone? This realized price is like a sturdy life jacket in a turbulent sea.

The MVRV ratio, just above 1, is waving a little flag of potential appreciation. 🚩

Meanwhile, the number of permanent holders—those brave souls who bought ETH and never looked back—is on the rise, echoing Bitcoin‘s trends. It seems they are resilient against the selling pressures from those exiting whales. 🐋

Moreover, the selling pressure in Ethereum’s Futures market has taken a nosedive compared to the glory days when ETH hit $4k, indicating that buying interest remains strong despite the price dips. Who knew? 🤷♂️

All these signs suggest that ETH might just echo its past rise, but remember, the outcome hinges on the ever-changing market sentiment and stability. 🎭

Ethereum’s short-term liquidity zones

The Ethereum liquidity heatmap reveals that the $2.5k to $3k zones are the battlegrounds for support and resistance. A real tug-of-war! ⚔️

Historically, these levels have either sent ETH soaring when acting as support or capped its gains when they turned into resistance. Talk about a double-edged sword!

The concentration of liquidations between $2800 and $3000 suggests this range is pivotal for ETH’s short-term movements. Keep your eyes peeled! 👀

A stable hold above $3k could echo the 2021 surge, while a slip below $2.5k might just send bullish momentum packing. 🏃♂️💨

These dynamics require

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- How to Get to Frostcrag Spire in Oblivion Remastered

- Doctor Doom’s Unexpected Foe: The Dark Dimension’s Ultimate Challenge Revealed!

- Moana 3: Release Date, Plot, and What to Expect

2025-02-12 22:21