- Bitcoin recently decided to take a breather, stabilizing after a wild ride of price swings.

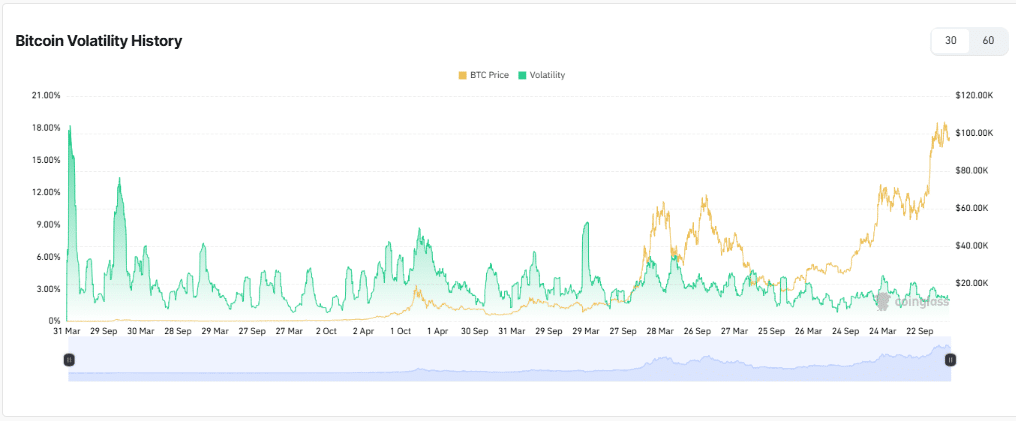

- Its volatility has taken a vacation in recent weeks, much like my enthusiasm for exercise.

Ah, Bitcoin [BTC], the cryptocurrency that’s like that friend who can’t decide if they want to be a millionaire or just a regular Joe. Recently, it’s been on a little vacation, enjoying a period of price stabilization—also known as the “sideways shuffle.” This is the calm before the storm, folks! After a long, drawn-out period of consolidation, it seems Bitcoin is ready to shake off the dust and attract some retail investors like moths to a flame.

Is it time to pop the champagne? 🍾

In the last 30 days, retail investor activity has dipped by about 2%. Not exactly a heart-stopping drop, but hey, it’s better than the 20% nosedive we saw in January. Progress, right?

This slight dip in retail demand suggests that the market is finally stabilizing, setting the stage for potential growth. It’s like watching a pot of water come to a boil—slow and steady, but eventually, it’s going to bubble over. And just like that, the analysis shows that previous surges in demand have been linked to price hikes. Who knew?

So, as retail demand starts to perk up again, we might just see a positive shift in market sentiment. Fingers crossed, right?

Bitcoin: The Little Engine That Could 🚂

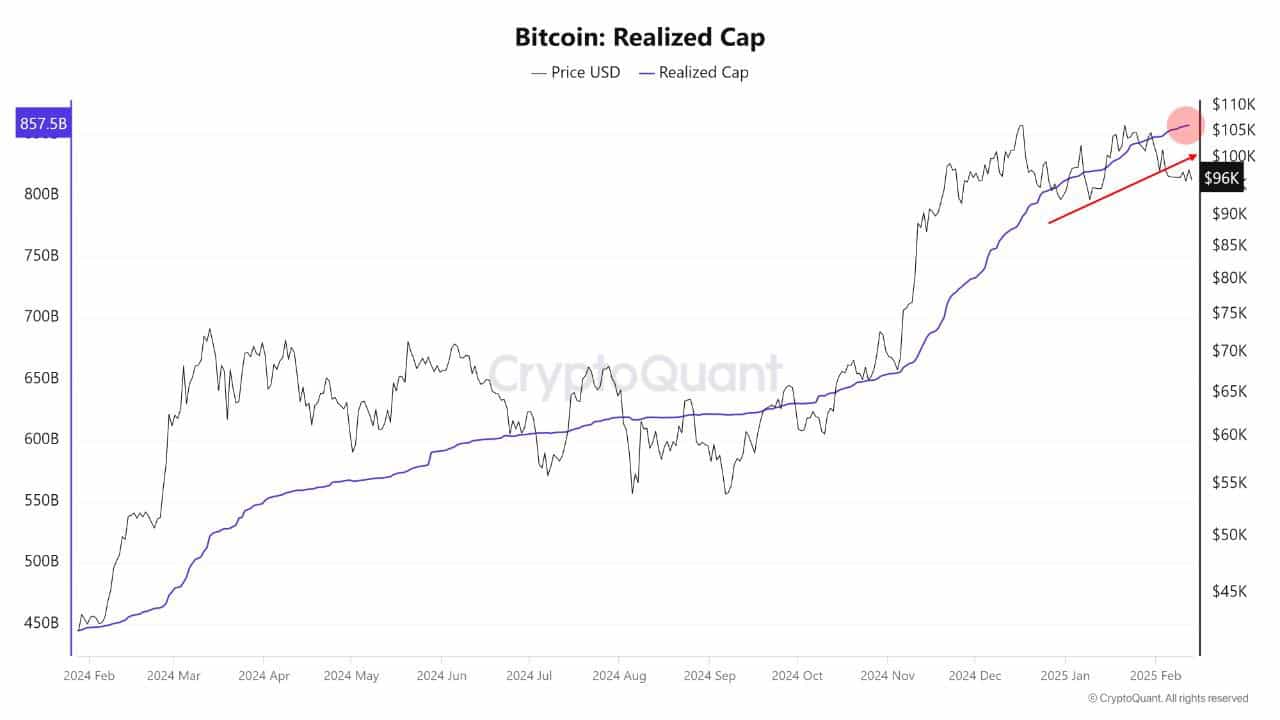

Bitcoin’s realized market cap recently hit a staggering $857 billion. That’s right, folks! It’s like the little engine that could, chugging along despite the occasional hiccup in price. Long-term holders are cashing in on these higher prices, showing confidence in this rollercoaster ride of an asset.

Meanwhile, new investors are jumping on board, absorbing sell pressure like a sponge. This delightful dance between long-term holders and fresh faces means that bullish sentiment is alive and well. Who knew investing could be so social?

FOMO: The Gift That Keeps on Giving 🎁

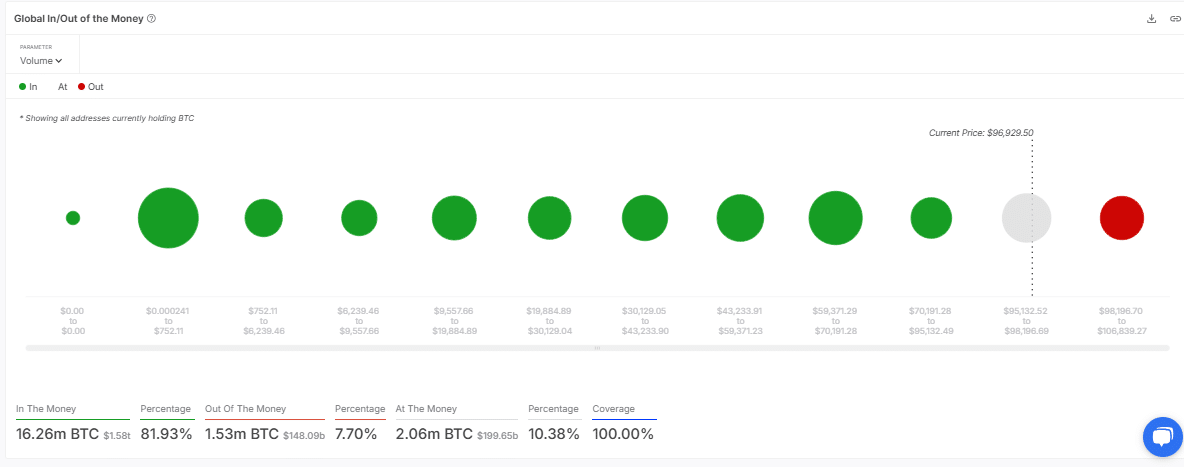

According to the latest gossip from Bitcoin’s Global In/Out of the Money metric, the crypto’s price of around $96,929.50 has left many addresses feeling quite “In the Money.” This revelation has investors feeling giddy, as if they’ve just found a $20 bill in an old coat pocket.

Of course, this FOMO (Fear of Missing Out) sentiment is palpable, with potential buyers scrambling to get in before the next big wave. Fewer ‘Out of the Money’ addresses mean less selling pressure, which could lead to a more stable price hike. It’s like a game of musical chairs, and everyone wants a seat!

Are we on the brink of something big? 🤔

Finally, Bitcoin’s volatility has taken a nosedive in recent weeks, much like my motivation to go to the gym. Since lower volatility often precedes significant price movements, we might just be on the cusp of something exciting. Or terrifying. Who knows?

This delightful cocktail of low volatility, a high market cap, and positive retail demand is crucial for BTC’s price action. If all the stars align, we might just see Bitcoin break out of its consolidation phase and into the wild blue yonder. Buckle up, folks!

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- Peter Facinelli Reveals Surprising Parenting Lessons from His New Movie

- Viola Davis Is an Action Hero President in the ‘G20’ Trailer

- 10 Must-Read Romance Manhwa on Tapas for Valentine’s Day

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2025-02-15 12:11