- Ethereum ETF’s institutional ownership jumped from 4.5% to 14.5% in Q4 of 2024

- Grayscale has sought the SEC’s nod for its ETH ETF staking feature

Ah, the world of Ethereum ETFs! Where institutional adoption is soaring like a caffeinated squirrel, while the retail crowd is left clutching their wallets in despair. According to Juan Leon, the senior investment strategist at Bitwise (who I assume has a crystal ball), institutional ownership of ETH ETFs has leaped from a mere 4.8% to a staggering 14.5%. Talk about a glow-up! 💁♂️

She noted,

“Institutional ownership of ETH ETFs increased from 4.8% in Q3 to 14.5% in Q4. The institutions are coming for ETH.”

A massive adoption uptick

In a shocking twist, ETH ETFs are gaining traction faster than a cat meme goes viral, outpacing Bitcoin ETFs despite Bitcoin’s reign as the king of crypto. According to Leon, Bitcoin ETFs are still holding strong at 21.5% in Q4 2024, down from 22.3% in Q3. It’s like watching a heavyweight champion slowly lose his title to a featherweight. 🥊

The latest gossip comes from the 13F filings with the SEC, which are like the financial world’s version of a reality TV show, giving us a peek into the lives of those managing over $100M in assets. Spoiler alert: BlackRock’s ETH Trust, ETHA, is being dominated by the likes of Goldman Sachs, Millennium Management, and Brevan Howard Capital. They’re practically swimming in ETHA shares like Scrooge McDuck in his money bin! 🦆💰

Leon added that this uptick in institutional ownership is just the beginning of a new phase in adoption.

“I think that points to entering the next phase of institutional accumulation: major institutions such as sovereign wealth funds and pension funds.”

And if that wasn’t enough to get your heart racing, there’s talk of ETF staking! The SEC Crypto Task Force recently had a little chinwag with Jito Labs and crypto VC MultiCoin Capital. It’s like a secret club meeting, but with more spreadsheets and fewer snacks. Grayscale has even submitted an application for an ETF staking feature for its U.S. Spot ETF product. Fingers crossed! 🤞

Nate Geraci from the ETF Store chimed in, saying that ETF staking is just a “matter of time.”

“Instead of just saying ‘no’, SEC is actually engaging in constructive conversations. Encouraging. IMO, staking in ETH ETFs is simply a matter of time.”

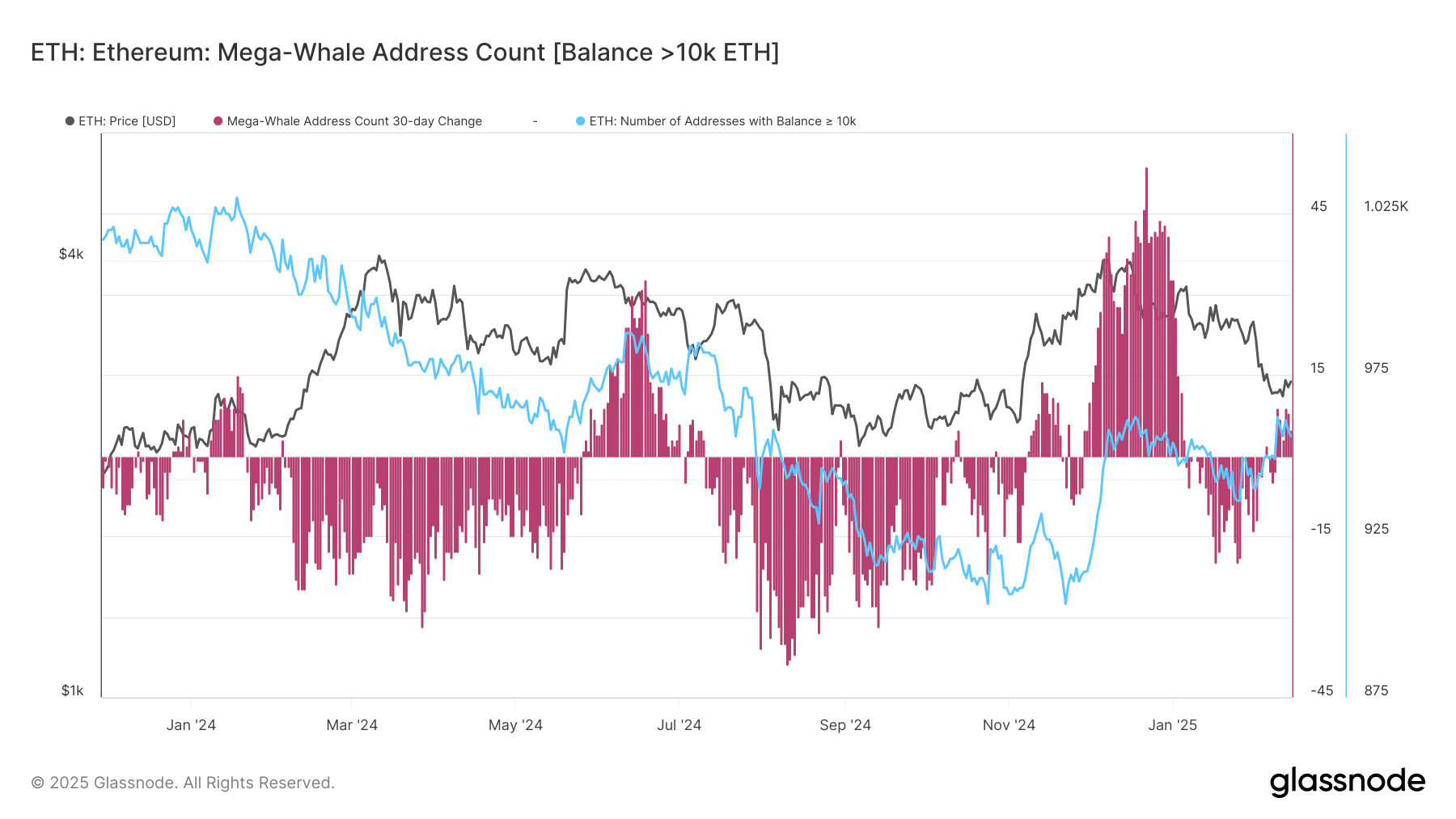

Meanwhile, the 30-day mega-whale address count (those with over 10K ETH) has turned positive again in February. The number of addresses has surged to 956 from 936. It’s like watching a reality show where the contestants keep multiplying! 📈

But hold your horses! Despite all this institutional love, ETH’s price is as flat as a pancake at $2.7k, down 34% from its December high of $4.1k. It’s like being invited to a party only to find out it’s a potluck and you forgot to bring anything. 🥴

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2025-02-15 16:10