- ENA has decided to flash a buy signal, but with key resistance levels looming like a bad hangover.

- Daily active addresses and transaction counts are showing moderate growth, which is about as exciting as watching paint dry.

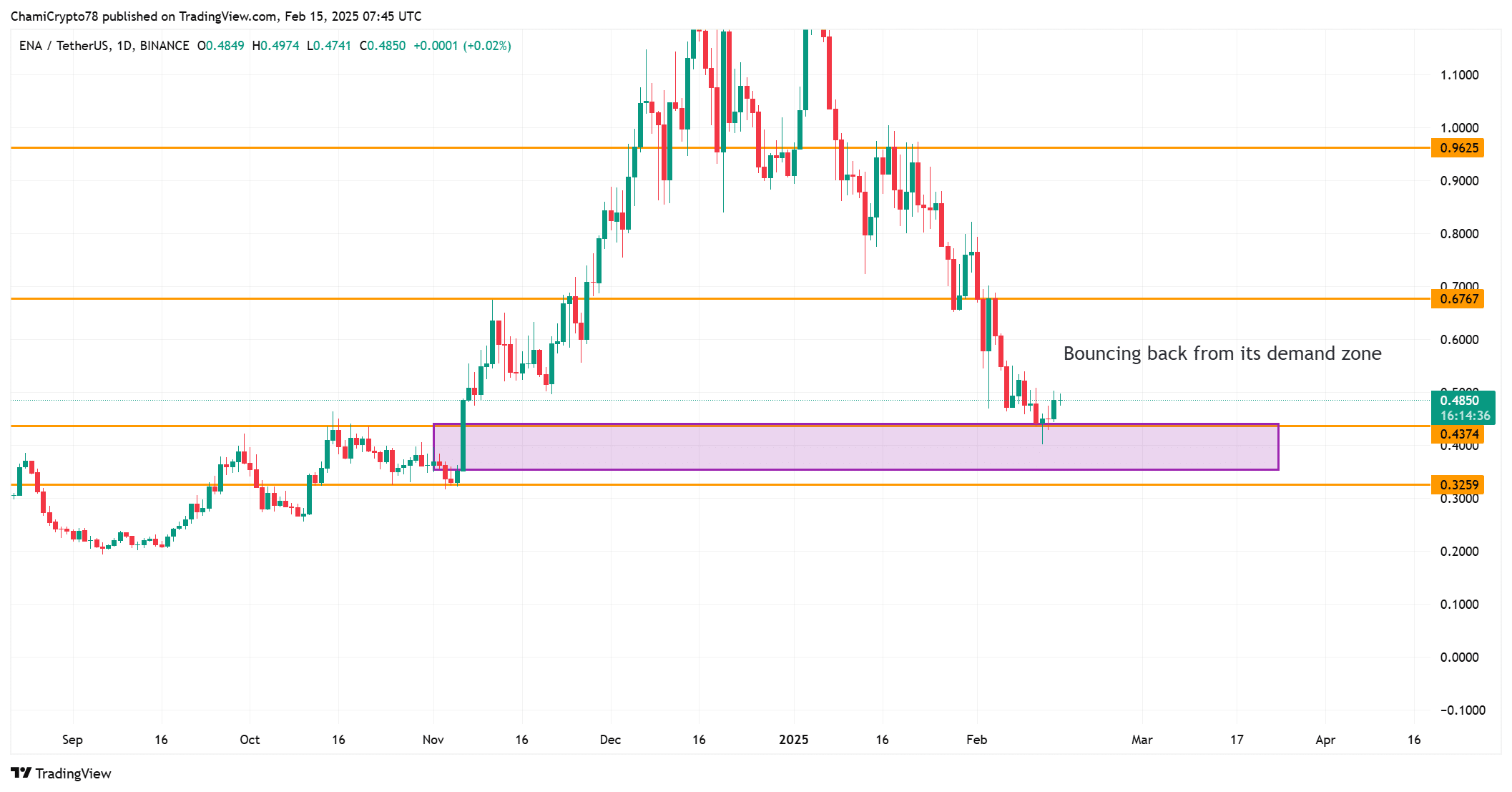

In a rather dramatic turn of events, Ethena [ENA] has recently decided to flash a buy signal on the 12-hour chart, courtesy of the TD Sequential indicator. This hints at a potential rebound after a rather dismal period of decline. As of this very moment, ENA is trading at a thrilling $0.4838, up by a staggering 4.49% in the last 24 hours. Hold onto your hats, folks! 🎩

However, let’s not get too carried away. Despite this optimistic technical signal, the road ahead is littered with resistance levels that could very well halt the price’s upward momentum. Investors are now watching with bated breath to see if this asset can break through these key obstacles and maintain its bullish momentum. Spoiler alert: it’s going to be a nail-biter!

What are the key resistance levels to watch for Ethena?

As we pen this riveting tale, ENA is bouncing back from its demand zone, which is conveniently located near $0.4374. This level appears to be providing some support after the altcoin’s latest price drop, much like a safety net for a tightrope walker. However, the next major resistance lies around $0.5249, which could prove to be as challenging as finding a decent cup of coffee in a small town.

If ENA manages to leap over this resistance, it will likely encounter yet another at $0.6770. These resistance levels will play a critical role in determining whether the ongoing bullish trend can be sustained or if it will fizzle out like a damp firecracker.

Indeed, ENA will need to break these key levels if it aims for a more prolonged rally. Fingers crossed! 🤞

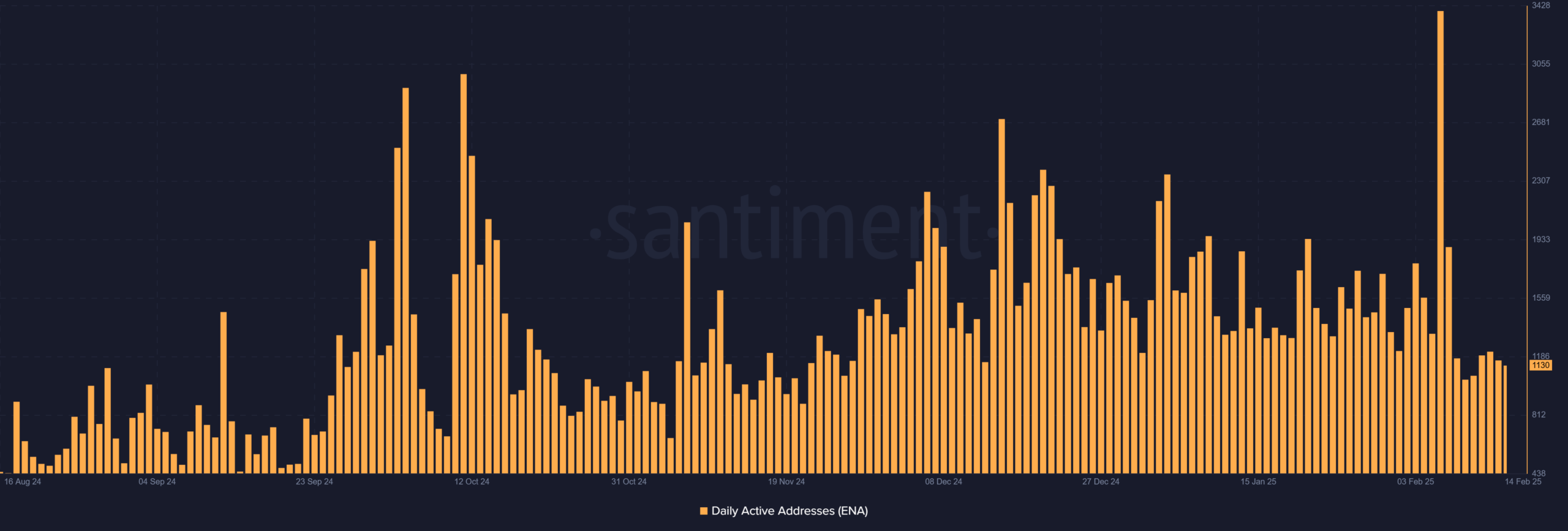

A look at the daily active addresses

The daily active addresses for ENA peaked at a thrilling 1130, reflecting moderate user engagement. This hike suggests that interest in ENA has been growing, albeit at a pace that could be described as leisurely. Additionally, rising network activity can contribute to the overall bullish sentiment if it sustains over time. But let’s not hold our breath, shall we?

However, this uptick alone may not guarantee further price appreciation unless it is backed by other indicators such as transaction volume. Therefore, the steady growth in active addresses could signal that ENA is building a solid foundation for future price gains, or it could just be a mirage in the desert of cryptocurrency.

Can Ethena’s transaction count support its upside?

Transaction counts for ENA also revealed a moderate hike, reaching 1120. While not a massive surge, this increase suggests that there is still consistent demand for ENA. As ENA’s price moves north, additional transaction activity could provide the momentum necessary to drive the price past its resistance levels. Or it could just be a flash in the pan. Who knows? 🤷♂️

However, if transaction volume falls again, the price could struggle to maintain its upside. Therefore, transaction activity might play a crucial role in supporting ENA’s price in the short term, much like a good friend who helps you move on a Saturday.

In/Out of the Money – A favorable position for bulls?

At the press time price of $0.4838, most Ethena holders were “in the money,” with nearly 70% of holders sitting pretty with profits. This is a promising sign for potential bullish momentum, as more holders are likely to remain invested if the price continues to rise. Or they might just take their profits and run. Who can blame them?

However, the percentage of addresses “out of the money” seemed to

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2025-02-15 22:19