- Oh, what a jolly good show! BNB Smart Chain has outshone all the other chains this past month, with its TVL soaring like a kite on a windy day!

- And guess what? The buying volume in the derivatives market has gone up faster than a cat on a hot tin roof, especially among the traders at Binance and OKX!

In the last 24 hours, our dear Binance Coin [BNB] has had a tiny little hop of 2.14%, keeping its bullish streak alive like a stubborn little weed, after a splendid week of 10.24%, trading at a cheeky $670.98.

Market analysis suggests that BNB is on a merry path, with several market sentiments cheering it on, including a delightful growth in volume both on-chain and in the derivatives market. Hooray!

New high despite market downtime

BNB Smart Chain is the only brave little chain in the market over the past seven and thirty days to have recorded positive volume growth, while the others, like Solana [SOL], Ethereum [ETH], Base, and Arbitrum [ARB], have taken a bit of a tumble. Poor things!

According to our trusty friend DeFiLlama, weekly volume growth has reached a whopping 66.63%, hitting $31.194 billion, and in the last 24 hours, it has climbed to $3.735 billion—the highest across all chains! What a spectacle!

The Total Value Locked (TVL), which tells us how much treasure is locked away in the protocols on a chain, has been growing steadily for BSC. From the 3rd of February to now, TVL has jumped from $4.895 billion to a dazzling $5.56 billion. Oh, the excitement!

When there’s a grand surge like this—a $665 million increase in TVL—it suggests that confidence in BNB is blooming like a flower in spring, as renewed interest often leads to a price rally while supply across exchanges does a disappearing act. Ta-da!

Buying volume surge on exchanges

There’s been a delightful surge in the buying volume of BNB across the top cryptocurrency exchanges, Binance and OKX, among the perpetual market traders. What a ruckus!

This was confirmed with the Taker Buy Sell Ratio soaring above 1 on both exchanges—Binance and OKX—with readings of 1.727 and 2.33, respectively. Quite the party, I must say!

When the Taker Buy Sell Ratio is above 1, it means there’s more buying than selling going on, like a game of musical chairs where everyone wants to sit down! 🎶

The Open Interest, which keeps track of the number of unsettled derivative contracts in the market, has also seen a gradual rise, with a growth of 1.78%, bringing the total value of these contracts to a staggering $866.70 million. Oh, my stars!

Resilience despite exchange flow increases

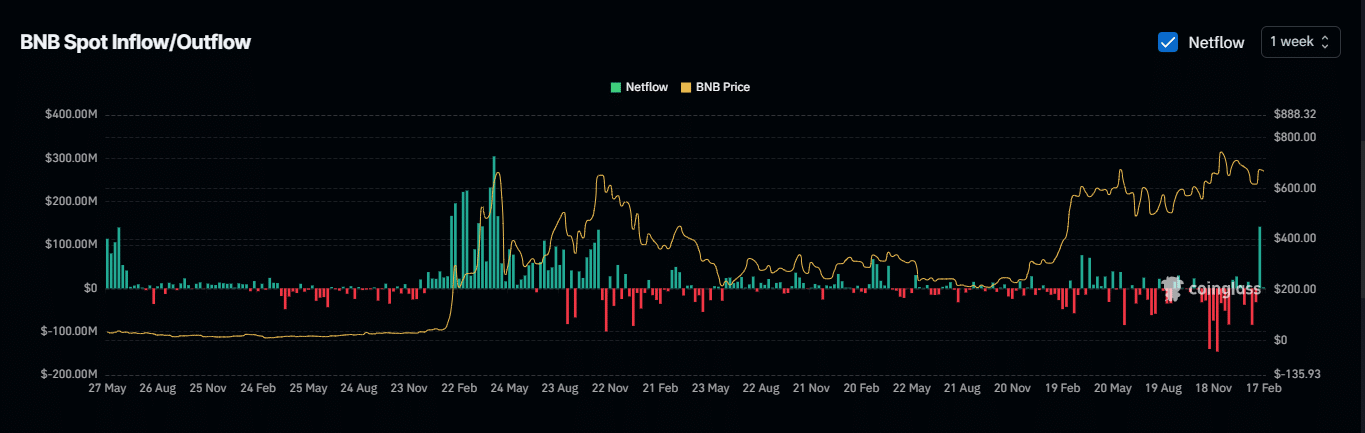

In the past week, from the 10th to the 16th of February, a massive surge in exchange netflow was recorded, with a reading of approximately $142 million—the highest since May 2021! What a rollercoaster ride!

When there’s a surge like this, it means sellers are moving their assets into exchanges, hoping to cash in. But fear not! Despite this large sell volume on the spot market, BNB surged 10%, showing there’s still a demand for those sold assets. Bravo!

If this demand keeps rising, BNB could continue to soar into the week like a rocket! Buckle up, folks!

Read More

- OM/USD

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Solo Leveling Season 3: What You NEED to Know!

- ETH/USD

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Inside the Turmoil: Miley Cyrus and Family’s Heartfelt Plea to Billy Ray Cyrus

- Aimee Lou Wood: Embracing Her Unique Teeth & Self-Confidence

- Moo Deng’s Adorable Encounter with White Lotus Stars Will Melt Your Heart!

2025-02-17 18:20