- Wall Street whispers: Solana ETFs could rake in a mountain of cash—up to $6 billion in year one! 💸

- A technical tango: Watch those pesky 50-Day and 200-Day Moving Averages (currently playing hard to get at $220 and $250).

The cryptocurrency world is, yet again, breathlessly excited over a new shiny thing—this time, Solana [SOL]. It’s like Bitcoin’s cool little cousin that shows up to the family reunion on a skateboard. 🛹

If you haven’t been paying attention (and who could blame you?), the SEC has finally noticed Solana’s potential, like someone spotting gold in a junk drawer. They’re now reviewing applications for Solana-based exchange-traded funds (ETFs) because who doesn’t want a slice of this crypto pie? 🥧

Enter SEC: Same Circus, New Clowns

It’s February 2025, and the SEC has decided to give Solana ETFs a second look, submitted by heavyweight players like Grayscale and Bitwise. For the SEC, this is like finally tasting sushi after turning it down at every dinner party—will they love it or spit it out? 🍣

Curiously, this change of heart coincides with the return of none other than Donald Trump to the White House, a plot twist worthy of a Netflix drama. Adding to the intrigue is Paul Atkins, the new SEC chair, who’s so crypto-friendly he probably dreams in blockchain.

Market Buzz: Hope, Hype, or Hallucination?

Investors are already trying to guess the ending of this story. JPMorgan predicts $3-6 billion could flood into Solana ETFs during year one, a sum that would make even Scrooge McDuck jealous. 🦆💰

Price forecasts are all over the place, from $479.88 to a sweaty $858 by December 2025. That’s a lot of caffeine for a coin currently snoozing at $183.12.

Chart Time: The Fibonacci Meets Its Match

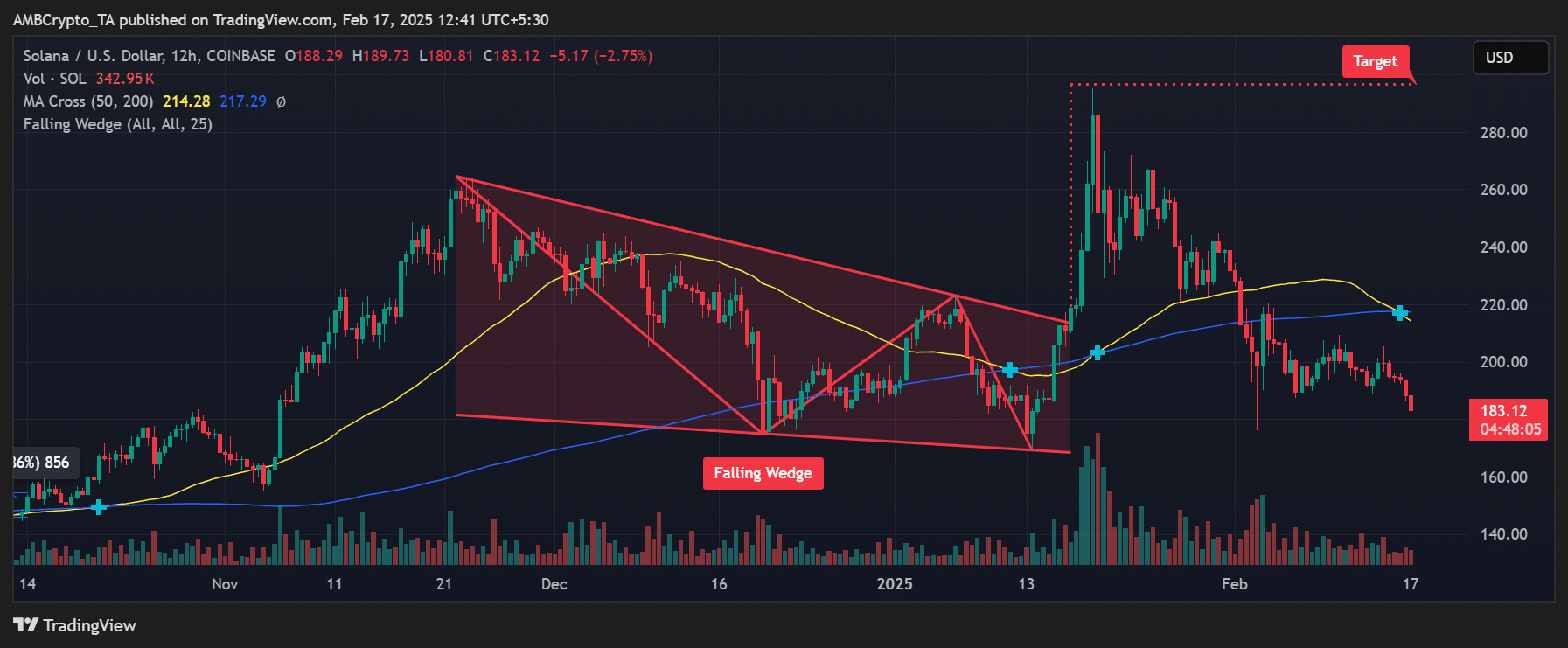

Look, no crypto saga is complete without some squiggly lines and dramatic jargon, right? Solana recently broke out of a falling wedge pattern—a technical term that sounds more like a pastry order at a fancy café. And hey, there’s a chart to prove it:

But here’s the kicker: there’s a 50-Day Moving Average at $214.28 and a 200-Day at $217.29, plotting their own medieval-style coup called the “Death Cross.” They basically want to see Solana trip over itself. 😬

Fib Levels: Math Meets Meltdown

For you numerically inclined thrill-seekers, Solana hovers precariously at the 0.618 Fib retracement (~$182)—a magical level for those who trust charts more than fortune cookies. If it drops further, it’s off to deeper levels, with $150 waving menacingly in the distance. Take a look:

But hey, maybe this is where the brave stock up. Or maybe it’s where the foolish pile in. Only time—and probably some panic memes—will tell. 🤷♂️

What Now? Salvation or Skid Marks?

If Solana wants to avoid being the butt of next month’s financial jokes, it needs to bounce above $220 and $250 resistance levels like a basketball on steroids. Failing that? Well, there’s always the comforting embrace of $150… and some angry Reddit threads. 💀

Closing Thoughts (a.k.a. Don’t @ Me)

Could Solana hit $550 by Q4 2025? Maybe. Projections are optimistic, but they depend on SEC approvals, investor love, and whether crypto Twitter can keep its composure for five minutes. For now, keep your eyes on the charts, your wallets ready, and your expectations…eh, somewhere between cautious and wildly naive. 🌌

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2025-02-17 22:51