- Oh dear, the ETH price action is rather like a damp squib, with buyers showing a distinct lack of enthusiasm.

- Ethereum must don its best frock and reclaim $2.9k as support if it wishes to change this rather dreary narrative.

In a previous tête-à-tête, we discussed how Ethereum [ETH] was valiantly battling against the formidable $2.8k resistance. Alas, last week’s selling pressure in the spot ETFs was merely a case of profit-taking—how positively pedestrian!

Meanwhile, the Korea Premium Index has decided to rise, suggesting that our friends in East Asia are feeling rather frisky about crypto. How delightful! 🎉

ETH Price Prediction

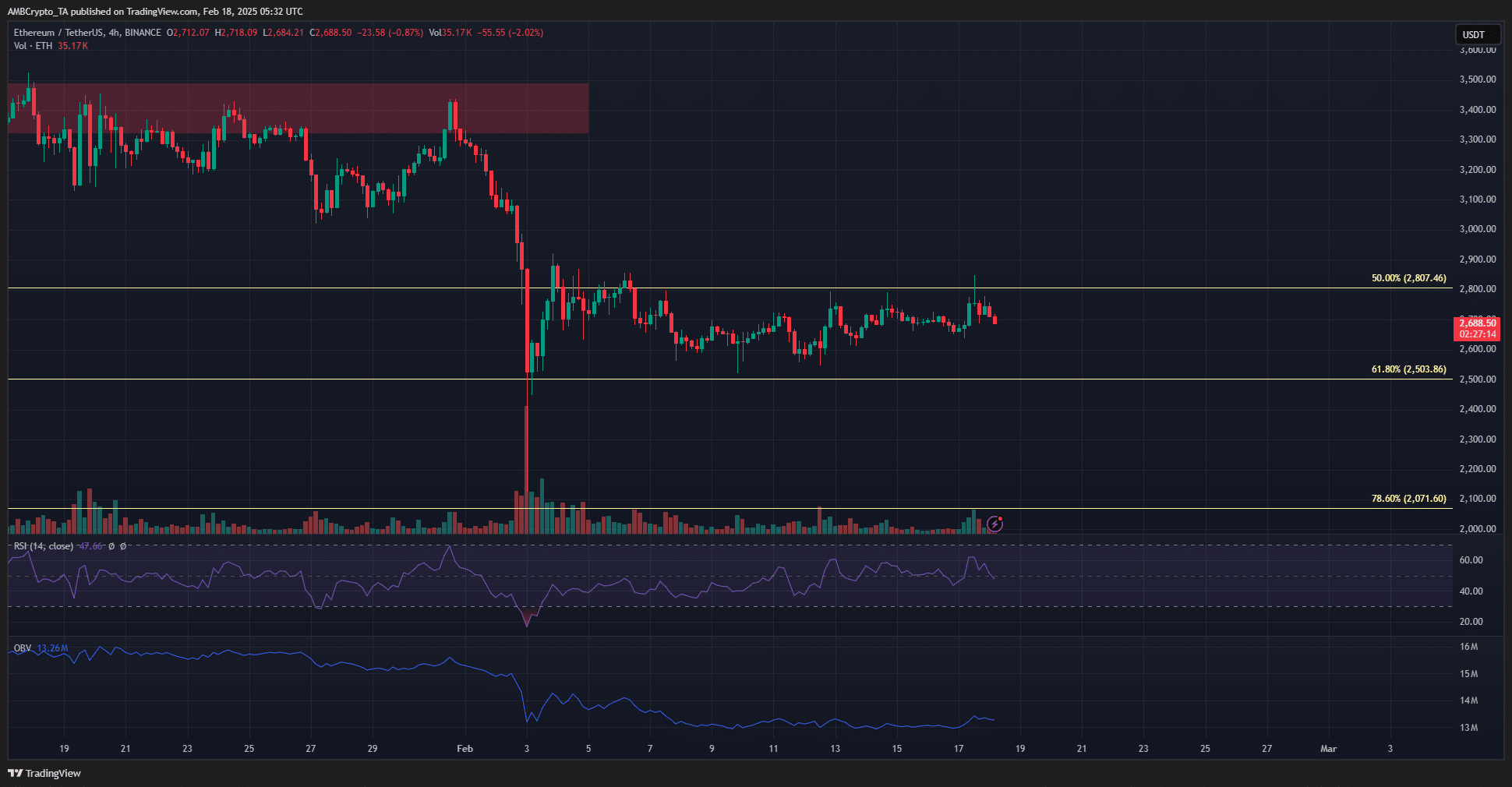

The 12-hour chart reveals that the selling pressure over the past month has sent the 12-hour OBV plummeting to a multi-month low. A tragedy, really, but not one to lose one’s monocle over—trends do have a way of shifting, after all.

Fear not, for the 1-day and 3-day OBV have remained as flat as a pancake since December, rather than spiraling downward. How charmingly stable!

While the price action structure is decidedly bearish, the RSI is merely flirting just below the neutral 50. The $2.8k level remains a significant horizontal landmark, but alas, the bulls seem to have misplaced their strength to reclaim this resistance.

The 4-hour chart echoes the sentiments of its 12-hour counterpart. The buying pressure in recent weeks has been as substantial as a feather in a windstorm. Even though the RSI has dared to poke its head above 50, the bearish structure remains as steadfast as a butler at a dinner party.

One tiny glimmer of hope is that ETH has managed to form higher lows over the past week. However, this is hardly a cause for celebration without a breach of the recent lower high at $2,880. A rather lackluster performance, wouldn’t you agree?

The absence of buying momentum, coupled with a slow upward crawl, sets the stage for a rather dramatic liquidity hunt. How thrilling! 🎭

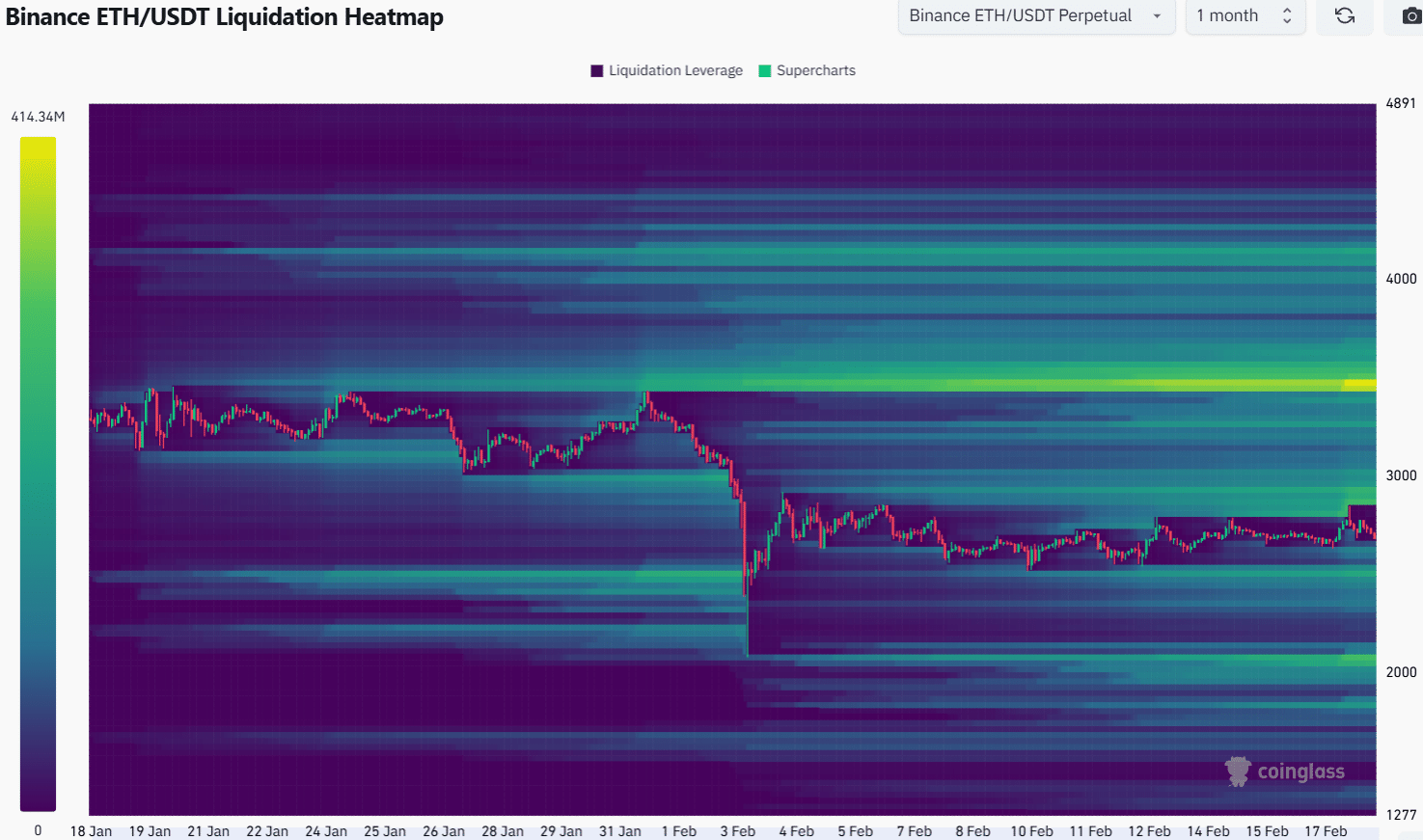

The Ethereum liquidation heatmap from the past month reveals that the $2.9k and $2.5k levels are the closest magnetic zones of considerable size. The former is tantalizingly close to the current price and is likely to pull it in soon—like moths to a flame!

This coincides with the higher timeframe resistance zone at $2,800-$2,850 and the lower timeframe $2,880 resistance. A price move to $2.9k followed by a retracement to $2.5k or $2.6k is anticipated over the coming days. How utterly predictable!

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Bitcoin’s Golden Cross: A Recipe for Disaster or Just Another Day in Crypto Paradise?

2025-02-18 16:10