- Ah, the professional investors! Their reign over the U.S. spot BTC ETFs stumbled last quarter, like a nobleman tripping over his own cape.

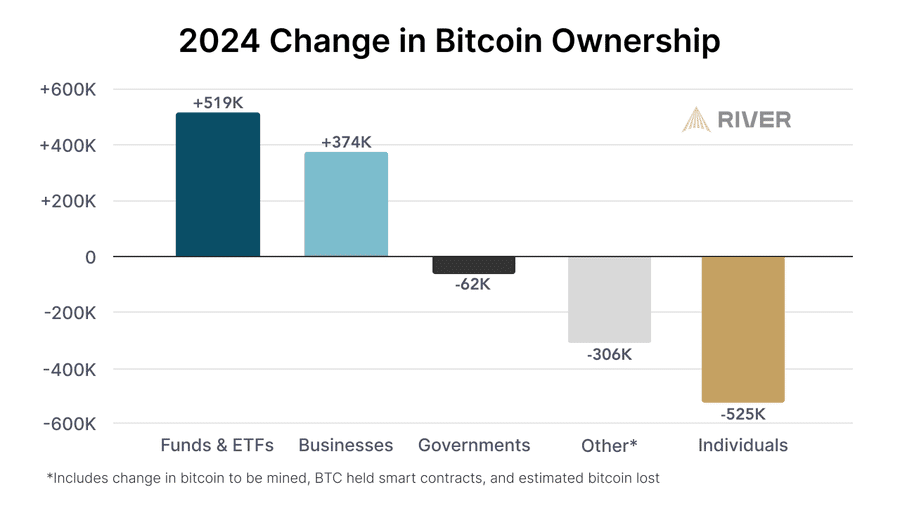

- In the year of our Lord 2024, retail sold a staggering 525K BTC, while the funds, ETFs, and businesses snatched up a glorious 893K BTC. Quite the spectacle, isn’t it?

Institutional ownership in Bitcoin ETF assets has increased threefold in the last quarter. According to the esteemed asset manager Bitwise, institutions now hold 28% of Bitcoin ETF assets, a princely sum of $38.7B, as of Q4 2024. How delightful!

In stark contrast, the big players possessed a mere $12.4B in Q3 2024, a clear indication of the waning retail market share in BTC ETFs. One might say, “Out with the old, in with the new!”

According to the ever-astute Matt Hougan, CIO at Bitwise, institutional ownership in BTC ETFs could soar to 40% by the end of 2025. A veritable gold rush, if you will!

“Professional investors now own 28% of Bitcoin ETF assets, up from 17% in Q3. This will be north of 40% by year-end.”

BTC vs. Gold: The Showdown

Bloomberg’s own Eric Balchunas echoed Hougan’s predictions, suggesting that a 40% institutional dominance in BTC ETFs could mirror the gold market share. He quipped,

“Institutional adoption of the bitcoin ETFs *tripled* in Q4 to $38B, and the % of the assets claimed by 13F filers is up to 25-30% for most of them. For context, $GLD is 40% and where I think these will end up.”

The pace at which BTC was offloaded by retail, while institutions stacked their treasures, only solidified these projections. According to the crypto trading platform River, ETFs, funds, and businesses acquired a whopping 893K BTC in 2024. Quite the haul!

Conversely, the same amount of BTC was sold by governments and individuals, with individuals parting ways with 525K BTC last year. A tragic tale of loss, indeed!

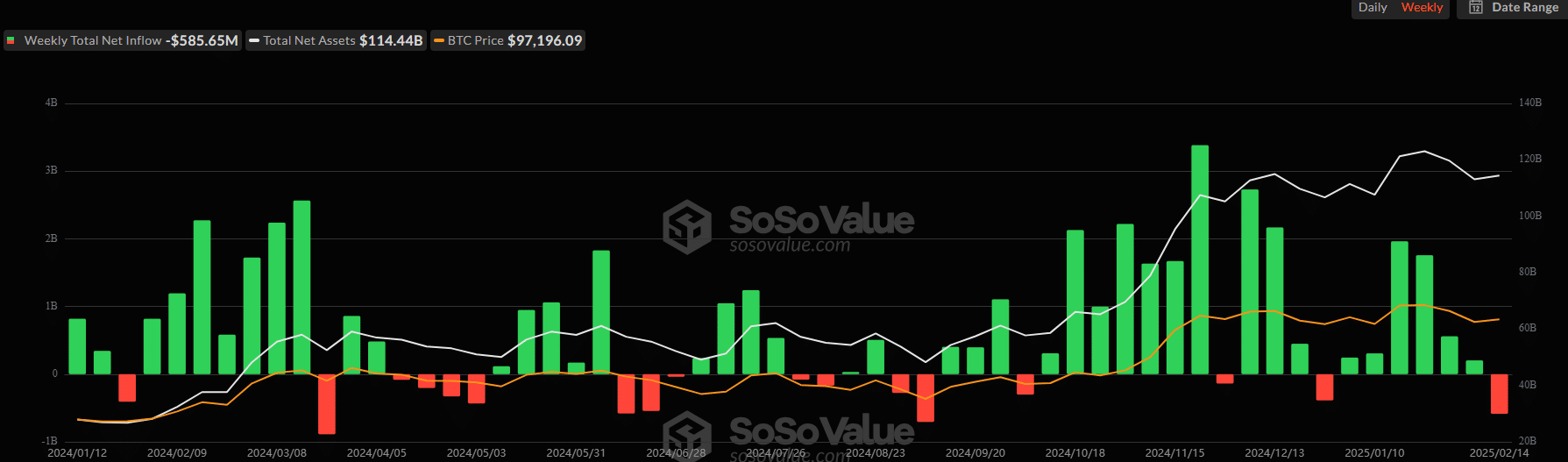

ETF data tracked by SoSo Value revealed that U.S. spot ETF products boasted $114.44B in total net assets as of early 2025. A fortune, if I may say!

The sustained growth of institutions can be attributed to the second phase of BTC ETF adoption, as wirehouses like Morgan Stanley began recommending these products to their risk-tolerant wealthy clients last August. How very generous of them!

Yet, one must ponder how this continued institutional growth in BTC ETFs will reconcile with the ever-looming concerns of centralization. A conundrum for the ages!

At press time, BTC was valued at $95.6K, still trapped within the $90K-$110K price range. A classic case of “the more things change, the more they stay the same!”

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2025-02-19 18:22