- The astute U.S. retail investors, with a flair for timing, have decided to refrain from purchasing BTC post-market opening, seemingly following in the footsteps of their institutional counterparts. Bravo!

- Yet, the cryptocurrency stage remains aglow, with billions of dollars’ worth of BTC being acquired, as if money grows on trees in this exhilarating market.

And what to make of Bitcoin’s rather capricious price dance, one might ask? Over the last thirty days, our beloved asset has taken a tumble—down by 12.42%—whilst managing to muster a rather tepid 0.26% increase in the last 24 hours, a performance that wouldn’t win any awards for boldness.

The current mood? A concoction of hope and skepticism, with significant purchases from our gallant retail investors and their whale-sized brethren. However, liquidity issues, akin to a bad dinner party, could throw quite the spanner in the works.

Buyers Remorse in the U.S. – A Tale of Panic-Selling 🏃♂️

Recent data, akin to a chilling ghost story, reveals that interest from U.S. retail investors and institutions has plummeted faster than a lead balloon.

Ah, behold the Coinbase Premium Index (CPI), which has decided to plummet below zero, indicating that the selling pressure is stronger than a triple espresso on a Monday morning.

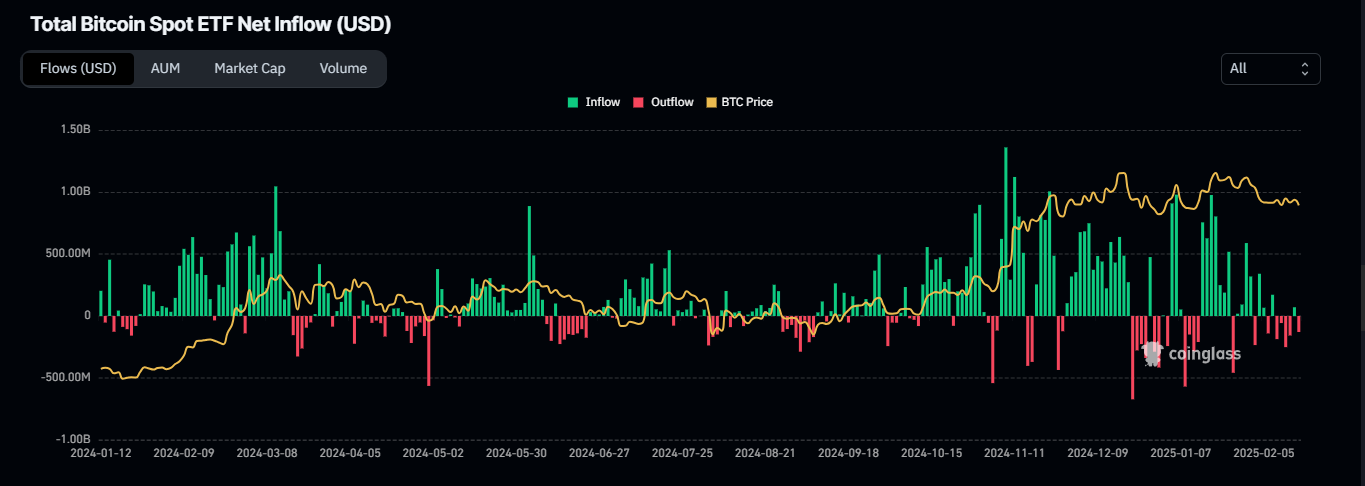

Just two days prior, on the 17th of February, the crypto community danced with glee at a price surge. Yet, ETF activity lately suggests a gloomy forecast, reminiscent of a drizzly English afternoon.

This February’s spot BTC ETFs experienced an inflow of $70.60 million—kudos!—only to be followed by a dreadful outflow of $129.10 million just a day later. Clearly a case of one step forward, two steps back.

This curious trend mirrors outflows seen earlier in the month, from the 10th to the 13th, as institutional investors threw caution to the wind and sold off their BTC holdings like it was a hot potato.

Bullish Sentiment: A Flickering Flame in the Storm

In spite of this tumult, a few brave souls dare to maintain a bullish outlook. As per CryptoQuant’s assessment, a notable address linked with over-the-counter trades appears to be hoarding BTC as if preparing for an upcoming apocalypse.

Currently, this entity has amassed over 28,000 BTC—worth a staggering $2.6 billion! Could this horde lead to a supply squeeze, sending circulating BTC into a tizzy? One could only hope.

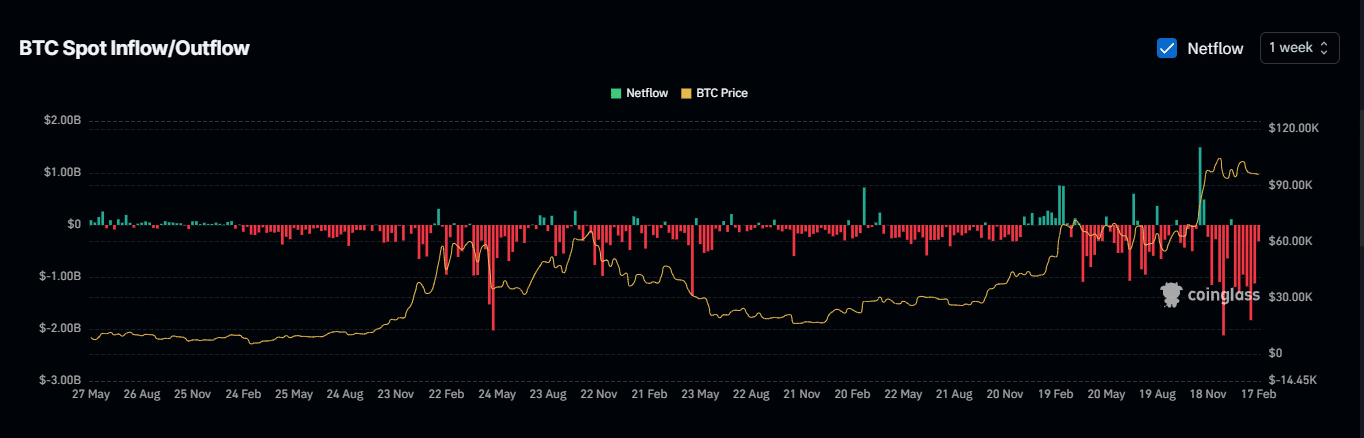

A glance at the spot market indicates similar fevered buying trends; last week, $314.70 million more BTC was acquired than sold. It seems there are still some optimists around!

The netflow data reflects a continuing accumulation trend since January 2025, adding fuel to the bullish fire.

Liquidity Levels: The Unwanted Party Crasher 🎉

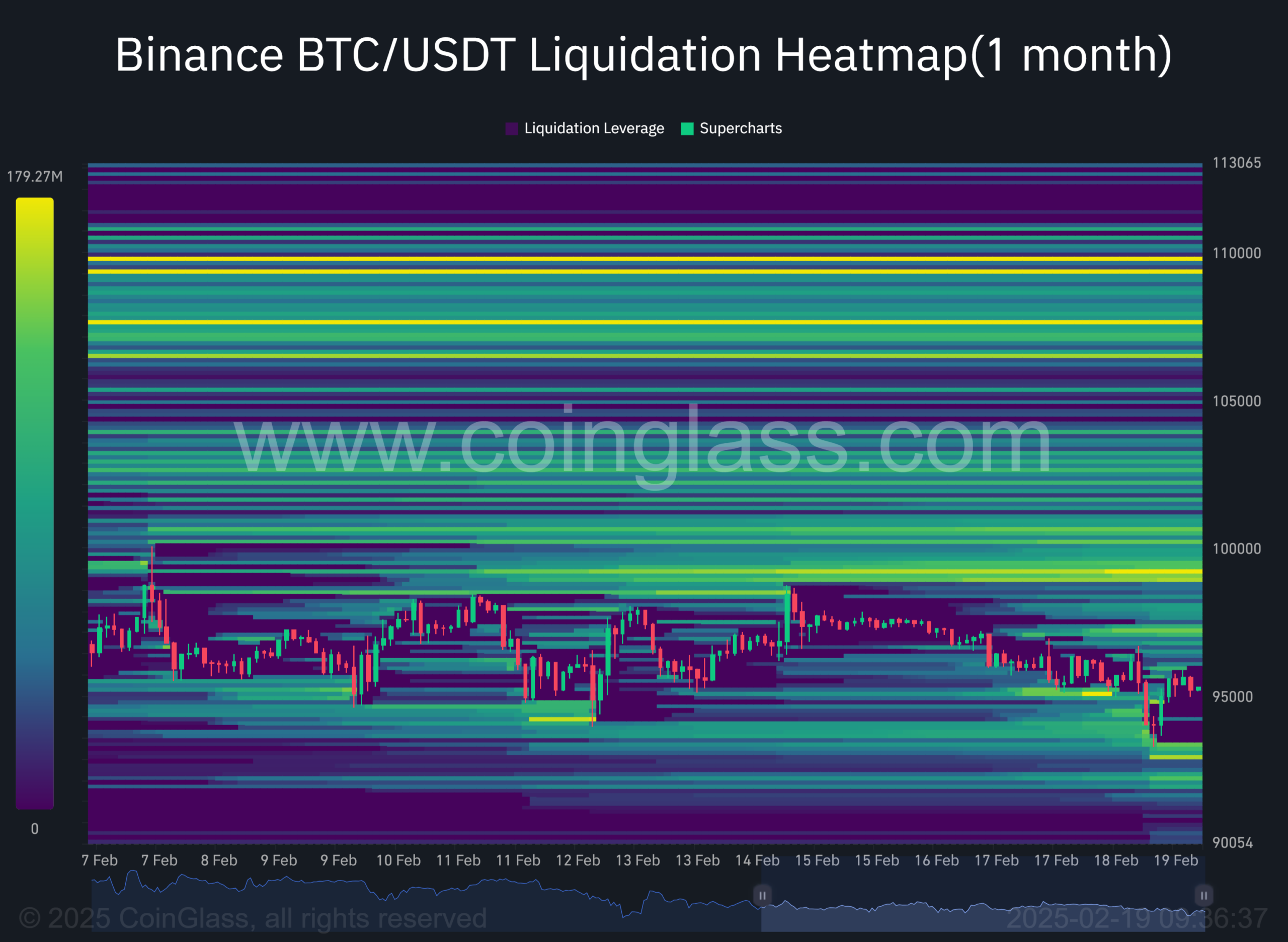

According to Binance’s liquidation heatmap, a significant liquidity level lies at $92,930.28, where a whopping $136.1 million in BTC buy orders lurk.

Generally speaking, these liquidation levels operate like magnets, often drawing the price in their direction. If BTC adheres to this rule, we may witness a plummet to this level followed by a swift rebound for good measure.

For the moment, market sentiment dances a waltz of mixed emotions, and only time, along with the latest data and on-chain activity, will reveal BTC’s next fabulous act.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Despite Bitcoin’s $64K surprise, some major concerns persist

2025-02-20 01:17