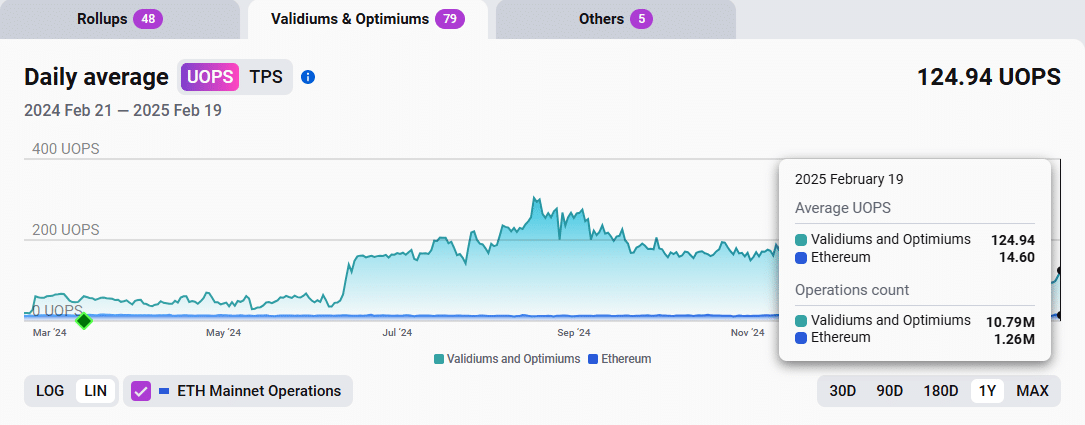

- Oh, the joy! A surge in Ethereum Layer 2 solutions has graciously offloaded some transactions.

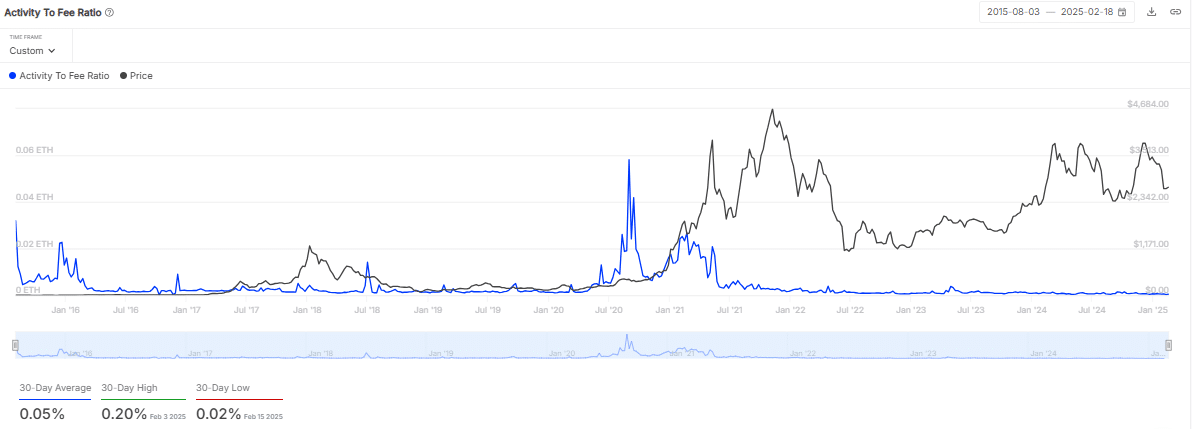

- And let’s not forget the delightful decrease in network activity, as the activity-to-fee ratio plays its part in this grand decline.

In a twist worthy of a theatrical performance, Ethereum’s [ETH] blockchain, the very heart of many a crypto project, including the ever-volatile DeFi and the whimsical NFTs, has experienced a jaw-dropping 70% crash in gas fees. Yes, you heard it right! As of the 20th of February, we are witnessing a four-year low that would make even the most stoic investor chuckle.

Daily fees have plummeted from a staggering $23 million to a mere $7.5 million. What a steal! 🤑

According to the oracle known as IntoTheBlock, the average gas price has nosedived to around 5 gwei, which translates to approximately $0.80 per transaction. This is a sharp decline from the $20-plus fees that were the norm during the peak of 2024. Talk about a rollercoaster ride! 🎢

Now, analysts and users alike are scratching their heads, pondering the mysterious forces behind this drop. The two main culprits? A surge in Ethereum L2s offloading transactions and a delightful decrease in mainnet network activity. Who would have thought?

The Rise of Ethereum L2 Solutions

Behold the rise of L2 solutions like Arbitrum [ARB], Optimism [OP], and Base! These clever little devils process transactions off-chain while basking in the security of Ethereum. They are the unsung heroes contributing to our low fee values.

L2 networks now handle over 1.5 million daily transactions combined, a significant leap from the 800,000 of yesteryear. Bravo! 👏

After the Dencun upgrade, which introduced “blobs” to reduce L2 data costs (yes, blobs!), gas fees on these networks have plummeted by as much as 90%. Some transactions now cost mere cents! Can you believe it?

For instance, Arbitrum’s average fee is now a laughable $0.15 compared to $2 before the upgrade. This newfound cost efficiency has siphoned activity from the mainnet, easing congestion and slashing fees like a hot knife through butter.

As for Rollups, they post data but still manage to reduce activity on the mainnet. It’s like magic! 🎩✨

Validiums and Optimiums, akin to Rollups, also periodically post state commitments of transactions validated by Ethereum, but they keep their data off the mainnet. Sneaky, aren’t they?

Declining Network Activity

Meanwhile, ETH’s mainnet has seen a slowdown, with daily transactions dropping from 1.2 million in January 2024 to just over 900,000 in February 2025. Oh, the humanity!

This dip coincides with DEX volumes falling to $2.62 billion daily, down from a 2024 peak of $5 billion. The waning hype around memecoins and speculative NFT drops has further softened demand for block space. What a tragedy! 😢

Since the Dencun upgrade, ETH issuance has exceeded burns by 197,000 ETH, or $500 million, indicating a delightful decrease in fee pressure. Who knew less could be more?

Cheaper transactions could indeed spur adoption, but beware! There’s potential for challenges as L2 fragmentation might dilute liquidity. It’s a double-edged sword, my friends.

As L2s like Base — boasting a whopping $8 billion in TVL — continue to thrive, Ethereum’s mainnet may evolve into a security backbone rather than a bustling transaction hub. What a plot twist!

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-02-21 02:18