- Alas! Sonic hath encountered a most unfortunate 46% decline in volume, as prices retreated from the lofty heights of $0.99.

- It is anticipated that the retest of $0.8 and $0.73 as support shall be followed by a most promising price ascent.

Our dear Sonic [S] (formerly known as FTM) hath exhibited a commendable bullish vigor over the fortnight past. It hath reversed its early February misfortunes and is gallantly striving towards the esteemed $1 mark.

At this very moment, the $0.8 threshold is being valiantly retested as support. It is most likely that the bulls shall defend this level with all their might. The momentum and volume doth suggest that it is indeed a buyer’s market, much to the delight of those with a penchant for risk.

Sonic is poised to continue its upward trajectory

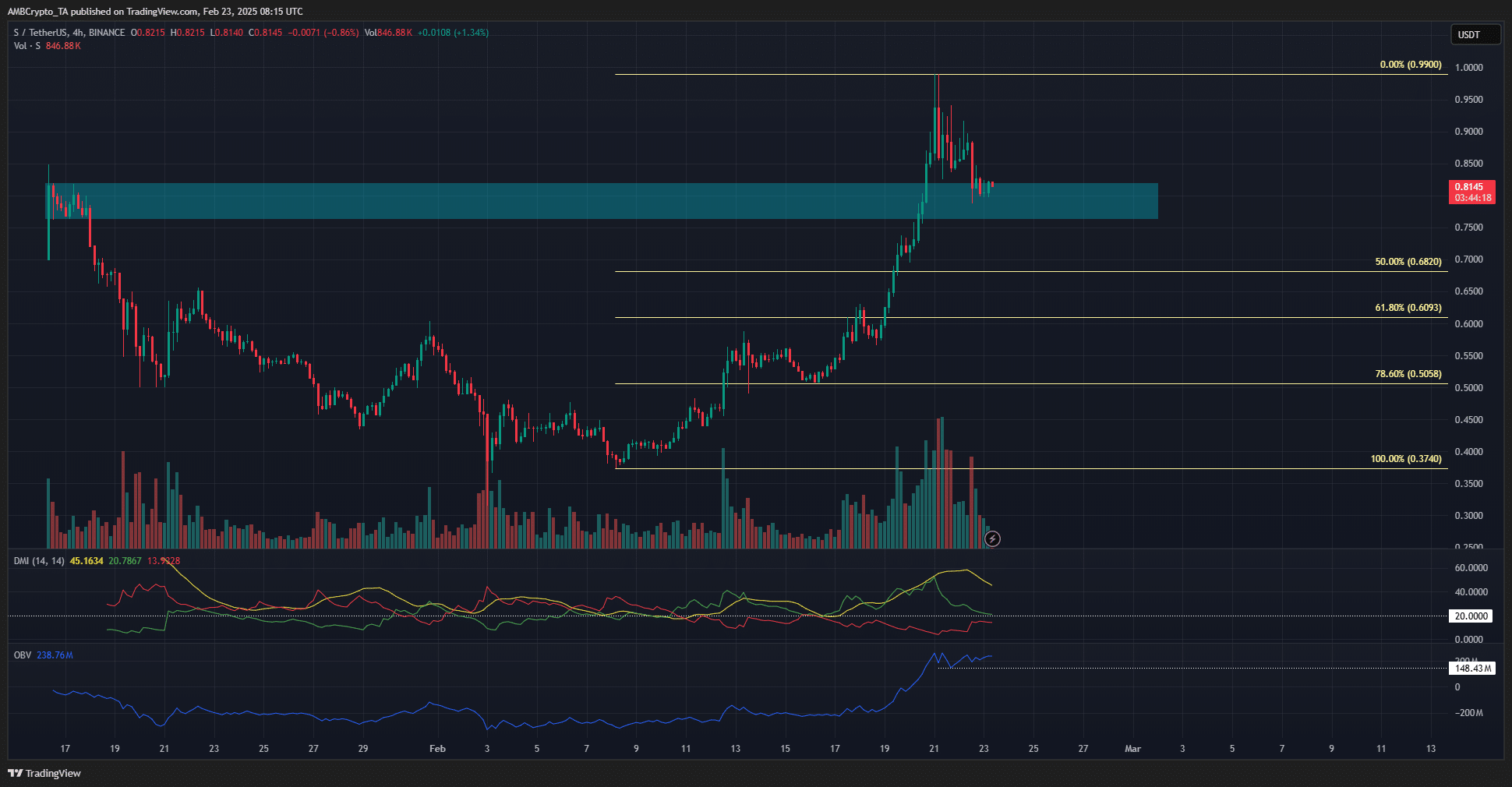

The 4-hour chart of S doth reveal that the uptrend is as robust as a well-bred gentleman. The price hath formed a series of higher highs and higher lows since triumphantly breaking above the $0.6 resistance level.

This resistance had been the lower high that witnessed the price plummet to the dismal $0.315 during the early February sell-off, a fate most unfortunate indeed.

The upward price movement over the past three weeks hath been propelled by a veritable torrent of buying pressure. The volume bars doth display exceptional buying volume, particularly over the past week, as if the market were a grand ball and everyone wished to dance.

This splendid ascent was accompanied by an S breakout beyond the $0.8 resistance, much to the chagrin of the bears.

The DMI of Sonic concurs with the findings from the price action, as the +DI and ADX lines are both above 20, indicating a significant uptrend in progress, akin to a well-planned courtship.

The OBV hath made strong gains as the volume soared in recent days, and is well above the local low marked in white, a sight most pleasing to the eye.

However, a descent below $0.75 would not entirely overturn the bullish market structure, yet it could indeed weaken the momentum. This could pave the way for a deeper retracement towards $0.609 or $0.505, a most precarious situation.

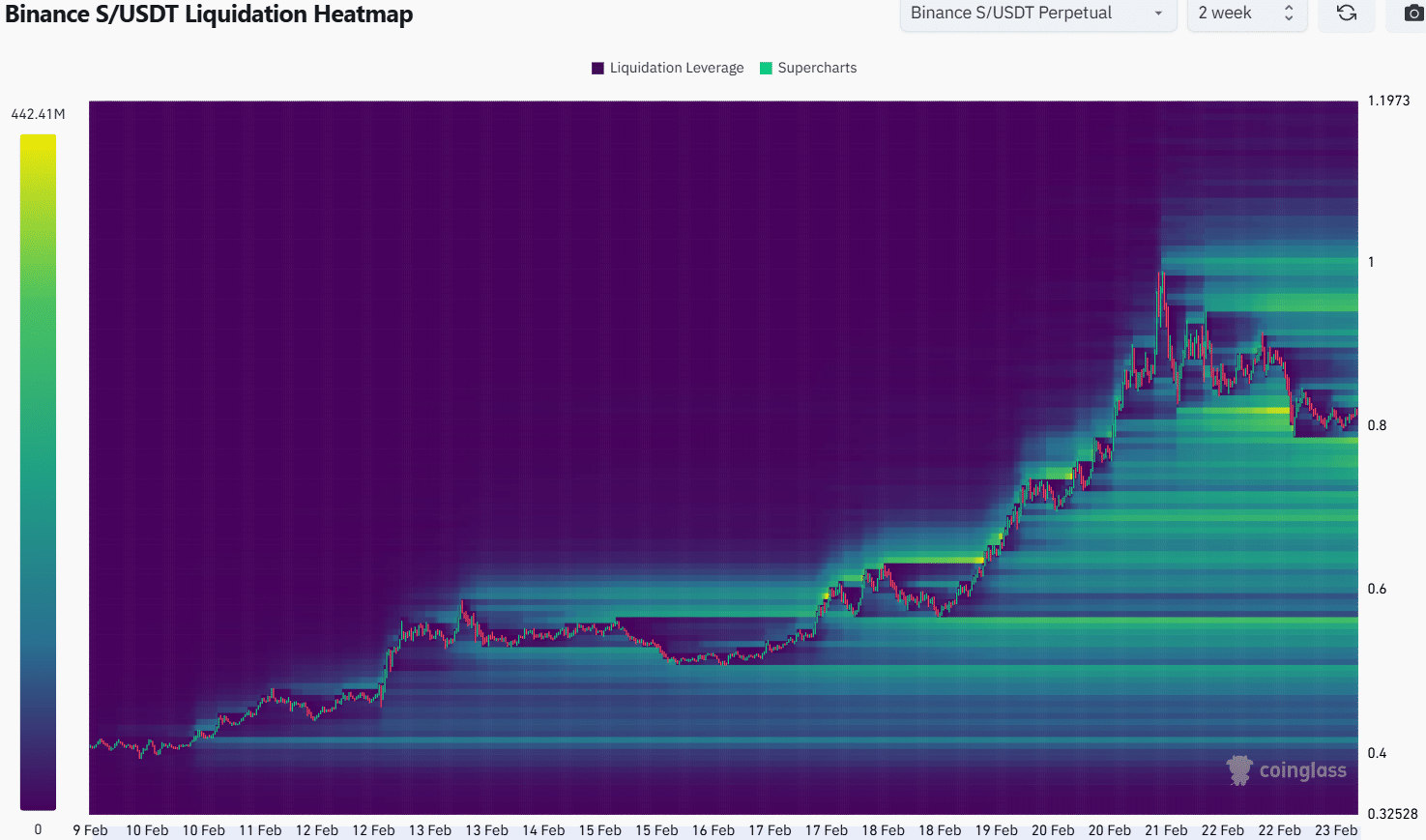

The liquidation heatmap doth reveal substantial liquidity below $0.8 and around $0.95-$1. These are the price targets for the days to come, as if they were the most sought-after invitations to a soirée. A move to $0.739 would sweep the liquidity to the south, much like a hasty departure from a dull gathering.

The forced long liquidations could be swiftly reversed, as the bulls maintain their grip on the market in the near term, much like a determined suitor.

Thus, S traders should remain vigilant of a price drop below $0.8, yet it would not serve as a signal to go short. The $0.71-$0.73 range is expected to function as a lower timeframe demand zone, a refuge for the cautious.

Above the illustrious $1, the $1.4 level is anticipated to be the next notable resistance level, a challenge worthy of any gallant trader.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2025-02-24 00:11