- Another decline is brewing as TRUMP breaks a consolidation phase.

- On-chain and technical indicators support the likelihood of a price drop.

Official Trump [TRUMP] recorded one of the steepest losses in the market, plummeting 13.46% and bringing its price to the $11 region, at press time.

This follows a dismal performance from the asset over the past week and month, with declines of 32.07% and 59.41%, respectively.

Interestingly, a fractal pattern TRUMP has been following suggests the asset’s price could plunge even lower, below the $10 region.

TRUMP’s Fall to a Single-Digit Figure—$8

At the time of writing, TRUMP is trailing a fractal pattern, hinting at a possible further decline.

A closer look at the 1-hour chart shows that after consolidating for four days, TRUMP experienced a major drop. This first occurred between February 19 and 23, with the asset consolidating before a 25.34% drop to the $12 region.

A similar scenario is unfolding, with TRUMP exiting another four-day consolidation phase between the 23rd and 28th of February. It is now on track for a 33.13% decline, targeting $8.37—a level last seen shortly after launch.

To assess the likelihood of this drop, AMBCrypto examined the derivatives market and found that speculation remains bearish.

Speculation for a Potential Fall

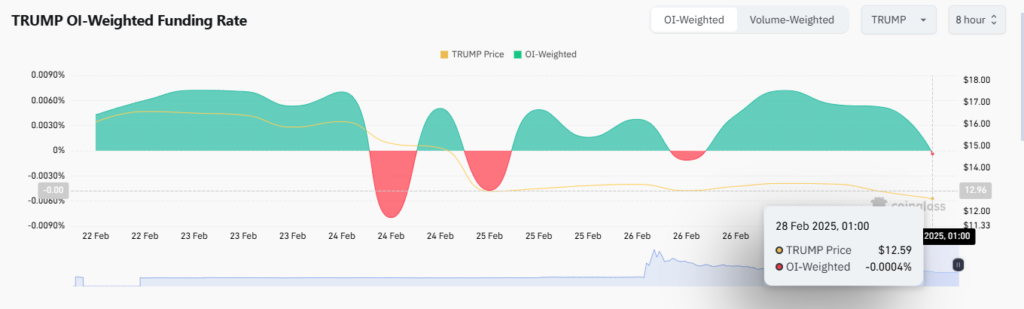

Key metrics in the derivatives market suggest a potential price decline, with the Open Interest (OI)-Weighted Funding Rate and Taker Buy/Sell Ratio indicating high selling volume.

The OI-Weighted sentiment, which was bullish for two consecutive days, has now turned negative, with a reading of -0.0004%, implying a growing bearish sentiment.

The OI-Weighted Funding Rate combines Funding Rate data with Open Interest to determine market trends, making it a reliable measure of trading activity.

The Taker Buy/Sell Ratio confirmed the bearish sentiment, as there has been more selling volume than buying volume. This is determined based on whether the ratio is above 1 (buying) or below 1 (selling).

At the time of writing, this ratio had declined to 0.9231, indicating high selling pressure. If it drops below 0.9, speculation will become highly bearish, accelerating TRUMP’s fall to the $8 region.

Bears’ Presence Confirmed

The Bull-Bear Power (BBP) indicator, which compares buyer and seller presence in the market, confirms the ongoing bearish sentiment.

BBP indicator’s momentum has shifted to the negative region, to -1.40, a level it has maintained since the 25th of February.

Meanwhile, the Money Flow Index (MFI) has entered the oversold region, suggesting sellers could soon exhaust their momentum, allowing for a brief price relief.

However, if other key indicators remain bearish, any relief will likely be short-lived, leading to further declines.

For now, investors remain focused on selling TRUMP, which could play a major role in the asset’s return to $8.

TRUMP’s Downward Spiral: Will It Crash to $8 Next?

Read More

- OM PREDICTION. OM cryptocurrency

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oblivion Remastered – Ring of Namira Quest Guide

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Quick Guide: Finding Garlic in Oblivion Remastered

- Sophia Grace’s Baby Name Reveal: Meet Her Adorable Daughter Athena Rose!

- Ryan Reynolds Calls Justin Baldoni a ‘Predator’ in Explosive Legal Feud!

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

2025-03-01 04:11