- BTC has made a moderate recovery over the past day, rising by 1.55%. (I mean, it’s not winning the lottery, but hey, it’s something!)

- Sellers still dominate Bitcoin markets, and it seems a short squeeze has led to a short-term recovery. (Short squeeze? Sounds like my last attempt at yoga!)

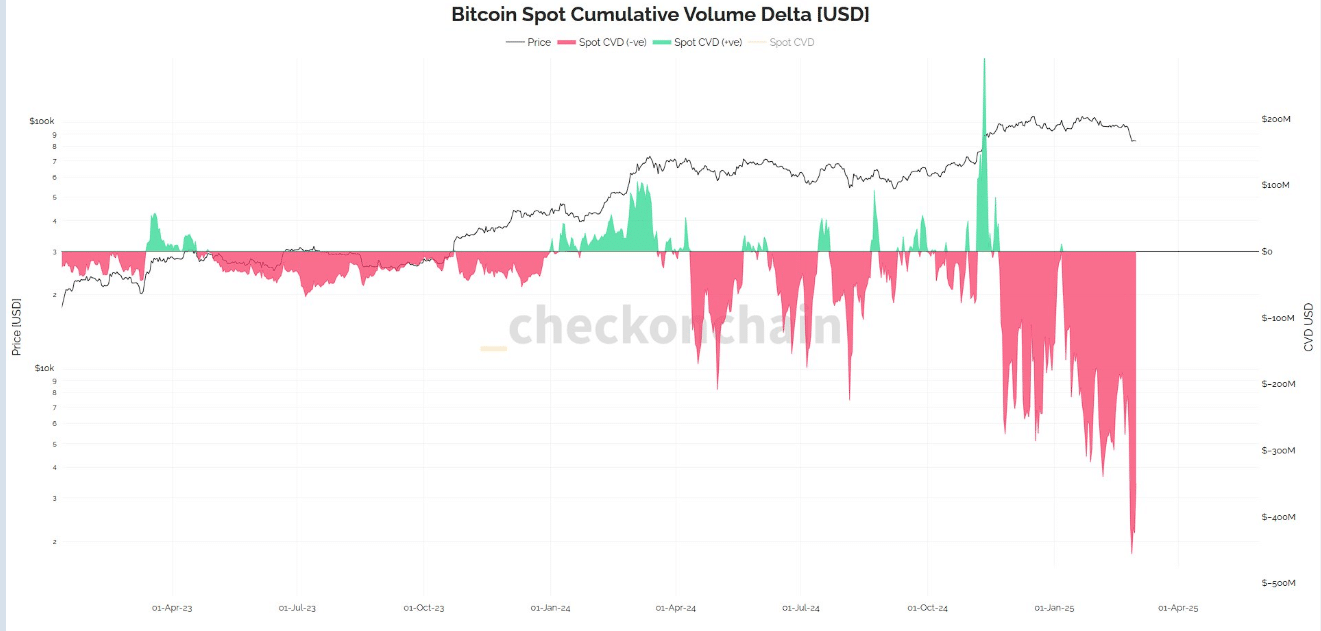

Bitcoin’s [BTC] market dynamics have taken a dramatic turn, with sellers dominating the scene as BTC’s Cumulative Volume Delta [CVD] plunges to its most negative level. (It’s like watching a soap opera, but with more numbers and less romance.)

This signals intense selling pressure, historically a precursor to further declines. However, a short squeeze may be shifting momentum, triggering a surprise recovery that pushed BTC back to $86,259. (Surprise! It’s like finding a $20 bill in your winter coat!)

Bitcoin CVD hits highest negative area

Over the past month, Bitcoin has had one of the worst performances over the past years, dropping by 17% in February. (February: the month of love and Bitcoin heartbreak.)

This drop saw BTC hit a 4-month low. However, this trend has reversed, with Bitcoin reclaiming $86259 as of this writing. (It’s like a comeback tour, but for cryptocurrency!)

Despite this recovery on daily charts, Sellers are still heavily active in the market, as evidenced by the declining CVD. (Sellers are like that one friend who just won’t leave the party.)

In fact, Bitcoin’s spot Cumulative volume delta has declined to hit its most negative area. (It’s like a bad hair day for Bitcoin—just not cute.)

Such a huge drop implies that the market is executing more sell orders than buy orders, suggesting that more investors are selling their BTC. (It’s a sell-off party, and everyone’s invited!)

Since CVD usually tracks cumulative sell v buy volume, an extremely negative level indicates that selling momentum outweighs buying, which typically reflects strong market bearishness. (Bearish? More like bear-y bad news!)

Historically, when sellers dominate the market, further price decline has preceded as Bitcoin struggles to find strong support. This decline resulted in more traders taking short positions as they expected prices to dip further. (It’s like a game of musical chairs, but with more stress and fewer chairs.)

However, the sudden demand for shorts seems to have resulted in the reverse effect, resulting in a short squeeze. (Short squeeze? Sounds like my jeans after Thanksgiving dinner!)

Did BTC experience a short squeeze?

While Bitcoin is experiencing higher sell orders, the markets are signaling a short-term recovery. As such, the short-term conditions suggest that BTC could make some moderate gains on its price charts. (Moderate gains? I’ll take it over my last date’s performance!)

This implies that while CVD has reached its highest negative value, it seems Bitcoin has experienced a short squeeze as demand for BTC among traders has gone short and surged. (Surged? Like my caffeine intake on a Monday morning!)

This led to the price recovery witnessed over the past day. (It’s like a plot twist in a rom-com—unexpected but delightful!)

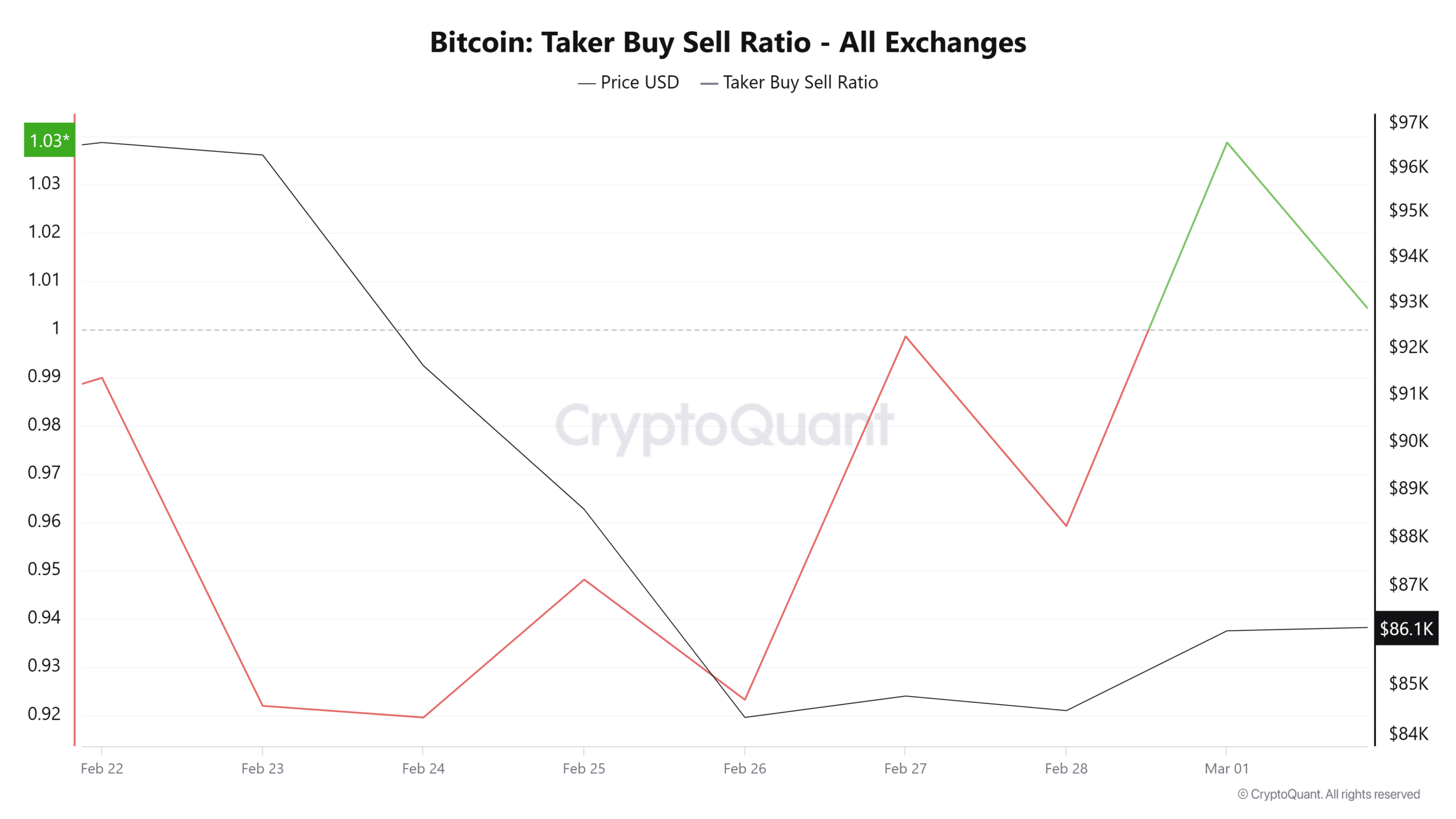

This sudden shift in sentiment arises from a rising demand for Futures. The surge in buy orders evidences the high demand for Futures as traders started going short. (Futures? Sounds like a fortune teller’s gig!)

These buyers have entered the market and absorbed the high sell pressure arising from the negative CVD. As such, the Taker buy-sell ratio has turned positive for the first over the past week. (Positive? Like my attitude after a good cup of coffee!)

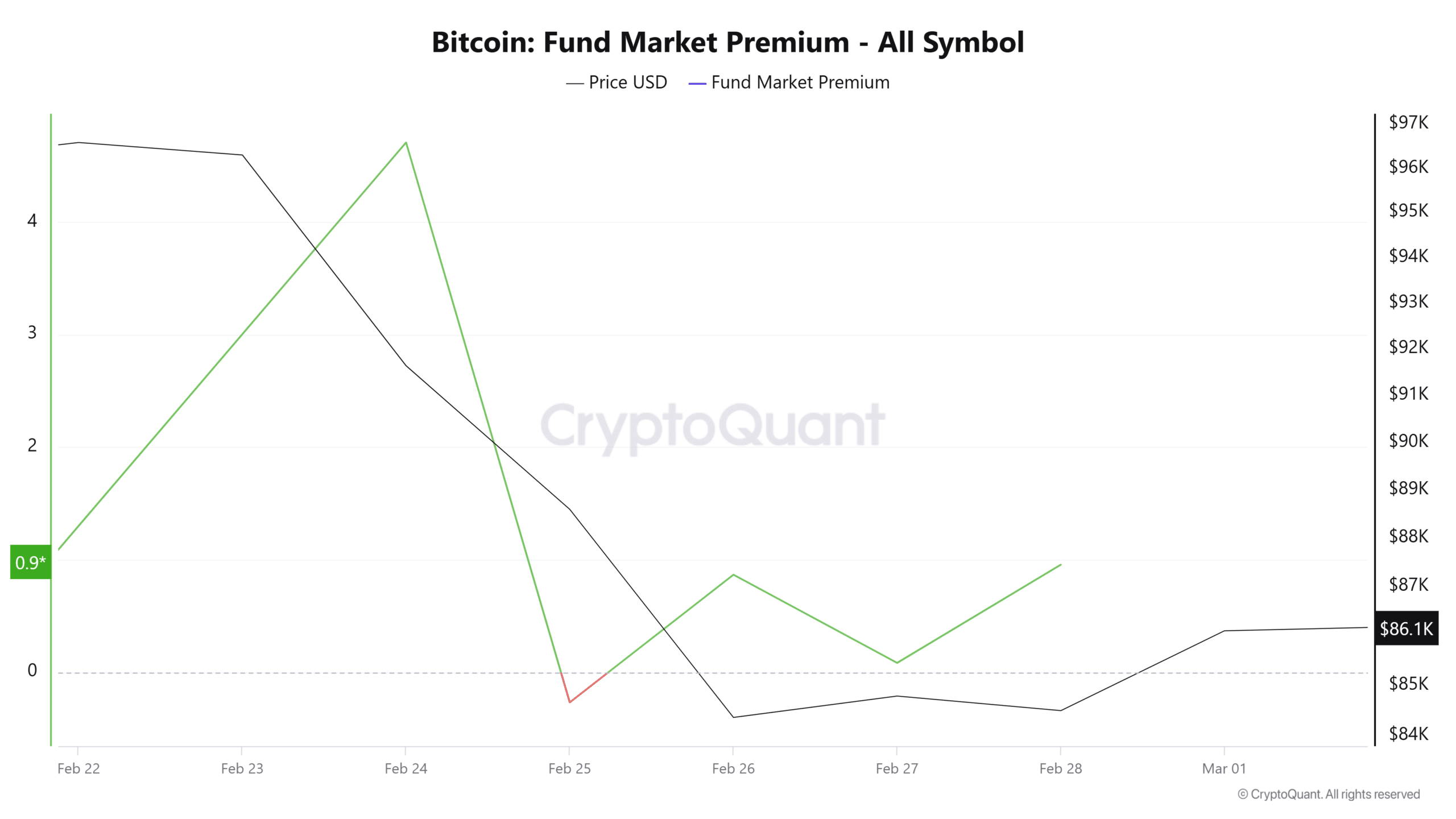

Additionally, Bitcoin’s Fund market premium has turned positive, suggesting that the Futures market is more bullish than the spot market. (Bullish? More like a bull in a

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2025-03-02 17:32