- Ethereum, like a moody artist, shrunk by 2.70% in the last 24 hours.

- As investors emerge from the shadows to buy the dip, Ethereum must nail down the elusive $2,350 for any chance at rallying.

In the theater of cryptocurrencies, Ethereum [ETH] has donned its dramatic mask, swinging wildly over the past fortnight. Just two weeks ago, ETH paraded proudly at a local high of $2.7k. Yet, quite the debacle unfolded, leaving it tumbling below $2,000—

a spectacular fall not witnessed since the echoes of November 2023.

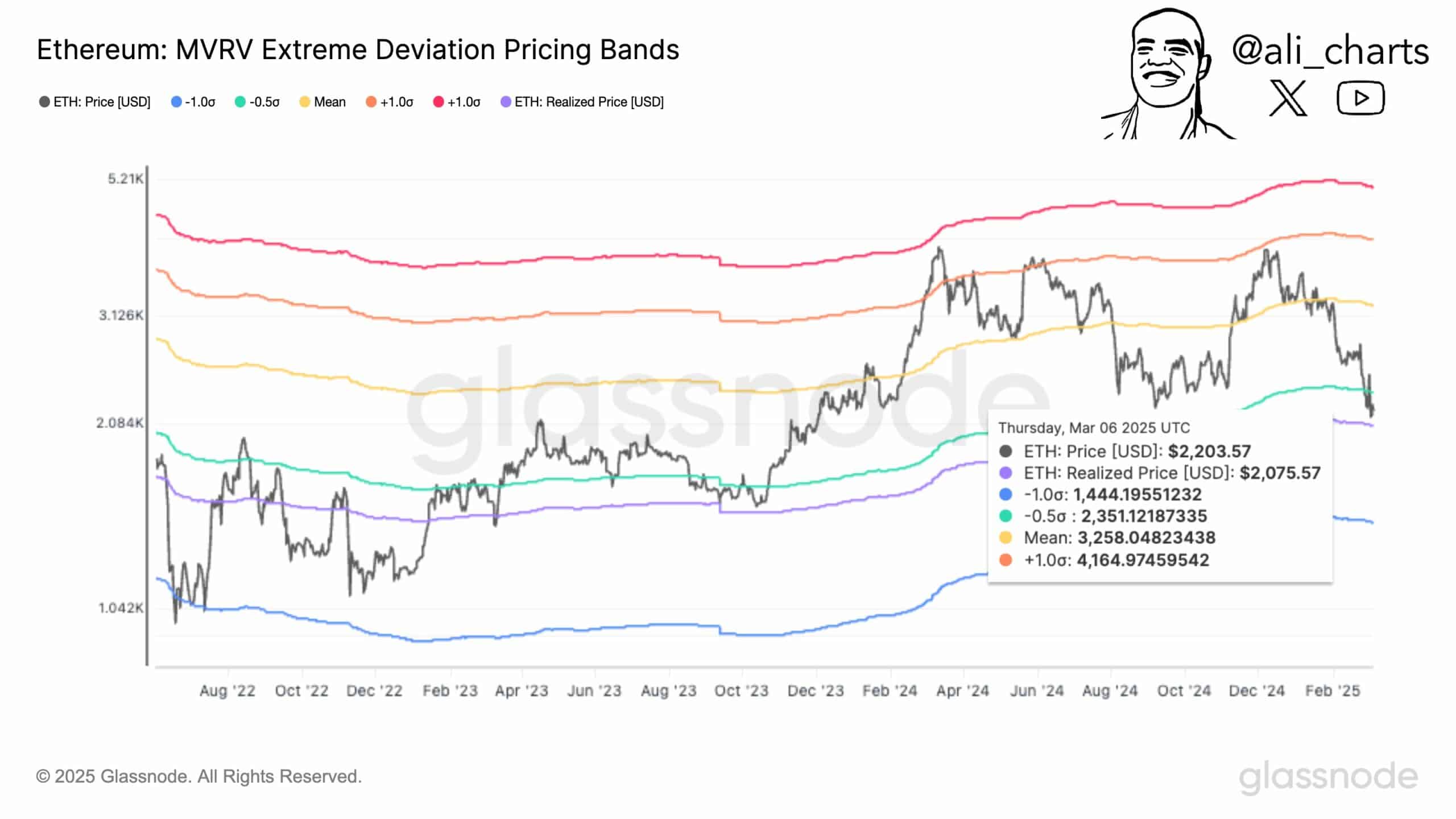

This latest price ballet has left the key stakeholders—some optimistic, others deeply contemplative—spinning in circles. Among the brighter orbs is Ali Martinez, the crypto prophet who chats about a potential ascent toward $3,260, all while referencing pricing bands and the mystical MVRV.

Can Ethereum scrape its way to $3,260 on the chart’s stage?

In this performance, Martinez shines a spotlight on the hefty resistance level at $2,350, ideal for a dramatic comeback.

Should ETH break free from this gravitational pull and ascend above it, the stage could be set for a surge of buying momentum, eyeing a magnificent next act around $3,260. A reclaiming of this level would not only stir the audience, but would signal a bullish trend worthy of a standing ovation, coaxing eager investors to plunge into the altcoin’s embrace.

Martinez, with his crystal ball, notes that Ethereum’s recent descent below its MVRV has orchestrated a grand opportunity to buy. Historically, stepping in at these levels has often rewarded investors handsomely—

a plot twist seen regularly since the gilded days of 2016.

Thanks to this marvelous decline, we find investors hopping on the buying dip bandwagon, reveling in the chaos.

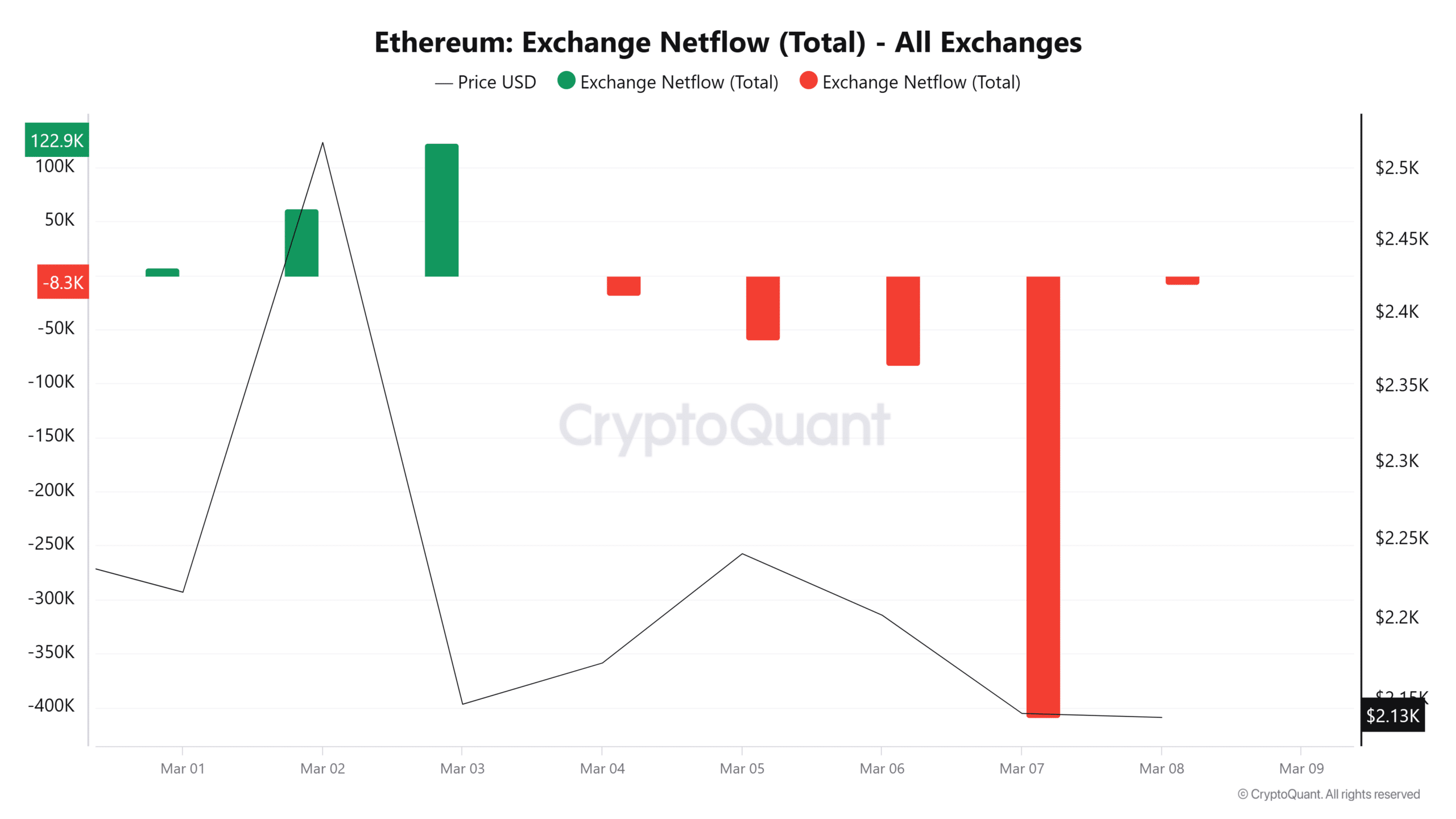

Evidence of this buying spree glistens in Ethereum’s exchange netflows, which have adorned negative attire for four consecutive days. A negative netflow suggests a culinary delight where buyers feast boisterously, with outflows devouring inflows.

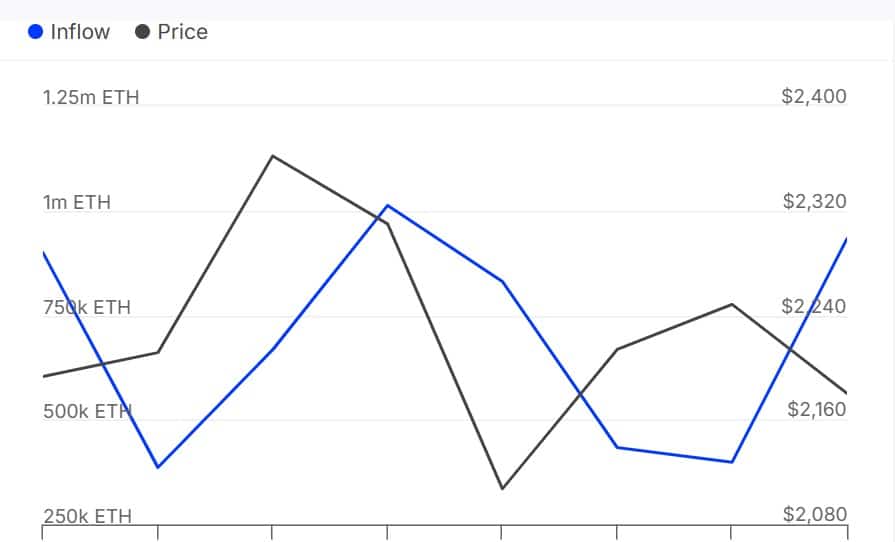

A closer inspection reveals that whale attendees in this grand crystal ball gazing have particularly indulged in the buying magic. According to the sages at IntoTheBlock, Ethereum whales have wrangled over 932.79k ETH tokens in a single day—quite the buffet!

Furthermore, large holders saw netflows jump to 474.89k, where capital inflows swelled beyond outflows. Should whales choose to accumulate while frolicking in bullish sentiments, this turn of events would surely make the dip a tempting affair for hungry investors.

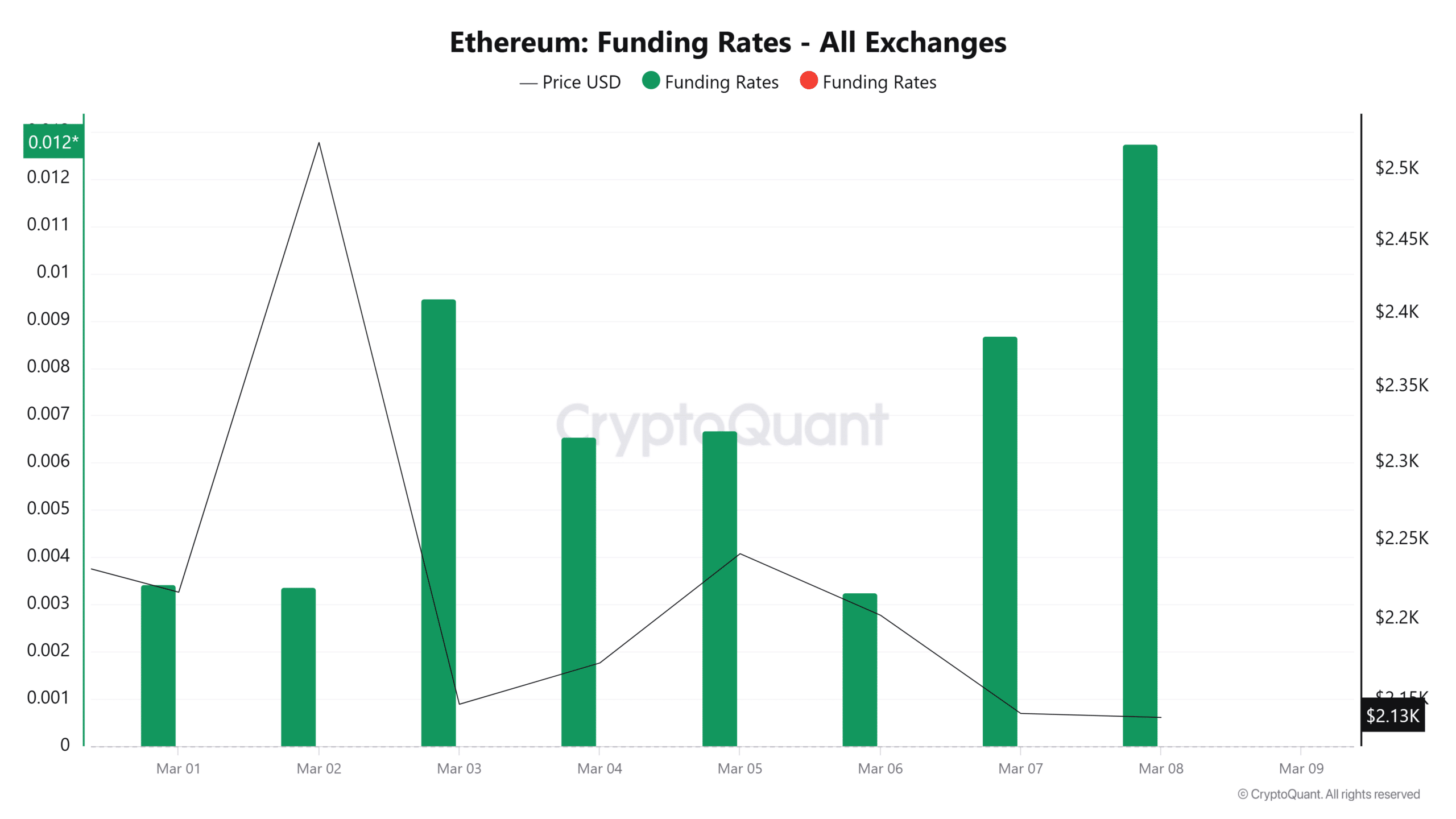

This bullishness receives additional applause from the rising funding rate, now strutting its stuff at a weekly high of 0.01.

When the funding rate pirouettes upwards, it implies traders are paying fees aplenty to hold their long positions—a testament to their unwavering anticipation for a price rally endorsed by rampant accumulation.

What’s next in the drama of ETH’s price action?

In conclusion, Ethereum’s buyers—both the crafty whales and the curious retailers—have waltzed back into the market. With sellers appearing rather fatigued after the recent tango, ETH stands at the precipice of recovery. Should the demand from yesterday persevere, the light at $2,325 might shine again, paving the way toward an encore at $2.7k.

However, if the bullish knights falter in their quest, the altcoin may wade through the murky waters, reassured that it would remain afloat between $2,114 and $2,300. For Martinez’s lofty targets to manifest, reclaiming $2.7k and $3k must come first—an uphill battle unless macroeconomic winds shift in favor.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- How to Get to Frostcrag Spire in Oblivion Remastered

- Doctor Doom’s Unexpected Foe: The Dark Dimension’s Ultimate Challenge Revealed!

- Daredevil’s Wilson Bethel Wants to “Out-Crazy” Colin Farrell as Bullseye in Born Again

2025-03-08 18:45