- Oh darling, Saylor dreams of the U.S. owning a staggering 1M-4.2M BTC in a mere decade!

- Bitcoin‘s price? A bit like a wallflower at a ball—muted, despite the nation-state FOMO swirling about! 💃

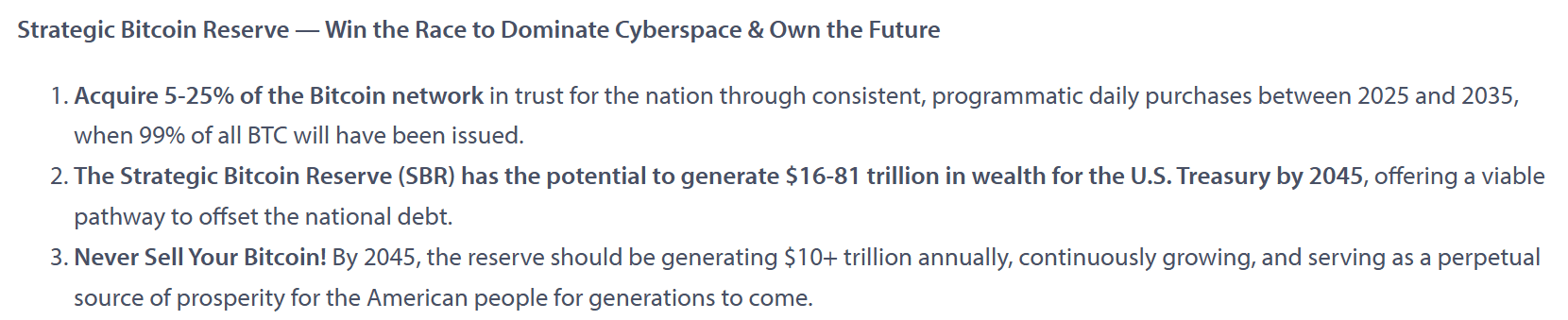

Michael Saylor, the illustrious Founder of Strategy (formerly known as MicroStrategy, but who’s counting?), has upped the ante, insisting that the United States should snatch up a cheeky 5%-20% of the total Bitcoin [BTC] supply. How positively audacious! 🎩

At the inaugural crypto summit at the White House—where the decor was as flashy as the proposals—Saylor unveiled his grand vision for U.S. digital supremacy in the 21st century. Part of this delightful scheme includes a 10-year BTC acquisition plan. Oh, the suspense! 🕵️♂️

According to Saylor’s rather ambitious plan, if the U.S. manages to acquire 5%-20% of the supply (1.05M-4.2M BTC), it could rake in a staggering $16-$81 trillion over the next 20 years. Quite the financial fairy tale, wouldn’t you say? However, this little escapade would set the nation back a cool $90 billion – $362 billion at current prices. A small price to pay for glory! 💰

Let’s not forget, this isn’t Saylor’s first waltz with the idea of the U.S. controlling 20% of Bitcoin’s market. Just last month, he warned that if the U.S. doesn’t act, other countries might just swoop in, with the UAE, Russia, and China all eyeing the prize. How scandalous! 😱

Bitcoin – Is Nation-State FOMO on the Horizon?

Brian Armstrong, ever the optimist, echoed the potential FOMO from other countries after the President established the U.S. strategic BTC reserve. He quipped,

“The rest of the G20 are looking at America on offense in this industry (Bitcoin, crypto), and will likely follow suit.” Oh, the pressure! 😅

According to Arkham data, the U.S. government currently holds 198k BTC, worth a dazzling $17 billion at current prices. However, some analysts suggest that a few of those forfeitures might just waltz back to Bitfinex, potentially shrinking the stash to a mere 88k BTC. How very dramatic! 🎭

How the U.S. government plans to adopt ‘budget-neutral strategies’ to acquire more BTC, as per executive order, remains a tantalizing mystery. Will they pull a rabbit out of a hat? 🎩✨

However, the nation-state FOMO could be just around the corner. Recent reports suggest that South Korea’s top financial insiders are also keen on considering a strategic BTC reserve. Such FOMO could give BTC’s value a delightful boost! 🚀

On the flip side, the short-term reaction to the U.S. strategic BTC reserve has been a classic “sell the news” affair. Despite the bullish update, the world’s largest cryptocurrency took a nosedive from $92.8k to $86.8k – an 8% drop. How utterly predictable! 📉

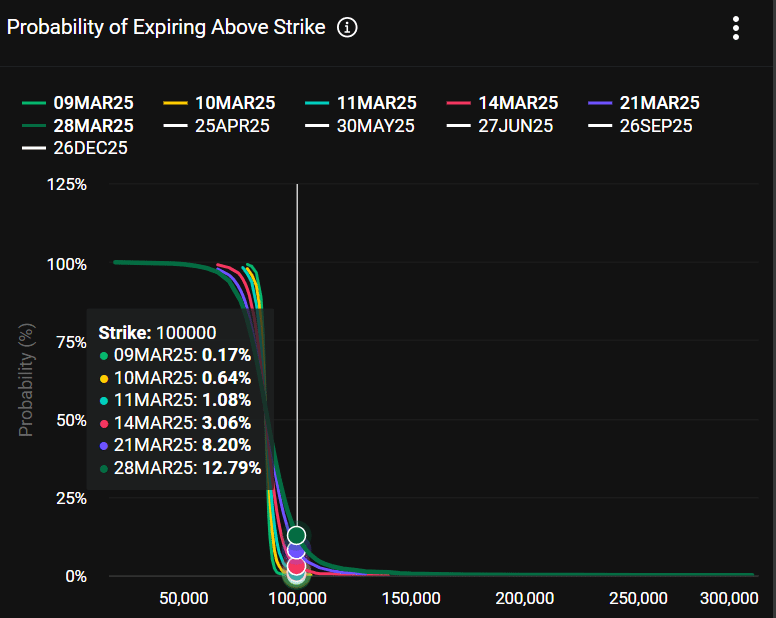

Even the end-March price projection looks rather grim at press time. According to predictions site Polymarket, the market is bracing for a likely dump to $70k rather than a jubilant rally above $100k. Oh, the drama! 🎭

According to Deribit data, Options traders are pricing in only a 12% chance that BTC will reclaim $100k by the end of March. How delightfully pessimistic! 😏

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- How to Get to Frostcrag Spire in Oblivion Remastered

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Daredevil’s Wilson Bethel Wants to “Out-Crazy” Colin Farrell as Bullseye in Born Again

- tWitch’s Legacy Sparks Family Feud: Mom vs. Widow in Explosive Claims

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

2025-03-08 19:38