- Avalanche is like that quiet kid in class who suddenly aces the exam – 2025, here we come!

- While everyone’s busy with Ethereum and Bitcoin, Avalanche is like, “Excuse me, I’m over here!” 🥱

Avalanche [AVAX] is sneaking up on us like a cat in a horror movie, with new user sign-ups skyrocketing in Q1 2025. Meanwhile, the market is glued to Ethereum’s L2 drama and Bitcoin ETF gossip, completely missing Avalanche’s glow-up. Seriously, it’s like watching a rom-com where the best friend finally gets the spotlight!

History tells us that when users flock to a platform, it’s usually a sign that something big is about to happen. With DeFi and GameFi activities picking up speed, could Avalanche be the next breakout star? Grab your popcorn! 🍿

Avalanche – The Numbers Behind the Drama

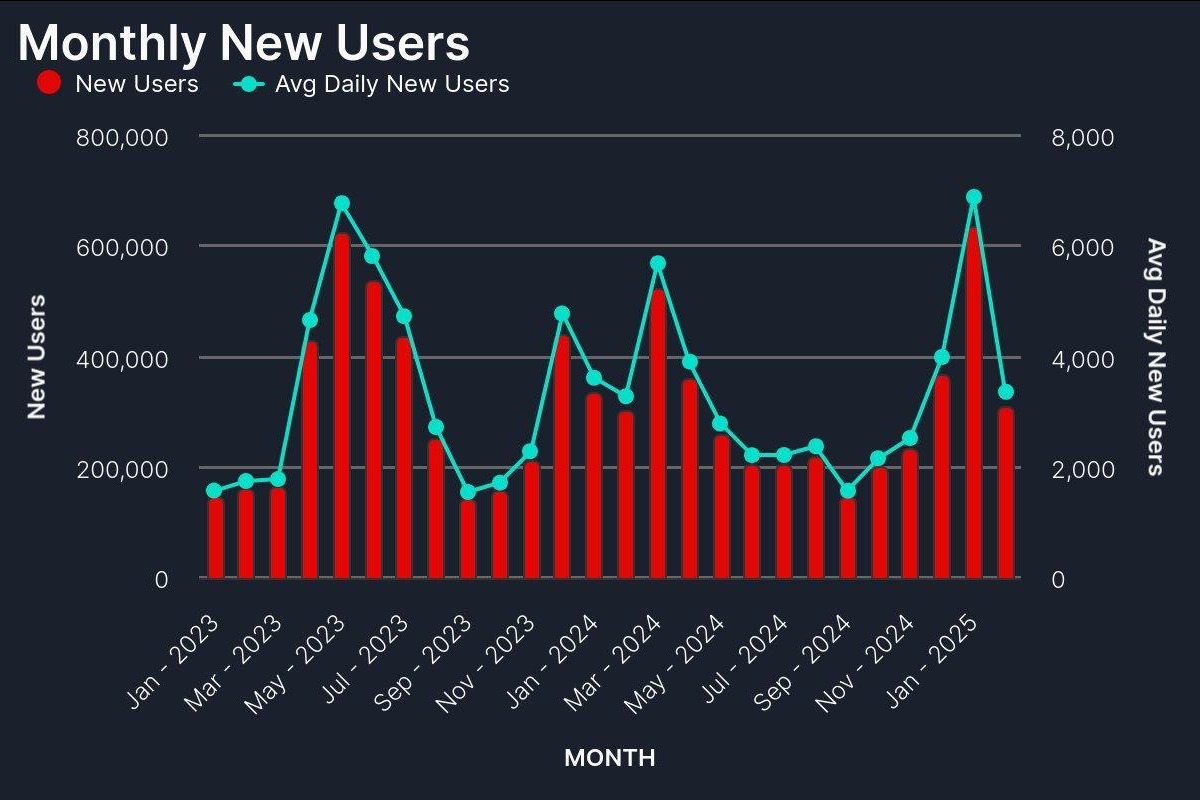

So, Avalanche’s user growth has been a rollercoaster ride over the last two years, with wild spikes and then… crickets. The latest surge in early 2025 was like a surprise party – 600,000 new users in a month and daily sign-ups hitting 6,000! 🎉

Contrast that with mid-to-late 2024, when user acquisition was as exciting as watching paint dry, stuck below 200,000 per month. Yawn!

This pattern shows that Avalanche has bursts of popularity, likely triggered by some juicy ecosystem developments or the market’s mood swings. If this trend keeps up, we might just see a renaissance of interest from investors and developers alike. Cue the dramatic music!

What’s Fueling This Comeback? 🔥

Avalanche’s recent glow-up can be traced back to a $250 million investment in December 2024, courtesy of Galaxy Digital and Dragonfly Capital. They’re basically the fairy godmothers of the crypto world, helping to expand the ecosystem.

And let’s not forget the Avalanche9000 upgrade, which launched on December 16. It slashed transaction fees by 75%! That’s like finding a 75% off sale at your favorite store. 🛍️ Daily transactions jumped by 38%, and institutional adoption is on the rise, with big names like BlackRock and Franklin Templeton getting cozy with Avalanche.

Why is No One Talking About It? 🤔

Despite its impressive user growth, Avalanche is like the wallflower at the crypto party. Everyone’s too busy fawning over Ethereum’s L2 expansion and Bitcoin ETF inflows to notice. Media coverage? More like a one-way ticket to Snoozeville, with Ethereum roll-ups and Solana’s memecoin madness hogging the limelight.

Another reason for this radio silence? The lack of high-profile endorsements. Unlike Solana, which has cheerleaders like Visa and Jump Crypto, Avalanche is still waiting for its moment in the sun. But hey, this under-the-radar vibe might just be the perfect setup for savvy early adopters to swoop in before the crowd catches on!

Whale Activity and Valuation Trajectory – Can AVAX Keep the Party Going? 🐋

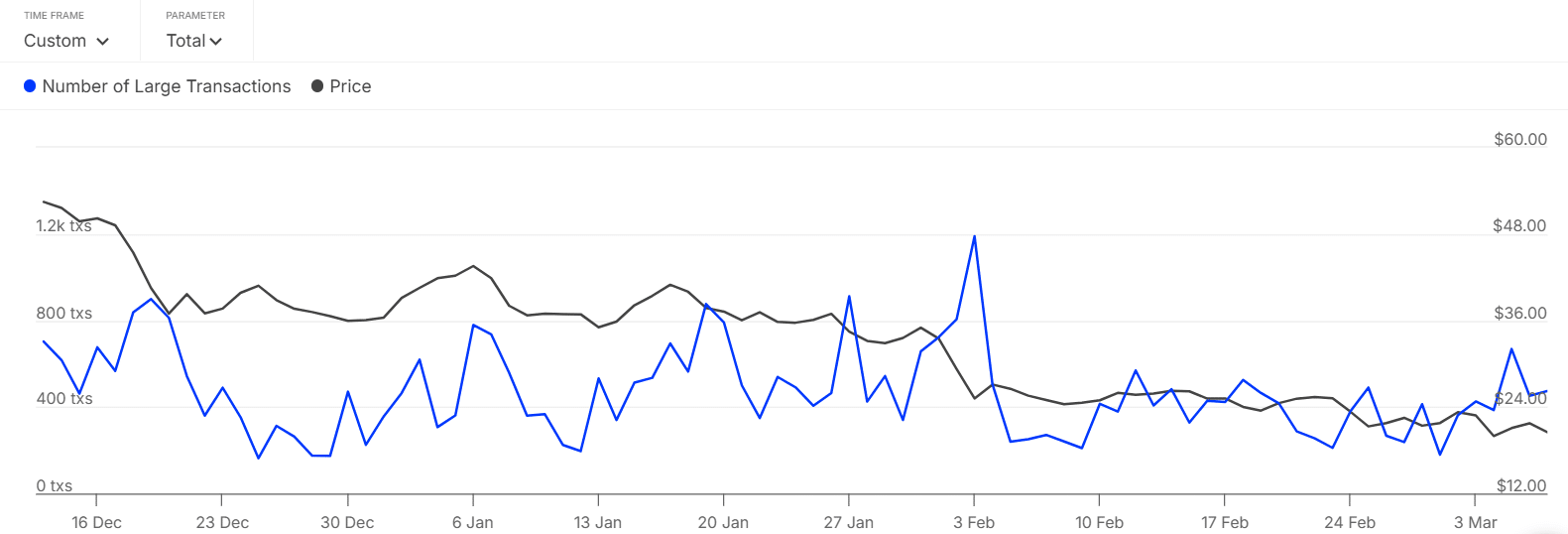

According to IntoTheBlock data, AVAX’s price action is like a dance closely following whale activity, with big transactions occasionally leading the price cha-cha. 💃

This suggests that institutional and whale investors are still in the game, but whether they’ll keep accumulating is anyone’s guess. It’s like waiting for the next season of your favorite show – will it get renewed or canceled?

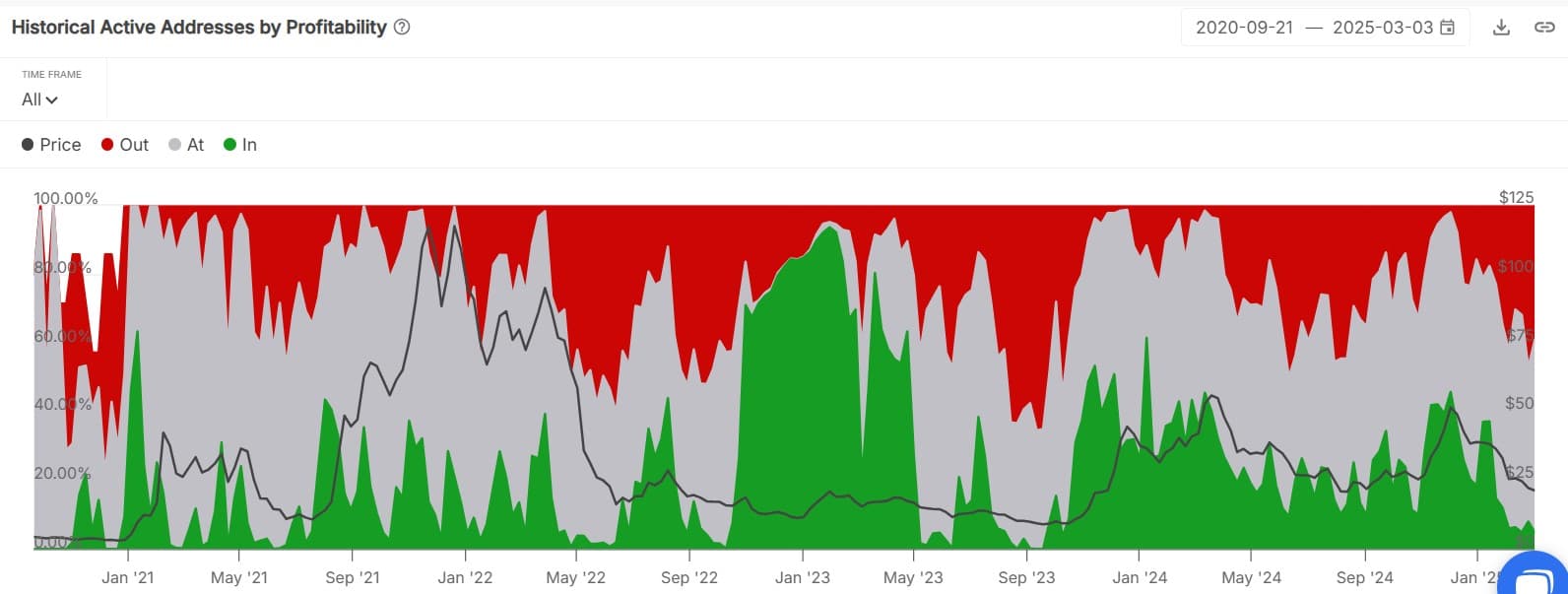

Finally, there’s a connection between active addresses in profit and AVAX’s price cycles. Historically, when profitable addresses spike, it often precedes local price tops. Meanwhile, periods of underwater holders set the stage for comebacks. If these patterns hold, AVAX could be in for a wild ride in 2025, assuming demand stays strong and the market doesn’t throw a tantrum!

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- How to Get to Frostcrag Spire in Oblivion Remastered

- Doctor Doom’s Unexpected Foe: The Dark Dimension’s Ultimate Challenge Revealed!

- Moana 3: Release Date, Plot, and What to Expect

2025-03-08 21:27