- Ah, Bitcoin! Testing the fabled $84,640 threshold, a stage set for either glory or despair.

- Should it stumble, we might witness a descent to $64,700 or even the dreaded $60K, but fear not, for a phoenix may rise from the ashes!

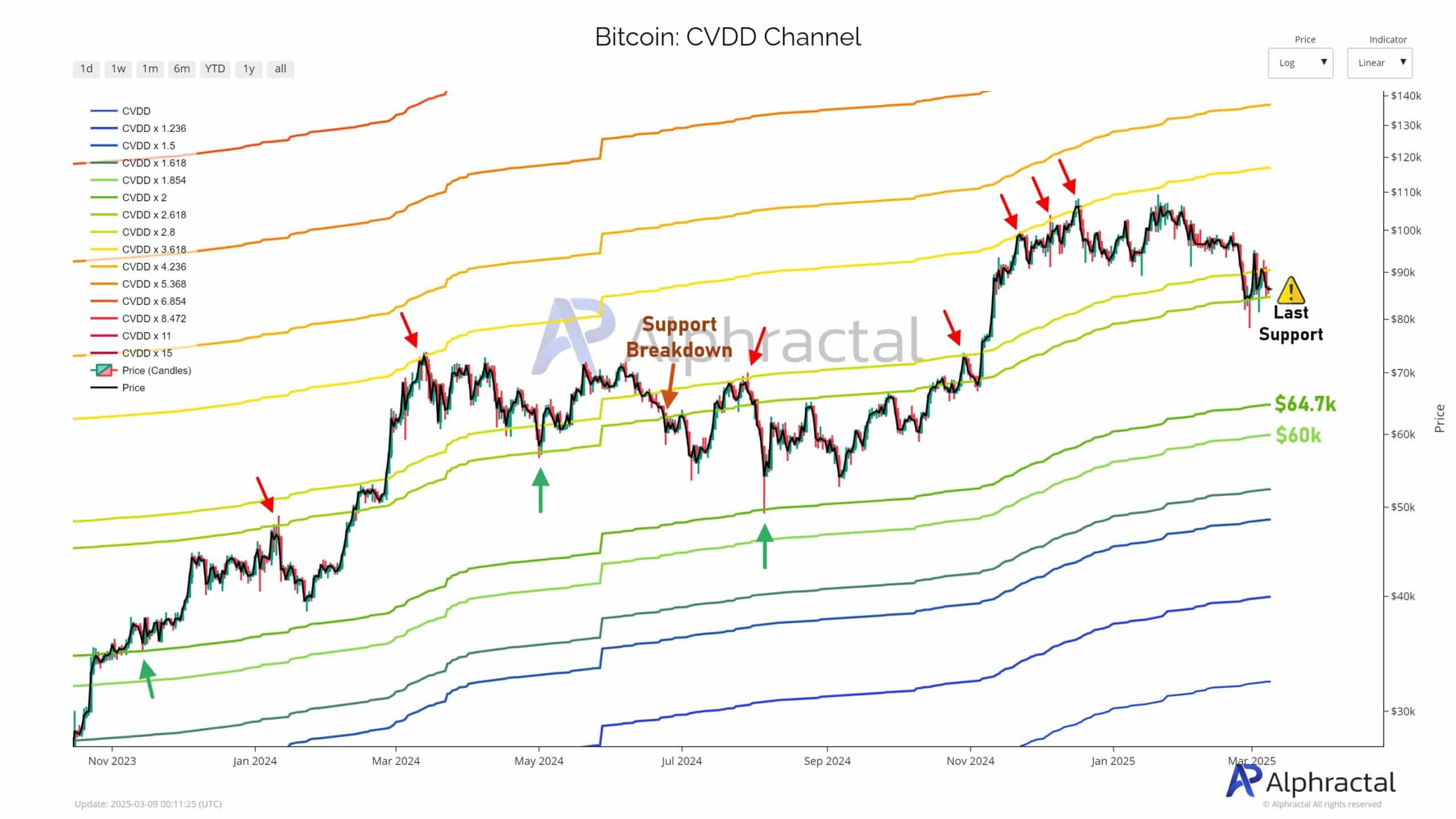

Behold, Bitcoin [BTC] teeters on the edge of a precipice, a tightrope walker in a circus of finance! The CVDD channel, a sage of the blockchain, whispers that $84,640 is the line between triumph and tragedy.

If our digital hero can hold its ground, a new all-time high may beckon. But should it falter, brace yourselves for a plunge towards $64,700 or the abyss of $60K.

Yet, history has shown us that from the depths of despair, great rallies often emerge, like a bad joke that somehow becomes a classic.

The CVDD Channel: A Tale of Wisdom

The CVDD (Cumulative Value Days Destroyed) Channel, a wise old owl, tracks the behavior of long-term investors, measuring the value of coins moved against their age. It’s a trusty compass for spotting the bottom of the cycle.

By weaving Fibonacci multiples into its fabric, this channel crafts dynamic support and resistance bands that Bitcoin has, in its whimsical nature, respected over time.

These lines serve as a crystal ball, revealing the future of price movements, where each breakdown or breakout is a prelude to the next CVDD band.

In essence, it transforms the chaotic dance of investors into a roadmap of predictions — and right now, it’s flashing a signal that could make a fortune teller blush!

Bitcoin’s Current Drama: A Historical Echo

At this moment, Bitcoin is flirting with the CVDD × 2.618 level, a lofty $84,640. This line has been a steadfast ally in past uptrends, but now it quivers on the brink of collapse.

Data reveals that similar breakdowns occurred in mid-2022 and late 2024, both of which sent prices tumbling to lower CVDD bands, like a bad habit that just won’t die.

Green arrows, the heralds of hope, point to previous bounces off mid-level bands, while red arrows mockingly highlight failed supports.

The market’s current antics mirror past episodes where prices failed to hold their ground, plummeting to the next level like a soap opera character in a dramatic twist.

A clean break here could echo the infamous 2022 plunge — but fear not, for a rebound may also be on the horizon, as seen in the tales of yore.

Peering into the Future

If Bitcoin can muster the strength to stay above the $84,640 line, it may just be laying the foundation for a new base. This could signal the formation of a local bottom, paving the way for a rally into uncharted territory.

Similar consolidations in 2021 and late 2023 were the precursors to strong bullish runs, like a well-timed punchline in a comedy routine. Sustained strength here would bolster bullish sentiment and validate the channel’s prophetic prowess.

However, should it tumble below $84K, prepare for a deeper correction, with the next support lurking at $64,700 — a ghost from the April 2021 all-time high.

If the selling pressure continues, we might see prices plummet to the depths of $60K.

While the short-term outlook may seem grim, such a dip wouldn’t be unprecedented; Bitcoin has danced this dance before in 2021, briefly dipping before soaring to new heights. The real question is: how long will it linger in the shadows?

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Serena Williams’ Husband’s Jaw-Dropping Reaction to Her Halftime Show!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- Oblivion Remastered – Ring of Namira Quest Guide

- Sophia Grace’s Baby Name Reveal: Meet Her Adorable Daughter Athena Rose!

2025-03-09 17:20