- OKX has emphatically denied any involvement in the grand escapade of Bybit hackers.

- ETH projections are as mixed as a smoothie made by a confused robot.

In a twist that could only be described as a plot twist in a poorly written sci-fi novel, OKX’s leadership has categorically denied the rather scandalous allegations of laundering a mere fraction of Bybit’s $1.5 billion worth of stolen Ethereum (ETH) through its DEX aggregator platform, affectionately known as the OKX Web3 wallet. Because, of course, who wouldn’t want to launder stolen funds through a wallet that sounds like it was named by a committee of hyperactive squirrels?

Star Xu, the illustrious founder and CEO of OKX, took to the airwaves to declare the reports “incorrect” and “misleading,” which is a bit like saying that a black hole is just a really enthusiastic vacuum cleaner.

“According to a Bloomberg report, Bybit seems to be pointing fingers at us, suggesting we’re helping the hackers launder a cool $100 million… This is incorrect and misleading,” he stated, probably while rolling his eyes so hard they nearly fell out.

Meanwhile, the Bloomberg report has attracted the attention of EU regulators, who are probably just looking for something to do. Xu, however, reassured everyone that OKX is more than willing to play nice with global regulators on Web3 policy, which is a bit like saying you’re open to sharing your dessert with someone who just stole your lunch.

Ben Zhou, the CEO of Bybit, chimed in to clarify that Bloomberg had misquoted them, which is a bit like saying the cat didn’t knock over the vase; it was just “exploring its options.”

“We did not provide any statement to this Bloomberg article. I believe when they say ‘according to Bybit,’ they were actually referring to http://lazarusbounty.com and the facts on it,” he explained, probably while trying to figure out how to unring that bell.

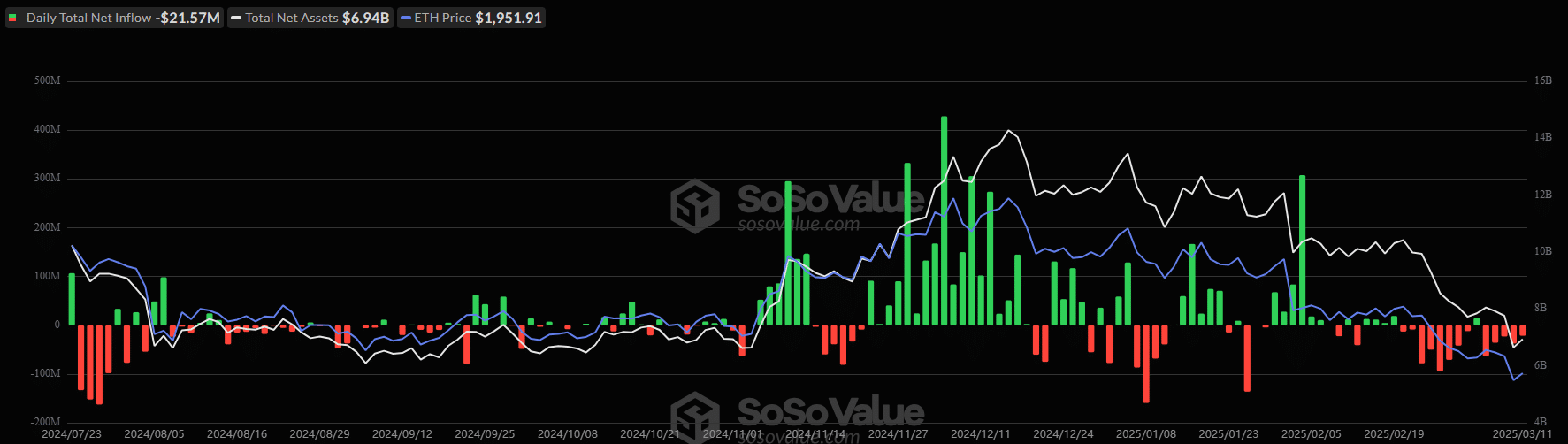

U.S. ETH ETFs Bleed Like a Stuck Pig

In the aftermath of the Bybit hack, the Ethereum market has taken a nosedive that would make even the most seasoned skydiver cringe. U.S. spot ETH ETFs have logged over $500 million in outflows over the past three weeks, which is a lot of money to lose in a game of financial musical chairs.

For six consecutive days, these products have been bleeding out like a punctured balloon, as investors react to U.S. recession fears. Because nothing says “invest in crypto” like a looming economic apocalypse!

On Tuesday, they saw $21.5 million in outflows, while a staggering $37.5 million of ETH ETF products were sold on the 10th of March. It’s almost as if investors are trying to set a world record for the fastest exit from a sinking ship.

Unsurprisingly, this risk-off mood has dragged ETH’s value down to a two-year low of $1.7K, which is about as appealing as a soggy sandwich left out in the rain. This has brought the altcoin back to levels before the current bull cycle began, which is a bit like returning to your childhood home only to find it’s been turned into a parking lot.

However, amidst the chaos, there are mixed outlooks and sentiments from market participants. Some analysts are optimistic about a potential rebound for the altcoin, citing technical indicators and price fractals, which sounds suspiciously like a magic spell.

For instance, Titan of Crypto noted that ETH’s market structure resembles BTC’s prior cycle, and a V-recovery could send it soaring higher, which is a bit like saying a rubber band can launch you into orbit.

Meanwhile, the pseudonymous analyst Crypto Rover has boldly predicted that ETH could surge to $8K, citing historical trend

Read More

- OM PREDICTION. OM cryptocurrency

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Serena Williams’ Husband Fires Back at Critics

- Christina Haack and Ant Anstead Team Up Again—Awkward or Heartwarming?

- WWE’s Braun Strowman Suffers Bloody Beatdown on Saturday Night’s Main Event

- Five Nights at Freddy’s: Secret of the Mimic Release Date Announced in New Trailer

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Solo Leveling Arise Amamiya Mirei Guide

2025-03-12 17:16