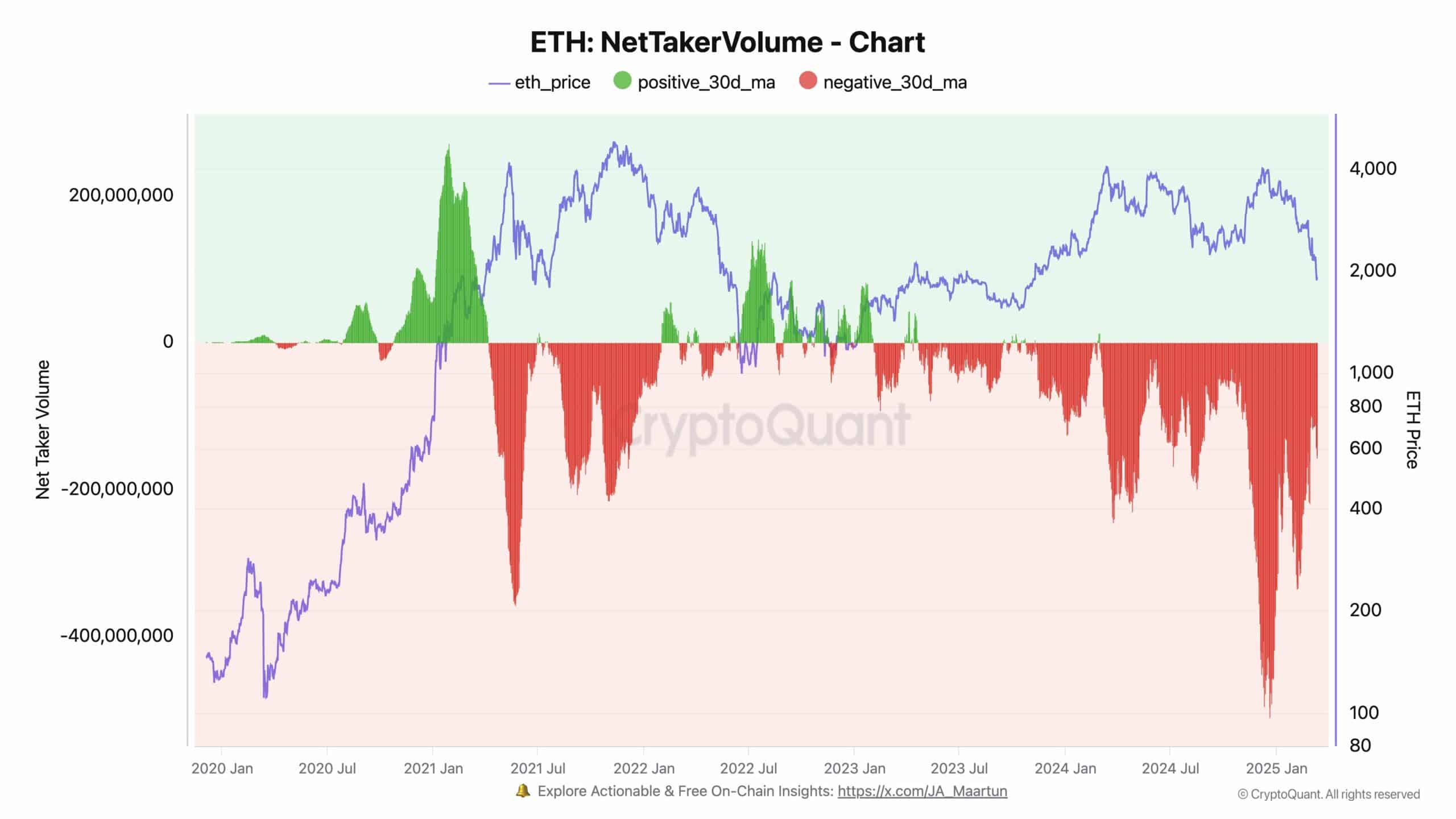

- Alas, Ethereum’s net taker volume languishes in the crimson depths, a testament to the relentless sell pressure that has gripped the market for months.

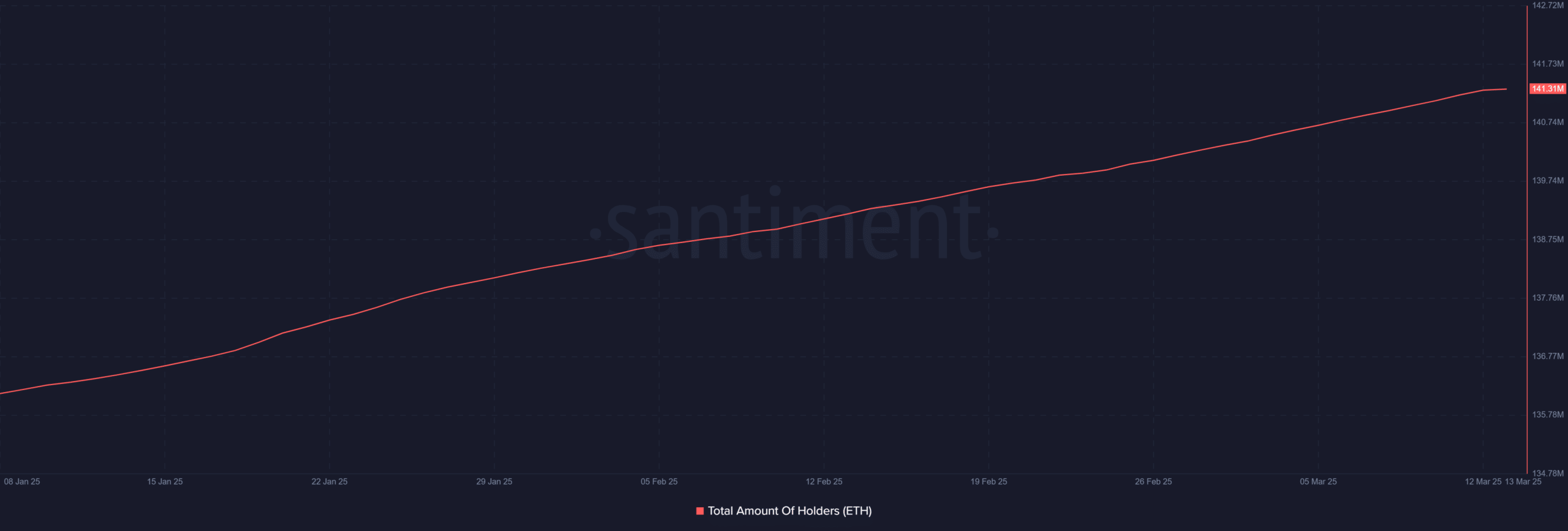

- Yet, in a twist of fate, the ranks of ETH holders swell, hinting at a curious accumulation amidst the chaos.

Oh, Ethereum [ETH], how you have endured a seemingly eternal tempest of selling! The net taker volume, a harbinger of doom, reveals a persistent negative momentum that has cast a shadow over the past few months.

This dismal trend, my dear reader, speaks of a sell-side dominance that would make even the most stoic investor quiver, often linked to a waning market confidence or a broader retreat from risk. Yet, amidst this storm, the number of ETH holders continues to rise, prompting one to ponder: are these steadfast souls accumulating in the face of adversity, or is a price reversal lurking just beyond the horizon? 🤔

The Relentless Sell Pressure of Ethereum

Data from CryptoQuant, that ever-watchful oracle, has unveiled an extended phase of aggressive selling, with net taker volume painted in deep red hues.

Such a scenario, dear friends, indicates that sell orders have trampled upon buy orders, ensnaring Ethereum in a bearish embrace. Historically, this prolonged negative taker volume has been a precursor to major corrections or capitulation events, which could spell further misfortune if this trend persists.

Reflecting upon the annals of history, we see that ETH has traversed similar paths of intense selling, only to be reborn when buying momentum re-emerges. However, the current saga appears more drawn out, suggesting that investor sentiment remains as cautious as a cat in a room full of rocking chairs. 🐱

The Growing Legion of ETH Holders

As Ethereum’s price flounders, the number of holders has been on a steady ascent.

On-chain data from Santiment reveals that the total ETH holders have reached a staggering 141.31 million, a testament to consistent growth despite the price’s dismal performance.

This curious phenomenon suggests that while the short-term traders flee like rats from a sinking ship, long-term investors are still convinced that there’s gold to be found in the depths of ETH’s current levels. 💰

One might speculate that institutional and whale investors are quietly amassing Ethereum while retail traders capitulate in despair. This accumulation could very well set the stage for a potential recovery, should the sell pressure relent and the broader market conditions improve.

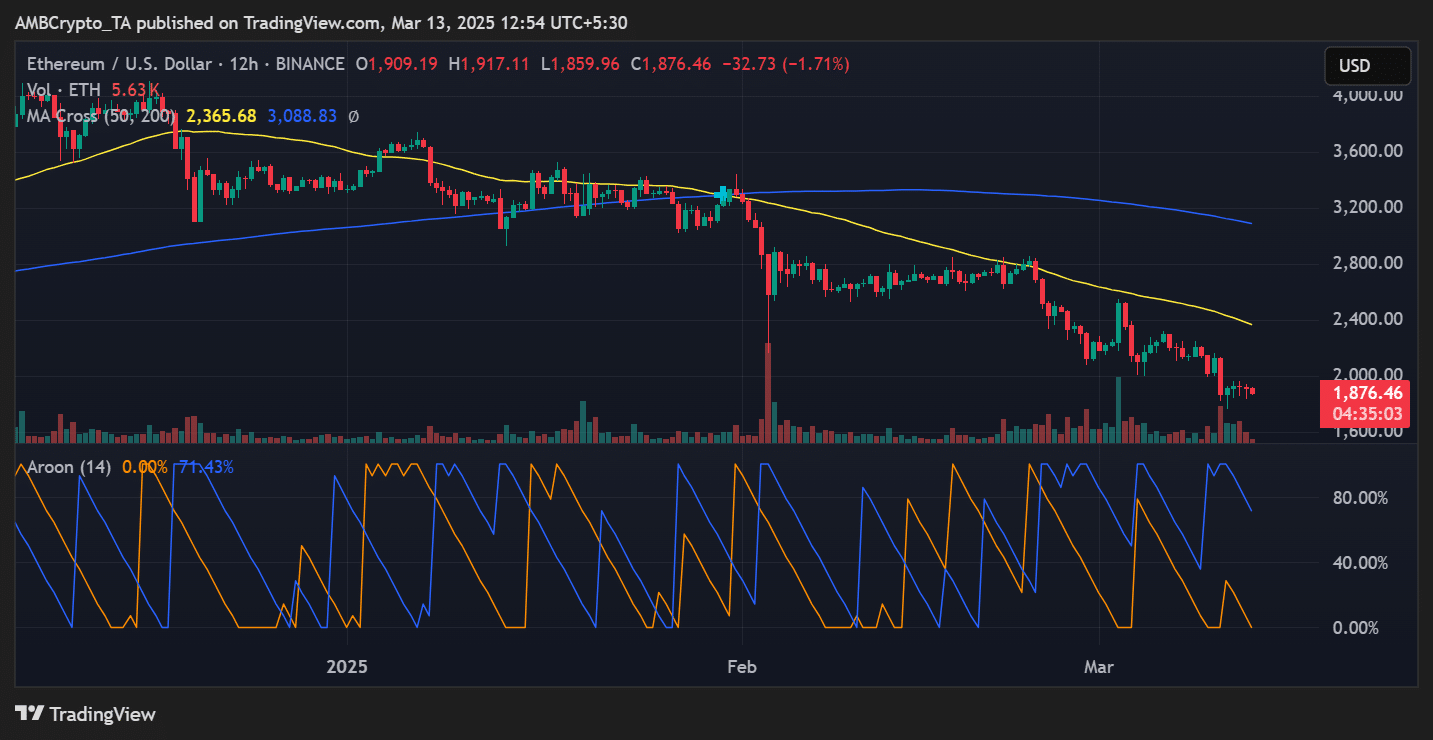

Price Outlook: Will ETH Find Support?

At present, Ethereum trades at $1,876, having endured a steady decline over recent weeks. Key support levels to observe include $1,850, a historical bastion of demand.

If the selling pressure intensifies, Ethereum may find itself testing the $1,750 region, a level that has previously served as a strong accumulation zone.

Conversely, should ETH manage to stabilize and reclaim the elusive $2,000 mark, it could herald a shift in sentiment.

The Aroon indicator, that fickle friend which measures trend strength, currently signals weakness, suggesting that ETH remains ensnared in a downtrend.

However, a breakout above the 50-day moving average [2,365] would indicate a resurgence of bullish momentum, much to the delight of beleaguered investors.

Conclusion

Ethereum’s market remains ensnared in a web of selling pressure, as evidenced by the sustained negative net taker volume.

Yet, the steady increase in ETH holders signals that some investors perceive the current price range as a golden opportunity for accumulation.

While the specter of downside risks lo

Read More

- OM PREDICTION. OM cryptocurrency

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oblivion Remastered – Ring of Namira Quest Guide

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Quick Guide: Finding Garlic in Oblivion Remastered

- Ryan Reynolds Calls Justin Baldoni a ‘Predator’ in Explosive Legal Feud!

- Bitcoin: The Dashing Drama of Saylor’s 21 Rules! 💰✨

- Sophia Grace’s Baby Name Reveal: Meet Her Adorable Daughter Athena Rose!

2025-03-14 00:12