- Dogecoin’s price is clinging to a critical support zone while multiple macro indicators put on their best synchronized dance performance.

- Will investors decide to throw caution to the wind for a high-risk, high-reward gamble? Place your bets, folks!

At this very moment, a flurry of bullish factors are working together to give Dogecoin’s [DOGE] market position a little extra sparkle and shine.

In fact, as I type this, DOGE has waltzed through some key technical levels, such as the 0.5 Fibonacci retracement (whatever that means), macro trend lines (important, apparently), and the 200-week SMA and EMA. Meanwhile, the 3-day RSI is lounging at historical lows, presumably contemplating life’s greatest mysteries.

If Bitcoin keeps its cool and the global economy doesn’t implode, analysts are suggesting this might be the last opportunity to snap up DOGE at “discounted” levels. Don’t say we didn’t warn you!

DOGE’s risk-reward setup looks oddly favorable

Historically speaking, Bitcoin’s consolidation has been like an all-you-can-eat buffet for memecoins, drawing in investors who are eager to take on high-risk, high-reward plays like a contestant on a reality show.

With BTC chilling between $80k and $85k, the total memecoin market cap has surged by a thrilling 3.6% to a staggering $46.19 billion in the last 24 hours. If this doesn’t scream “speculative asset frenzy,” I don’t know what does.

As of now, Dogecoin seems to be having a little chat with the $0.15 support level, after taking a delightful trip down to pre-election levels.

On-chain data is suggesting that this area is becoming a hotspot for demand. Historically, that’s the kind of signal that might just indicate a trend reversal is coming. If this demand keeps up, DOGE could be gearing up for a spectacular recovery, making this an ideal moment for some strategic accumulation (or reckless speculation, depending on your perspective).

From a technical standpoint, DOGE’s 3-day RSI has hit historic lows, confirming that it’s been oversold. With retail and “smart” money flowing in (because that’s totally a thing), liquidity absorption has already triggered a 10% rebound, pushing DOGE back to $0.17—just in time for your next coffee break.

In addition, the 0.5 Fibonacci retracement is giving a polite nod to the possibility of a local bottom. DOGE also seems to have reclaimed the 200-week SMA and EMA, which are apparently the kind of indicators that hint at sustained uptrend strength. Who knew?

With volume metrics and key indicators aligning in a perfect harmony that would make a symphony jealous, Dogecoin’s current setup could be the ultimate high-risk, high-reward opportunity. Or not. Who are we to judge?

Can Dogecoin keep this train rolling?

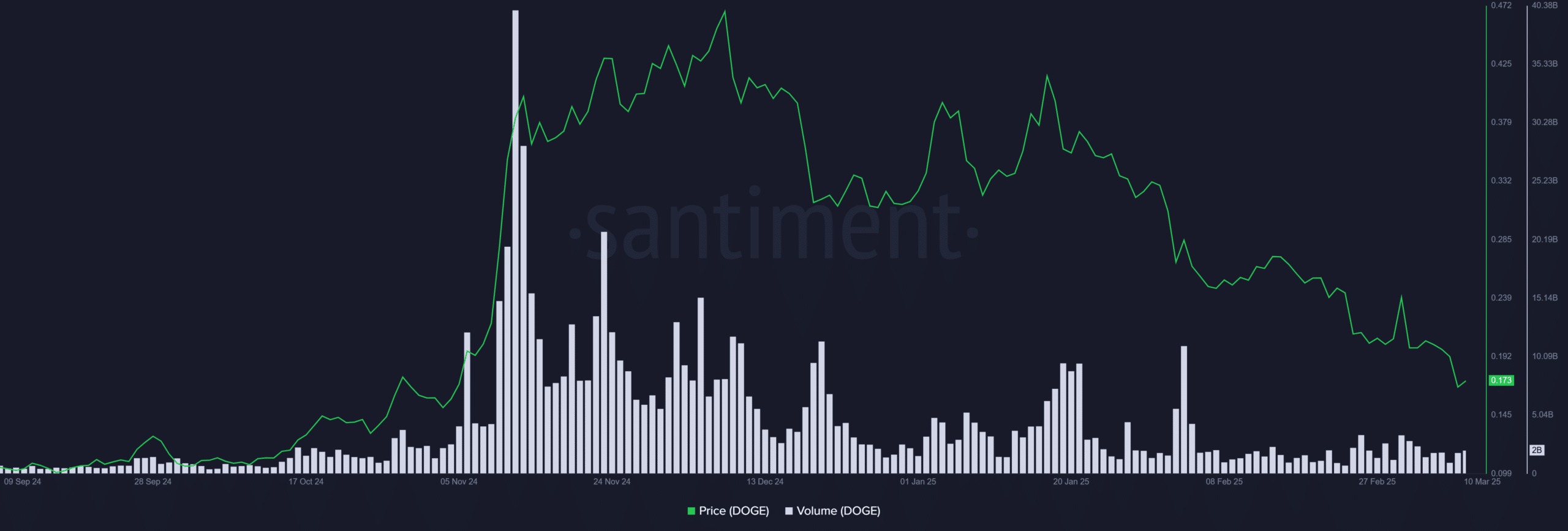

Dogecoin’s trading volume has just exploded past 2 billion, repeating the same setup it had in October 2023—just before the “Trump pump” sent it soaring past $0.40 (because why not?).

For now, DOGE is in “accumulation mode,” which sounds a lot more ominous than it really is. Its price action is pretty much tied to Bitcoin’s every move, so don’t expect any fireworks until BTC breaks $85k. This setup has historically been a precursor to some serious breakouts. Probably. Maybe. Who knows?

If momentum keeps up, a rise above $0.20 could trigger the next big leap in DOGE’s rally, further cementing its bullish vibes.

With technicals, on-chain metrics, and historical patterns aligning like some kind of cosmic joke, this could be the optimal “dip buying” phase for those of you brave (or foolish) enough to take the plunge. But, of course, external risks still loom large. Stay tuned.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- How to Get to Frostcrag Spire in Oblivion Remastered

- Doctor Doom’s Unexpected Foe: The Dark Dimension’s Ultimate Challenge Revealed!

- Moana 3: Release Date, Plot, and What to Expect

2025-03-14 10:24