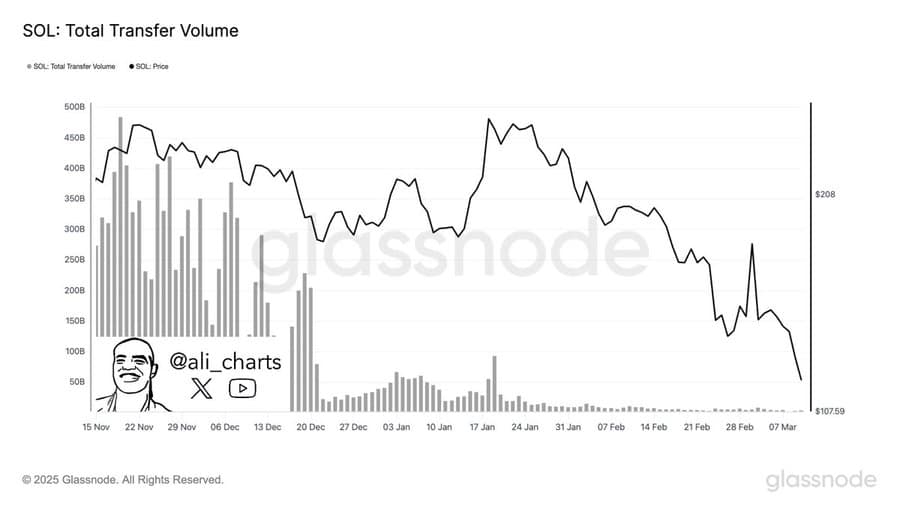

- Solana has taken a nosedive in trading volume, plummeting to its lowest level of 2024. Who knew crypto could be so dramatic?

- On the charts, SOL is flirting with disaster, especially if total value locked (TVL) decides to take a vacation.

In the past month, Solana’s price has been about as lively as a sloth on a Sunday, dropping a staggering 36%. At this point, market sentiment is practically waving a white flag, as more sellers join the party.

Liquidity movement analysis shows a spike in SOL outflows, which is just a fancy way of saying people are bailing faster than rats off a sinking ship. This trend seems to be sticking around, especially as it loses a key support level that usually acts like a safety net.

Momentum Falls Massively as SOL Weakens

One of the main culprits behind Solana’s decline is the dramatic drop in momentum. Press time data reveals that the altcoin’s trading volume has hit rock bottom, with a mere $3 million in daily trading volume—last seen in September 2024. Talk about a comeback!

When both trading volume and price are in freefall, it’s a clear sign that market participants are selling their prized possessions. This could lead to a further drop in demand, which is just what we all need, right?

TVL, which tracks liquidity flow within Solana-based protocols, has also taken a nosedive. After peaking at $12.19 billion in January, it has nearly halved, now sitting at a paltry $6.69 billion. It’s like watching your favorite restaurant go out of business.

These massive liquidity outflows are a clear sign that investors who once locked their assets are now selling them off like they’re going out of style. This is likely due to a plummeting confidence in the asset and a desperate attempt to protect themselves from further price drops.

Potential Drop to $100 or Below

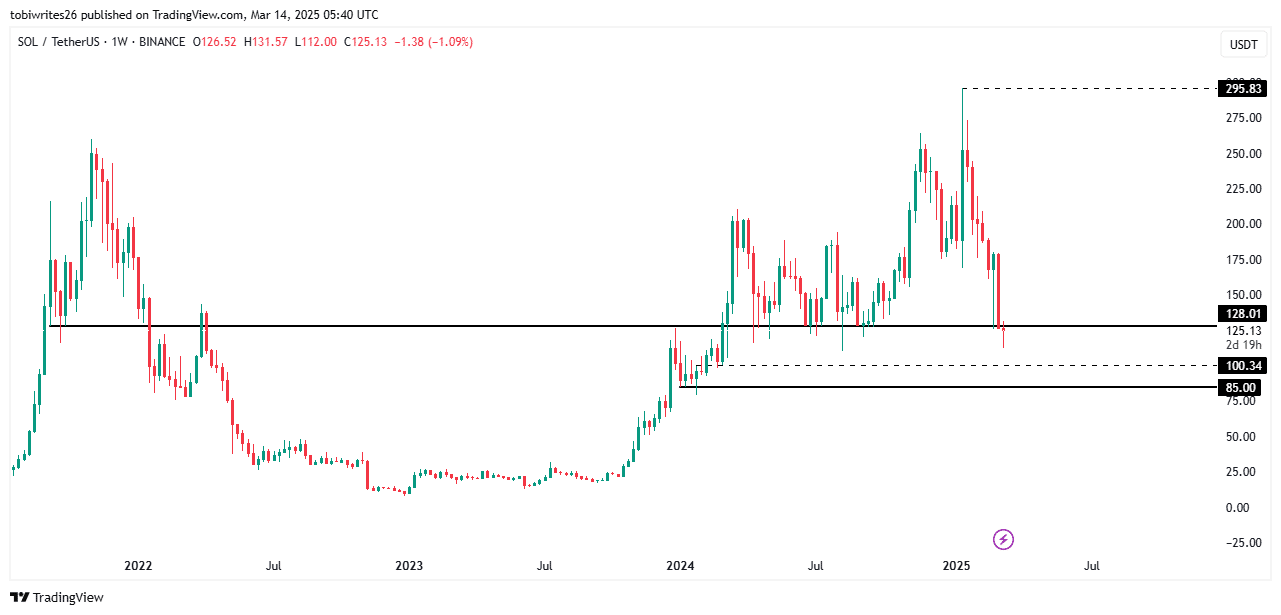

According to AMBCrypto’s analysis, SOL could be on a one-way ticket to $100 after losing the key support level at $128.01. It’s like watching a slow-motion train wreck, and you can’t look away.

Support levels usually provide a cushion for price and facilitate rebounds, creating a drop-to-rally scenario. But when they’re breached, it’s like a toddler throwing a tantrum—selling momentum outweighs buying pressure.

If SOL can’t hold above the next support at $100.34, we might be looking at further declines to $85. That would bring the asset back to the two-digit price range—something we haven’t seen since 2024. Nostalgia, anyone?

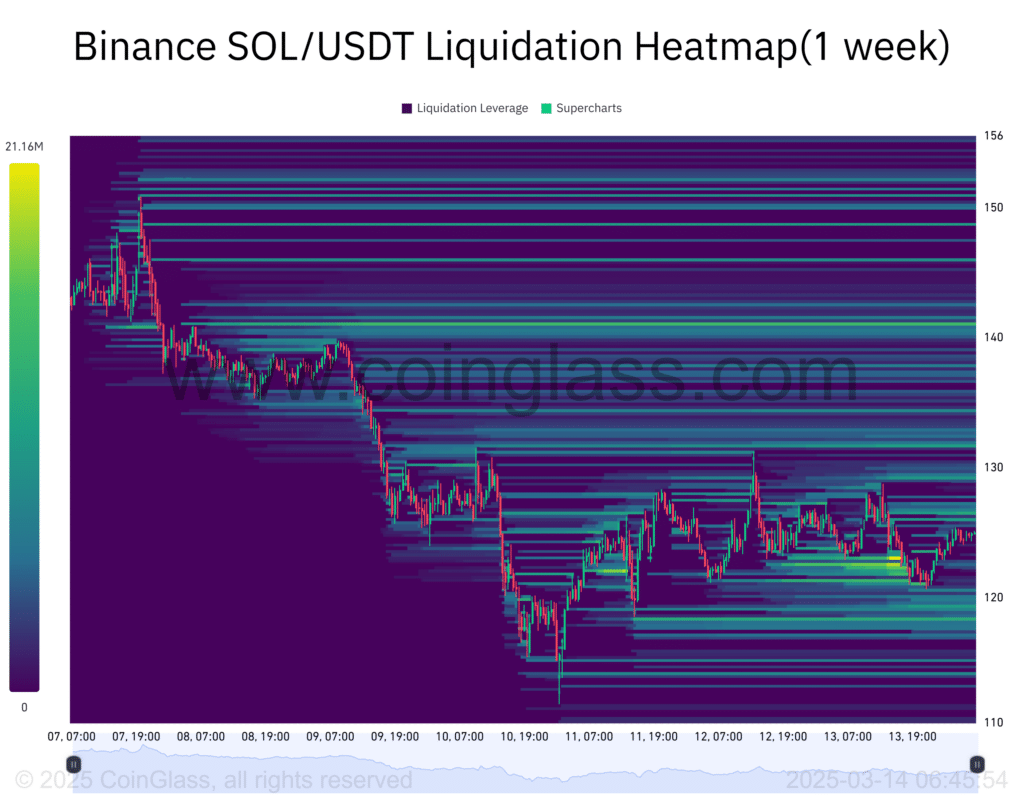

An analysis of the liquidation heat map shows several liquidity clusters between $120 and $114. These clusters often act like magnets, drawing the price towards them and, in some cases, pushing it lower. It’s like a cosmic joke, really.

Given the prevailing downtrend, SOL could drop even further, setting new lows on the charts. Buckle up, folks!

Not All Traders Are Bearish

In the derivatives market, some traders are placing long bets, hoping for a SOL rebound. Recently, buying volume in the derivatives market has increased, alongside the OI-weighted funding rate. It’s like watching a group of optimists at a funeral.

Coinglass’s long-to-short ratio, which measures the buying volume relative to selling volume, had a reading of 1.004 at press time. A level above 1 indicates that there are more buyers than sellers. Who knew optimism could be so contagious?

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Oblivion Remastered – Ring of Namira Quest Guide

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Sophia Grace’s Baby Name Reveal: Meet Her Adorable Daughter Athena Rose!

- E.T.’s Henry Thomas Romances Olivia Hussey’s Daughter!

2025-03-14 18:20