- Ah, the altcoins, those fickle friends, prancing in unison with Bitcoin and Ethereum, heralding the specter of volatility or perhaps a market peak!

- Do keep your eyes peeled for those delightful accumulation phases before you leap back into the fray with gusto!

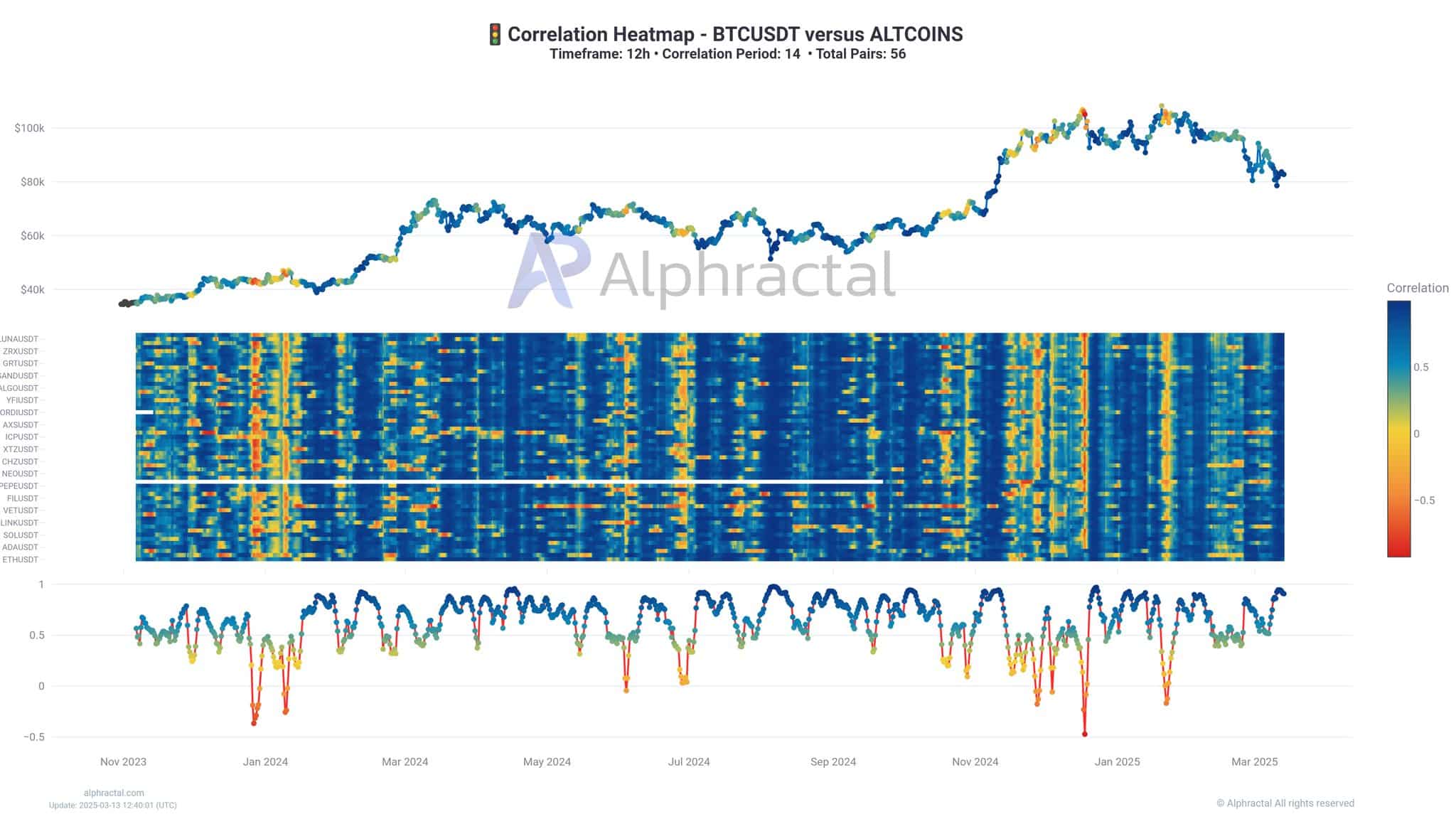

Once more, the altcoins find themselves in a waltz with Bitcoin [BTC] and Ethereum [ETH], a high-correlation market that appears as stable as a house of cards in a windstorm. History, that ever-watchful guardian, reminds us that such synchrony often precedes a delightful chaos or a local market peak. How charming!

Alas, most altcoins are ensnared in a downtrend, making any premature foray into the market akin to stepping onto a stage without a script. Timing, dear reader, is of the essence – await the signs of accumulation and the unmistakable shifts in structure before you consider re-entering this theatrical performance.

The state of the market – Correlation returns

The dense blue bands adorning the altcoin pairs suggest that, over the past several months, they have been moving in perfect harmony with BTCUSDT. A market dominated by macro trends, where the unique tales of altcoins struggle to find an audience. How tragic!

Historically, those moments of low correlation – when the heatmap resembles a Jackson Pollock painting – have often heralded major volatility or local market tops. A true spectacle!

As I pen these words, the data reveals a tightly clustered behavior, suggesting that altcoins are unlikely to shine independently unless Bitcoin and Ethereum decide to take the spotlight first. How predictable!

The three phases of altcoin price action

Ah, the altcoin price cycles, a tragicomedy in three acts: Downtrend, accumulation, and uptrend. Currently, our dear altcoins are deep in the downtrend phase, marked by a series of lower lows and relentless selling pressure. Welcome to the danger zone, where early entries often lead to a most unfortunate demise.

The accumulation phase follows, a time when selling pressure wanes and prices stabilize within a defined range. Key signs include reduced volatility and the valiant defense of a range low. Finally, the uptrend phase begins when the market structure shifts to a bullish narrative. A most delightful transformation!

Thus, keep your eyes peeled for clean breaks above resistance or sustained pullbacks to re-enter with the confidence of a seasoned actor on opening night.

Reading range lows and re-entering with momentum

As our altcoins begin to find their footing, attention turns to the range lows – those historical zones where sellers lose their grip and buyers tiptoe in. These levels often serve as the stage for momentum shifts. When prices consistently defend a range low, it may suggest a change in sentiment is afoot. How thrilling!

Structural signals like higher lows or decisive breakouts can indicate the early stages of a trend reversal. In previous cycles, such setups have aligned with broader market recoveries. While not every range results in a jubilant rally, firm support at key levels often marks a growing confidence. A standing ovation, perhaps?

For now, Bitcoin and Ethereum remain the lead actors in this grand play. And, altcoins are likely to follow only if the momentum carries through. Bravo!

Read More

- OM PREDICTION. OM cryptocurrency

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oblivion Remastered – Ring of Namira Quest Guide

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Quick Guide: Finding Garlic in Oblivion Remastered

- Sophia Grace’s Baby Name Reveal: Meet Her Adorable Daughter Athena Rose!

- Ryan Reynolds Calls Justin Baldoni a ‘Predator’ in Explosive Legal Feud!

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

2025-03-15 01:40