- Ah, the Bitcoin miners, those modern-day alchemists, liquidating over $27 million, raising eyebrows and existential dread about BTC’s capacity to maintain its price momentum.

- BTC, that fickle mistress, faces a formidable resistance at $87K while the miners’ selling pressure mounts—can the bulls muster the strength to absorb this onslaught?

In a world where fortunes are made and lost in the blink of an eye, Bitcoin [BTC] miners have been shedding their significant holdings, cashing in over $27 million in realized profits. This, of course, occurs at a time when BTC seems to be caught in a delicate dance within a key price range, teetering on the edge of fate.

As the miners sell with reckless abandon, one cannot help but ponder the implications of such actions on BTC’s impending trajectory. Will this sell pressure suffocate Bitcoin’s potential ascent, or is the market, in its infinite wisdom, absorbing these liquidations like a sponge in a flood? 🤔

The Miners’ Profits: A Spike or a Scream?

Recent data reveals that early Bitcoin miners have realized over $27.2 million in profits while BTC languished around the $83,000-$84,000 range. A significant liquidation phase, indeed, especially following Bitcoin’s recent retreat from its lofty heights above $90,000. Oh, the irony! 😅

Historically, such profit-taking by miners can herald a short-term cooling period for Bitcoin’s rally, leading to either a somber consolidation or a potential retracement into the abyss.

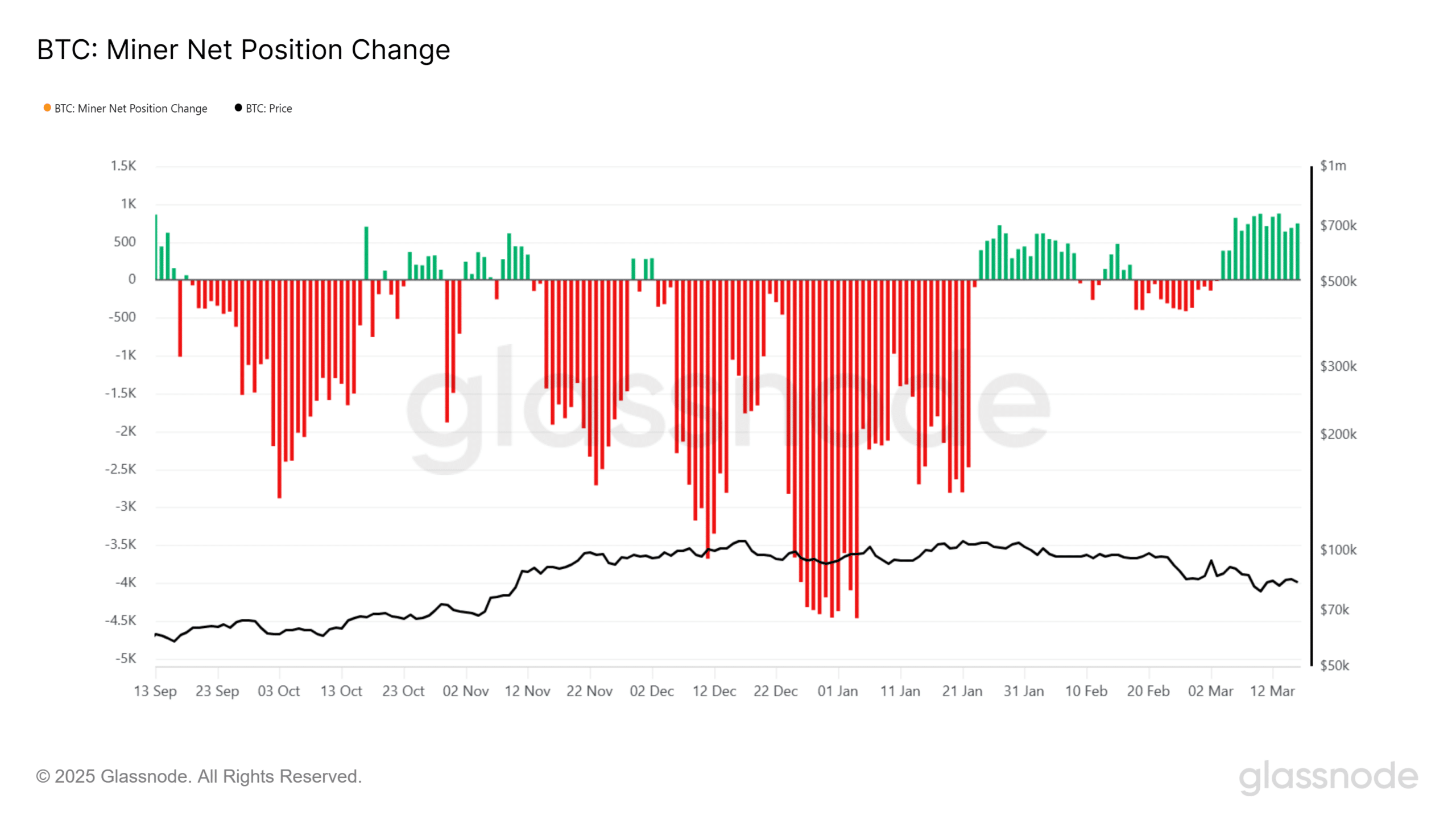

Glassnode’s miner net position change chart, a veritable oracle, shows continued selling pressure, with outflows surpassing inflows. Miners seem to be reducing their holdings rather than accumulating, reinforcing the possibility of near-term price weakness. How delightful! 🙃

How Much BTC Remains in the Miners’ Clutches?

Despite this selling spree, Bitcoin miners still clutch a substantial amount of BTC. Yet, the rate at which their holdings dwindle signals their outlook on price movements. A tragic comedy, if you will.

The data suggests that while some miners are securing profits, others may be clinging to BTC in anticipation of another bullish leg. Hope springs eternal, does it not?

If BTC can maintain its current support levels, a resurgence in buying interest could stabilize prices. However, should the miners persist in their liquidation frenzy, Bitcoin might find itself grappling with key resistance levels, particularly near $87,000-$90,000. A tragic fate indeed!

Key Levels: The Watchers of the Night

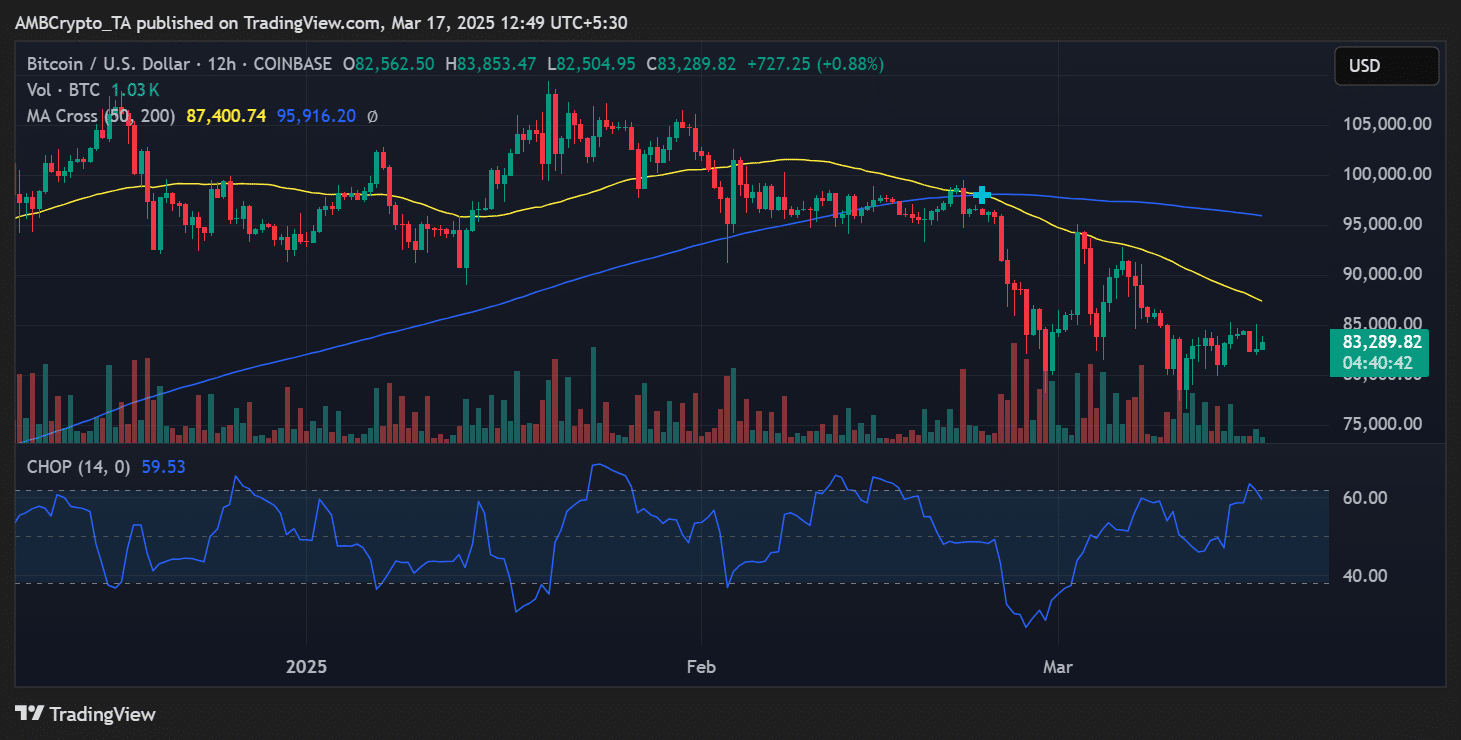

At present, Bitcoin trades around $83,289, with the 50-day moving average looming at $87,400 and the 200-day moving average near $95,916. These levels serve as critical resistance points that BTC must surpass to reclaim its bullish momentum.

Immediate support rests at $82,500. A breakdown below this level could open the floodgates to further declines toward the ominous $80,000. Oh, the humanity!

Key resistance stands at $87,000. A decisive move above this mark could trigger renewed bullish momentum, or perhaps just a fleeting illusion of hope.

As miner selling escalates, BTC’s ability to hold its ground will be crucial in determining its next move. Traders, those brave souls, should remain vigilant for shifts in miner behavior, as continued sell-offs could stall Bitcoin’s ascent, while stabilization might pave the way for a glorious rebound. Or not. 😏

Read More

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oblivion Remastered – Ring of Namira Quest Guide

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Quick Guide: Finding Garlic in Oblivion Remastered

- Solo Leveling Arise Amamiya Mirei Guide

- Sophia Grace’s Baby Name Reveal: Meet Her Adorable Daughter Athena Rose!

- Ryan Reynolds Calls Justin Baldoni a ‘Predator’ in Explosive Legal Feud!

2025-03-17 19:07