- Ah, Coinbase, darling, with a charming 11.4% of Ethereum’s staking market share in February!

- Our dear Ethereum educator Sassal has suggested that Coinbase might just be the largest node operator. How quaint!

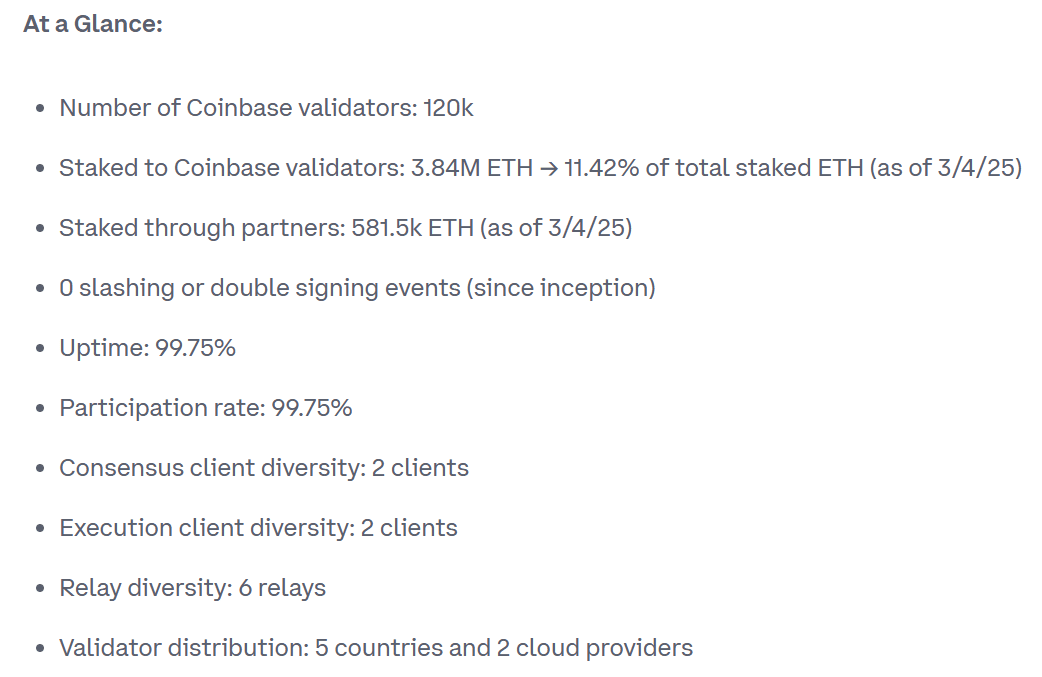

In the delightful month of February, Coinbase strutted about with 120k validator nodes, clutching a rather impressive 11.4% of the total Ethereum [ETH] staking market. According to a transparency report—how very modern!—the exchange had a staggering 3.84M ETH staked in its validators. 💰

These validator nodes, my dear, were scattered across the globe—Japan, Ireland, Singapore, Germany, and Hong Kong. A veritable world tour! And let’s not forget, Coinbase relied on two execution clients and cloud providers to keep the whole charade running smoothly. How very tech-savvy! ☁️

Ethereum Staking: A Dashing Expansion!

Reacting to the report, our esteemed Ethereum educator Sassal acknowledged that this 11.4% market share makes Coinbase the largest validator node operator. Bravo! 🎉

“This, of course, makes Coinbase the single largest node operator on the network (Lido is bigger as a collective, but each node operator has a much smaller % share).” Oh, Sassal, you do have a way with words!

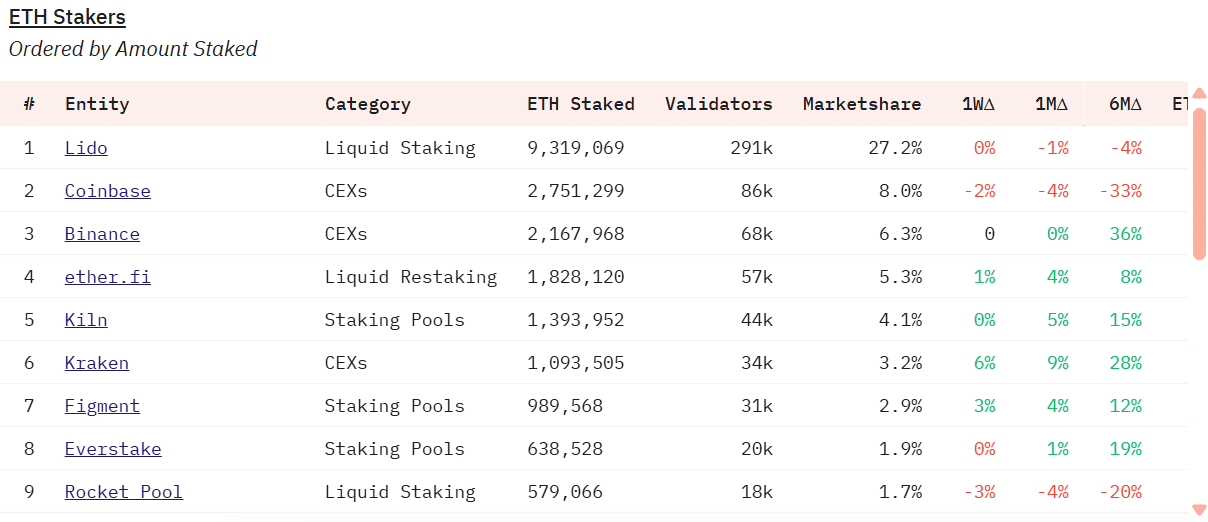

The report was released after some rather insistent industry players urged Coinbase to share its Ethereum staking operations, as most data were based on estimations—how scandalous! In fact, Dune Analytics estimated Coinbase’s market share at a mere 8% with 2.7M ETH staked. Oh, the drama! 🎭

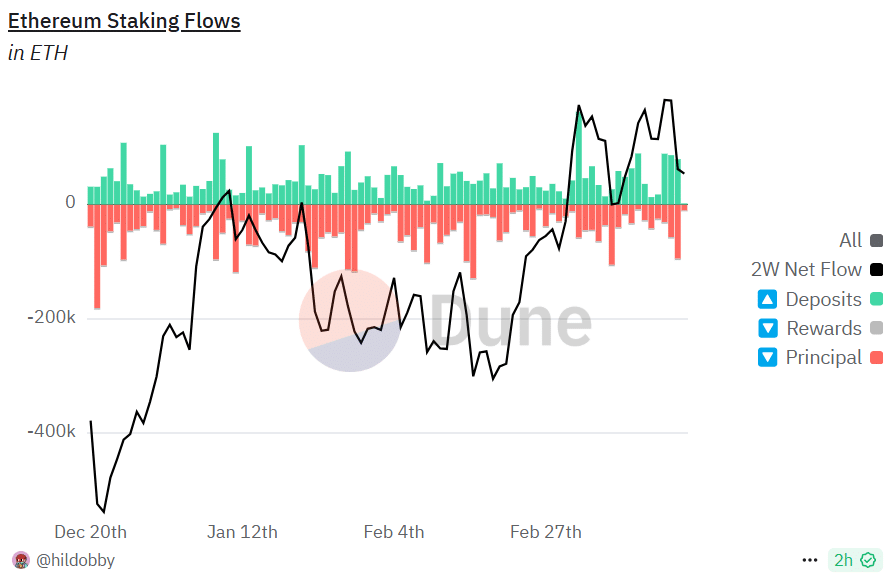

In the grand scheme of staked ETH, Lido appeared to maintain its lead with a whopping 9.3M staked ETH. Overall, a delightful 34.1M ETH has been staked, or 27.7% of the total supply. After a rather dismal slump in January 2025, marked by outflows, ETH staking made a charming comeback in February. How refreshing! 🌼

Over the past fortnight, 54k ETH flowed into the staking system, reinforcing confidence in the altcoin, despite a rather massive drawdown on the price charts. Oh, the irony! 📉

According to Staking Rewards, ETH stakers are entitled to a 3% annualized reward, offering a delightful extra yield for long-term investors. How generous! 💸

However, despite the record interest in ETH staking, the altcoin’s price has been rather sluggish compared to its peers. At the time of writing, it was valued at just over $2k, down a staggering 54% from its recent highs. Oh, the tragedy! 🎭

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-03-21 10:19