- Ethereum users decided to lock their ETH after the Merge. Because, you know, trust issues. 🤷♀️

- ETH exchange supply has diminished by 16.4% over the previous seven weeks. Guess they’re not into casual flings anymore. 💔

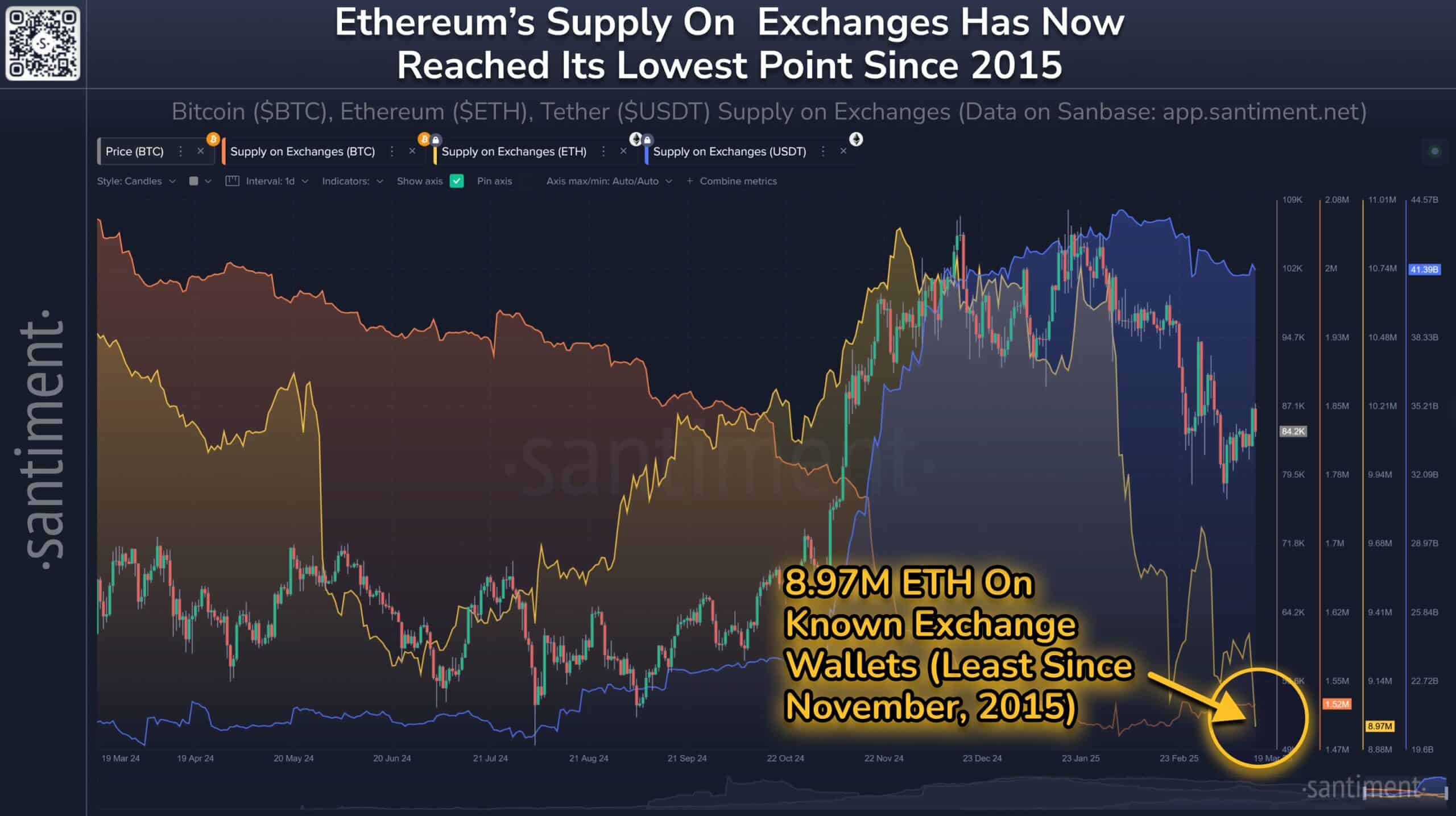

The amount of Ethereum [ETH] on centralized exchanges has dropped to 8.97 million ETH, marking its lowest supply since November 2015. That’s right, we’re talking pre-Trump, pre-Brexit, preinsert your personal crisis here*. 🕰️

Additionally, investor behavior has shifted significantly as the immediate trading supply of ETH reaches this historical low. Turns out, people are more into long-term relationships now. Who knew? 💍

Santiment data reveals a consistent decline in Ethereum supply on centralized exchanges, reflecting increased confidence in Ethereum’s long-term potential. Or maybe they’re just too lazy to move it. 🛋️

As a result, ETH holders are increasingly using their tokens for staking and decentralized finance (DeFi) activities, shifting away from prioritizing immediate trading. Because why sell when you can just sit back and watch the numbers go up? 📈

Supply shift: Impact of DeFi and staking

The voluntary transfer of Ethereum from exchanges is primarily driven by growing interest in DeFi functions and staking rewards. After the Merge, ETH users began locking their tokens as the shift to Proof of Stake offered staking rewards along with network security benefits. It’s like a spa day for your crypto. 💆♂️

Additionally, Ethereum’s leadership in the DeFi sector has attracted diverse user groups participating in activities like lending, liquidity provision, and yield farming. It’s basically the Wall Street of the blockchain world, but with fewer suits and more memes. 🐸

This shift in ownership reflects a preference among investors to engage actively within the ETH network rather than keeping their ETH on centralized exchanges. Because who needs middlemen when you can be your own bank? 🏦

The increasing interaction with the Ethereum platform supports its long-term sustainability and growth. Or, you know, it’s just a really good distraction from the existential dread. 🌍

Ethereum’s exchange supply decline accelerates

ETH exchange supply has decreased by 16.4% over the past seven weeks, marking the largest drop since late 2024. That’s a bigger drop than my motivation on a Monday morning. ☕

This sharp decline reflects growing investor confidence, as many shift their holdings toward staking and DeFi applications. Ethereum is evolving into a yield-generating asset rather than merely a trading instrument. It’s like turning your crypto into a little money tree. 🌳

The ongoing outflow from exchanges suggests that holders anticipate a rise in Ethereum’s value, supporting a long-term bullish outlook. Or maybe they’re just really bad at timing the market. 🕰️

Diminished exchange supply could significantly impact market dynamics. Limited ETH availability might drive prices higher due to scarcity at stable demand levels. It’s basic economics, folks. Supply and demand, but make it dramatic. 🎭

Additionally, reduced liquidity on exchanges could lead to increased volatility, amplifying price movements. The continued migration of Ethereum from centralized platforms highlights strong network confidence, reinforcing bullish sentiment. Or, you know, it’s just a really elaborate game of musical chairs. 🎶

As DeFi and staking attract more capital, Ethereum’s position as a valuable long-term asset strengthens within the evolving crypto market landscape. So, buckle up, folks. The future’s looking bright, or at least less dim than usual. 🌟

Read More

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Oblivion Remastered – Ring of Namira Quest Guide

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Solo Leveling Arise Amamiya Mirei Guide

- Ryan Reynolds Calls Justin Baldoni a ‘Predator’ in Explosive Legal Feud!

- Avowed Update 1.3 Brings Huge Changes and Community Features!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

2025-03-21 13:14