- Cardano’s latest buy signal hinted at potential for a short-term rally, but uncertainty remains

- Despite hike in market activity, the funding rate and MVRV ratio highlighted caution

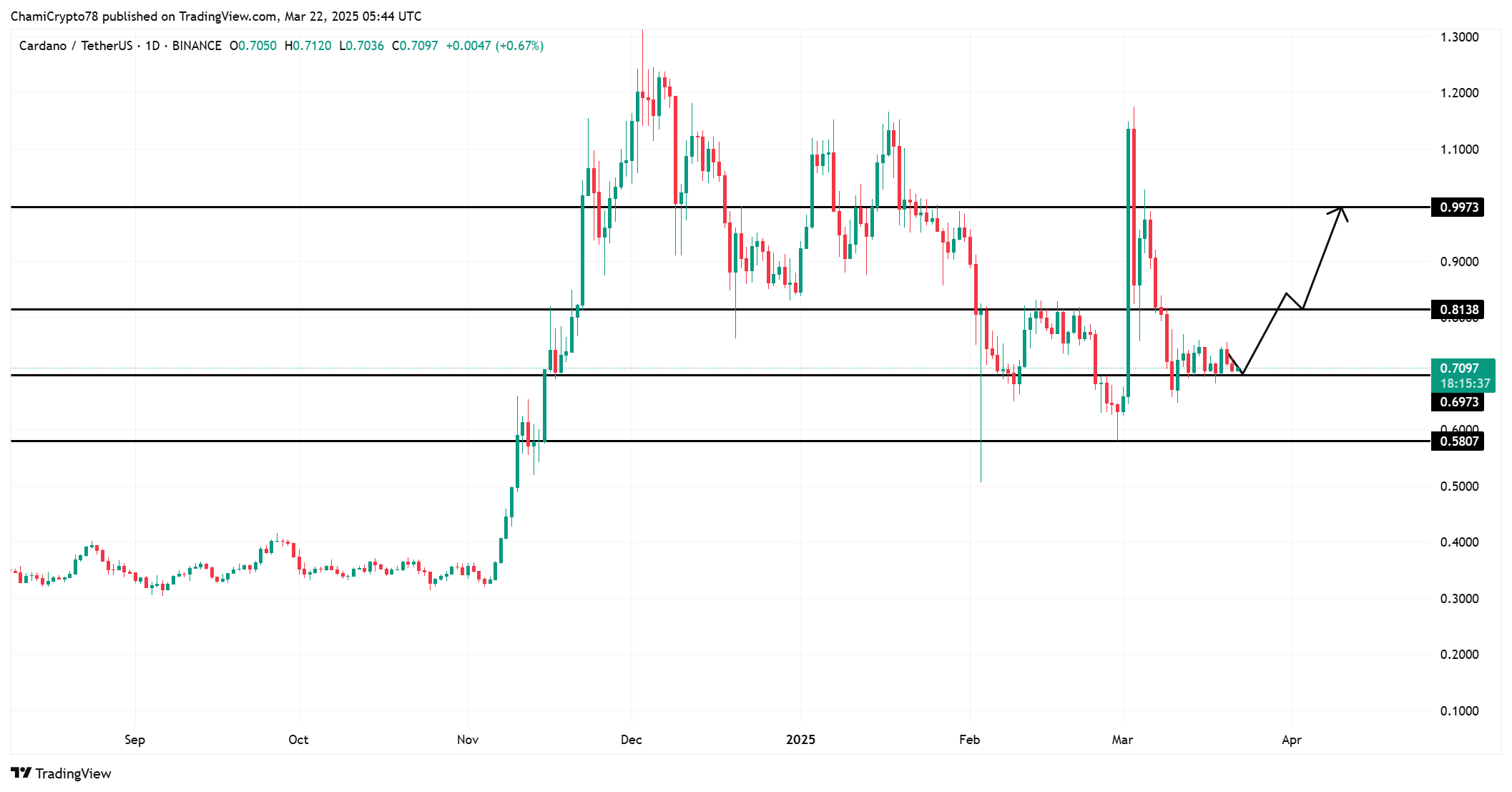

The TD Sequential indicator, that fickle oracle of the trading world, has once again graced us with its presence, this time bestowing a buy signal upon Cardano [ADA]. At press time, the altcoin was trading at $0.7100, down a modest 0.98%. This technical signal, like a siren’s call, has lured traders into a state of hopeful anticipation, whispering promises of a price rebound. But, as with all things in the cryptoverse, one must tread carefully. 🧐

As the market watches with bated breath, the question lingers – Could this be the dawn of a short-term rally, or merely another ephemeral spike destined to fade into obscurity? 🤔

Examining Cardano’s recent price action reveals a tale of consolidation following a period of volatility. The price made a valiant attempt to break above the $0.8138-level, only to find solace in the $0.6973-level. If ADA can maintain its grip on this key support level, it may set its sights on the next resistance around $0.8138. In essence, the TD Sequential buy signal has offered a glimmer of hope to traders yearning for a price rebound. 🌟

Binance funding rates analysis – Is sentiment bullish or bearish?

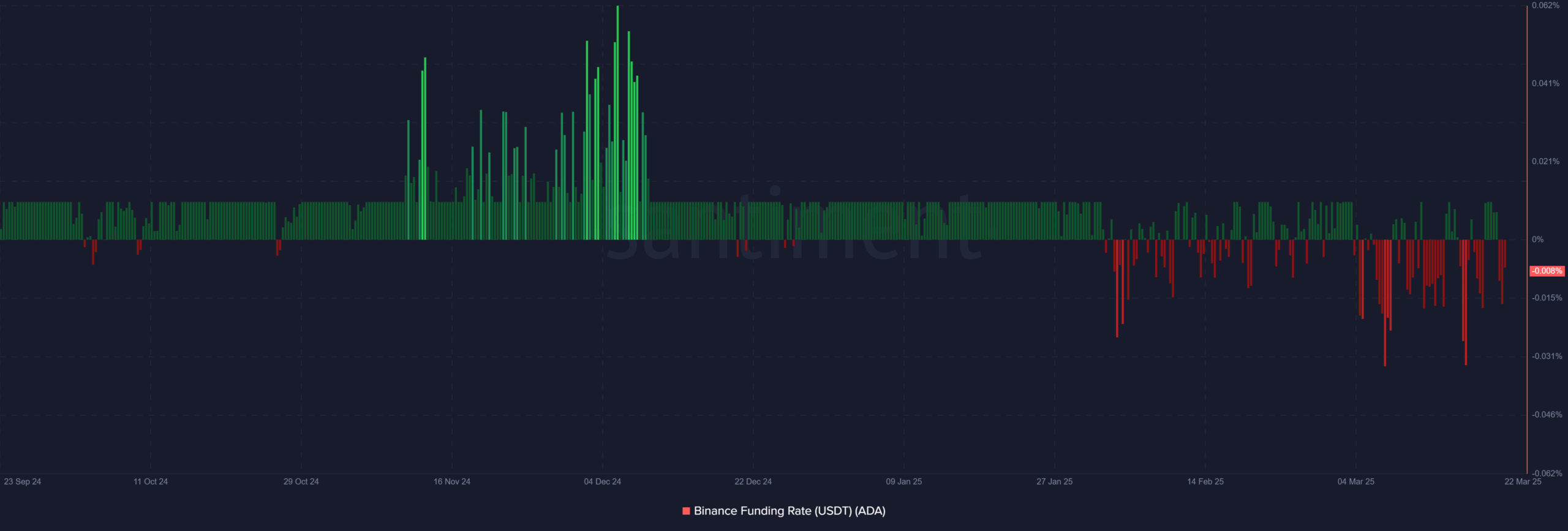

At the time of writing, the Binance funding rate for Cardano stood at a rather unimpressive -0.0084%. This negative rate, like a dark cloud on the horizon, suggested that more traders are holding short positions – A clear sign of bearish sentiment in the market. 🐻

However, the rate’s mild fluctuations hinted that the market remains relatively balanced, with no extreme sentiment driving the price in either direction. This negative funding rate could, of course, lead to downward pressure if short positions continue to dominate. But let’s not get ahead of ourselves. 🎭

Daily active addresses and transaction volume analysis

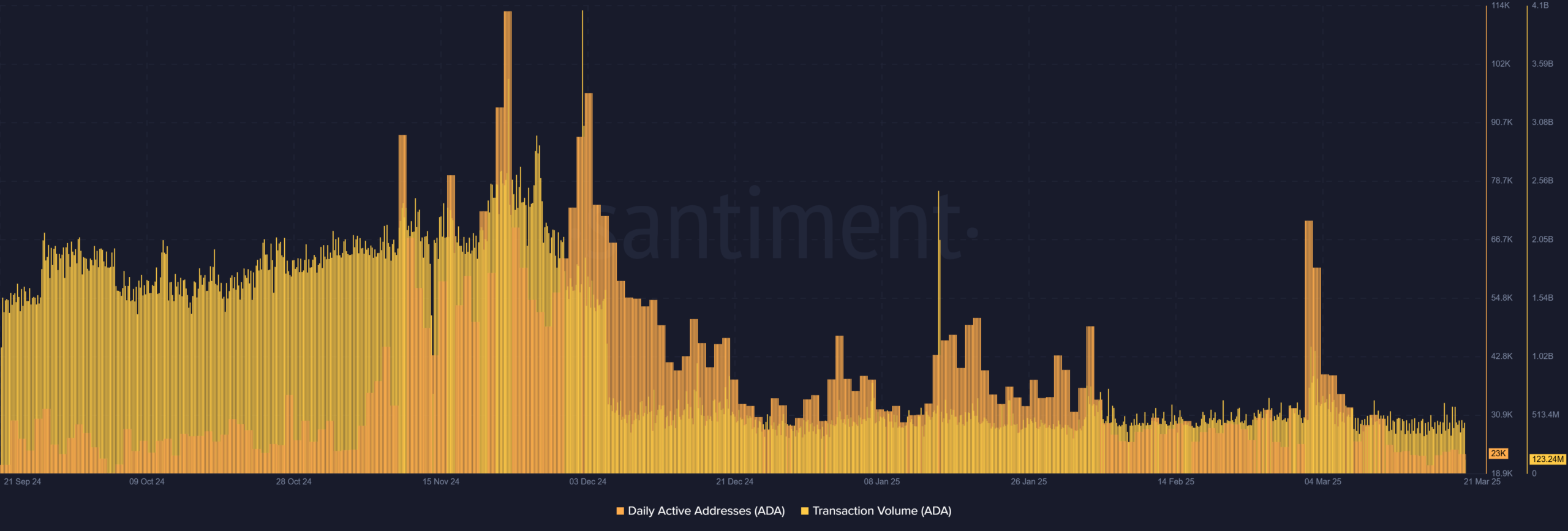

Cardano’s daily active addresses recently saw a noticeable uptick, climbing to 23,009 addresses. Additionally, transaction volume surged to 123.24 million ADA, signaling growing interest in the asset. This hike in activity could indicate that more investors are participating in the market, potentially supporting a short-term price surge. 🚀

However, despite the growth in addresses and transactions, the market has been iffy. This could be a sign that the ongoing trend may not be sustainable for the long term. So, while the numbers look promising, one must remain cautious. 🧐

ADA MVRV ratio – Overvalued or undervalued?

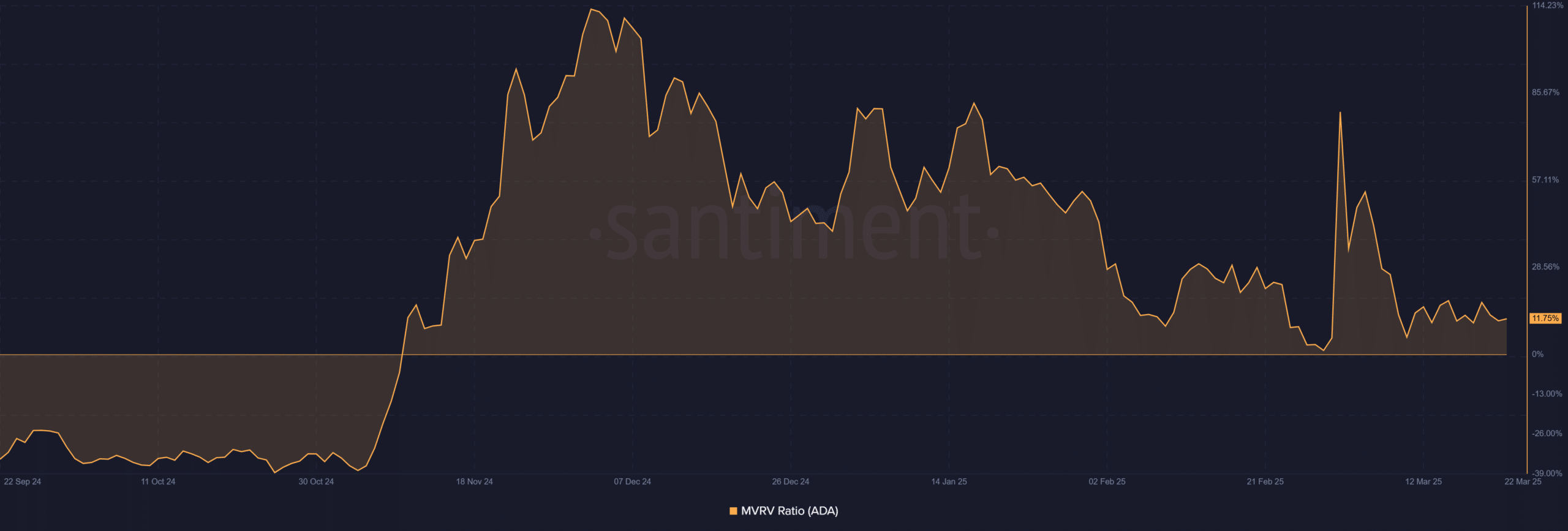

Cardano’s MVRV ratio stood at 11.75% – A sign that the asset was somewhat overvalued in the short term. This ratio, which measures the difference between Cardano’s market value and its realized value, indicates potential profit-taking pressure. While the MVRV ratio hinted that ADA could face some resistance at higher price levels, it also pointed to a potential long-term bullish trend. In essence, despite short-term overvaluation, Cardano may still see growth potential in the future. 🌱

Will Cardano’s rebound hold or fade away?

The latest buy signal and hike in market activity for Cardano hinted at a potential short-term rally. However, the negative funding rate and high MVRV ratio pointed to caution among traders. Based on prevailing market conditions, Cardano may see a temporary price bounce. However, the rally might not be sustainable in the long run. Therefore, Cardano’s price may see some upward movement, but it is unlikely to trigger a lasting bull run at this time. 🎢

Read More

- OM PREDICTION. OM cryptocurrency

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Elevation – PRIME VIDEO

- Christina Haack and Ant Anstead Team Up Again—Awkward or Heartwarming?

- WWE’s Braun Strowman Suffers Bloody Beatdown on Saturday Night’s Main Event

- Serena Williams’ Husband Fires Back at Critics

2025-03-23 00:11