🚨 The Ethereum Exodus: $760M in Outflows as Traders Flock to Bitcoin 🚨

- Ethereum ETFs see $760M in outflows as investor sentiment shifts towards Bitcoin amid favorable conditions.

- Bitcoin ETFs attract $785M in inflows, signaling renewed investor confidence, while Ethereum faces investor retreat.

🤔 Ah, the fleeting nature of investor love. It seems Ethereum [ETH] has lost its charm, at least for now. Over the past month, U.S.-listed Ethereum ETFs have recorded more than $760 million in outflows, a stark contrast to the surging interest in Bitcoin [BTC].

🚀 In just the last six days, Bitcoin ETFs have pulled in $785 million in fresh capital, signaling a decisive shift in investor sentiment and raising fresh questions about Ethereum’s role in the evolving digital asset landscape.

Ethereum ETFs see steady outflows as market sentiment turns cautious 📉

🚫 Ethereum ETFs have entered a prolonged period of investor retreat, shedding over $760 million in net outflows over the past month.

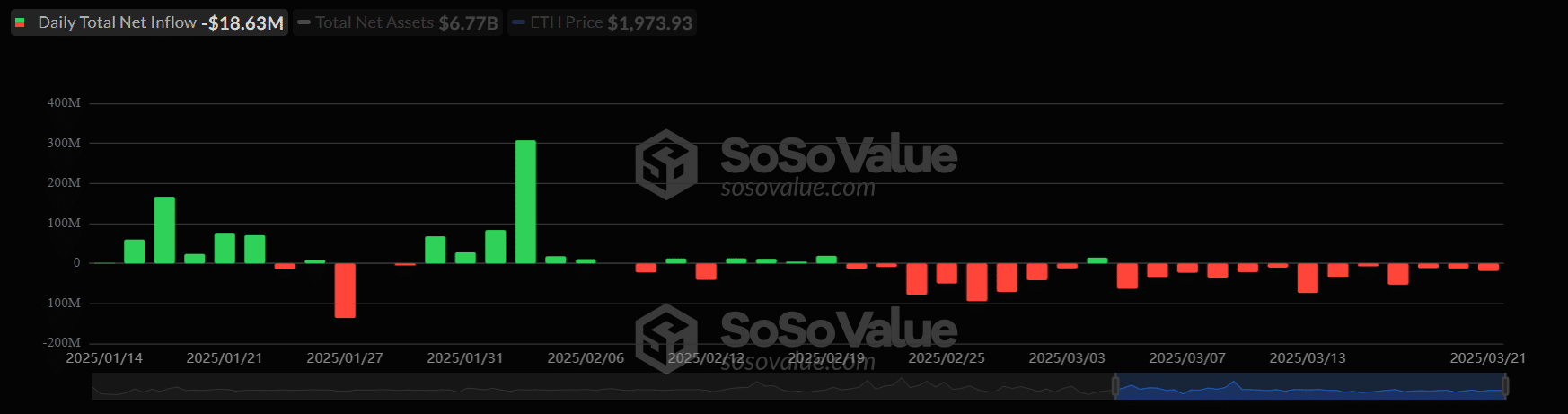

💸 Inflows peaked briefly at the end of January — most notably with a single-day surge above $300 million — but quickly reversed into consistent outflows through February and March.

📊 Since mid-February, red bars dominate the chart, illustrating a nearly unbroken stretch of daily net outflows that reflect growing caution toward Ethereum.

Total net assets for Ethereum ETFs now sit at $6.77 billion, with ETH itself trading just under $2,000.

🤝 Institutional investors are losing confidence in Ethereum’s near-term performance, especially amid a broader narrative increasingly centered around Bitcoin.

💔 With outflows accelerating, Ethereum risks losing its standing as the second most favored crypto asset among ETF investors.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-03-23 18:17