Ah, the capricious Bitcoin! Like a sulking poet, it has recently corrected its price, yet the whispers of on-chain data suggest a tantalizing structural supply shortage is brewing, hinting at a potential bullish pirouette in the days or weeks to come. 🕺💸

🔥 Trump Tariffs Shock Incoming! EUR/USD in the Crosshairs!

Massive forex shifts expected — don't miss the crucial insights now unfolding!

View Urgent ForecastDeclining Bitcoin Inflows: A Comedy of Reduced Selling Pressure

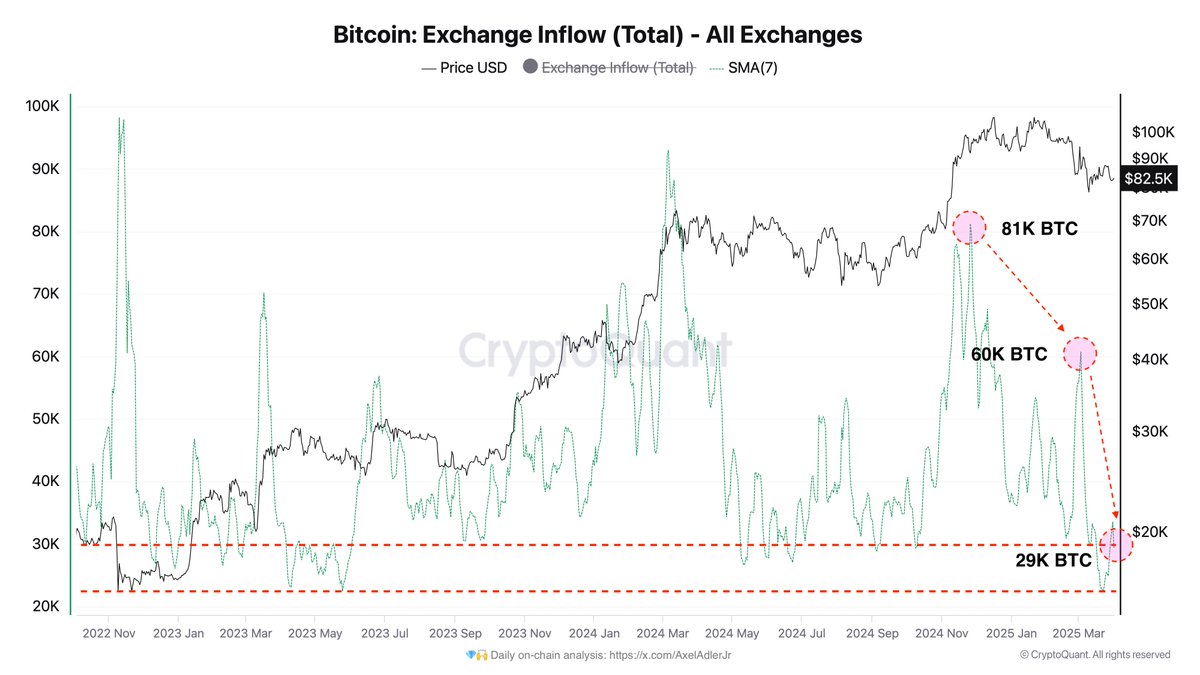

Market analysts, those ever-watchful hawks, have noted a delightful decline in Bitcoin inflows onto exchanges, a phenomenon that could play a pivotal role in alleviating the burdensome weight of selling pressure. Our dear CryptoQuant scribe, Axel Adler, has pointed out that the average Bitcoin selling pressure across major exchanges has taken a nosedive. Daily inflows have plummeted from a dizzying peak of 81,000 BTC to a mere 29,000 BTC, as if investors have suddenly decided that selling is so last season. 🥳

This delightful reduction in inflows suggests a less frantic selling atmosphere, creating a cozy nook for price stabilization or perhaps even a charming recovery. Adler, with a flourish, describes this as entering a “zone of asymmetric demand,” where most sellers have gracefully exited at recent price highs, leaving current buyers to accumulate or hold within this delightful consolidation range. 🏰

Support Levels and the Potential Price Surge: A Tale of Hope

Adler, ever the optimist, has also pointed out that certain critical support levels could act as a safety net for Bitcoin, potentially catapulting its price back above the illustrious $90,000 mark. While the April-May period may resemble a languid intermission, analysts remain hopeful that a vigorous upward impulse could emerge once Bitcoin breaks free from its current range. 🎢

Historically, significant exchange inflows have been the harbingers of sharp price drops, while dwindling inflows often signal a serene period of price stabilization or recovery. As of late March 2025, Bitcoin’s price has been frolicking within the $80,000–$85,000 range, and the 7-day moving average (SMA) of exchange inflows continues its downward waltz, supporting the notion that selling pressure is, indeed, diminishing. 🌊

Bitcoin’s Next Move: The Anticipation Builds

While Bitcoin remains ensconced in its consolidation phase, the ongoing decrease in inflows and the delightful reduction in selling pressure may create a veritable garden of opportunity for price appreciation. Should these trends persist, Bitcoin may be poised for yet another bullish escapade, though we might have to wait until late Q2 for the grand breakout to materialize. Patience, dear reader, is a virtue! ⏳

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

2025-04-01 21:19