Ah, Dogecoin – the cryptocurrency equivalent of that charming, underachieving cousin who somehow always manages to land on his feet. According to a certain analyst, there are a couple of resistance levels for Dogecoin that could well ignite its next bullish escapade. Perhaps it’s time to dust off your meme stock collection?

Dogecoin’s Roadblocks: A Tale of On-Chain Resistance

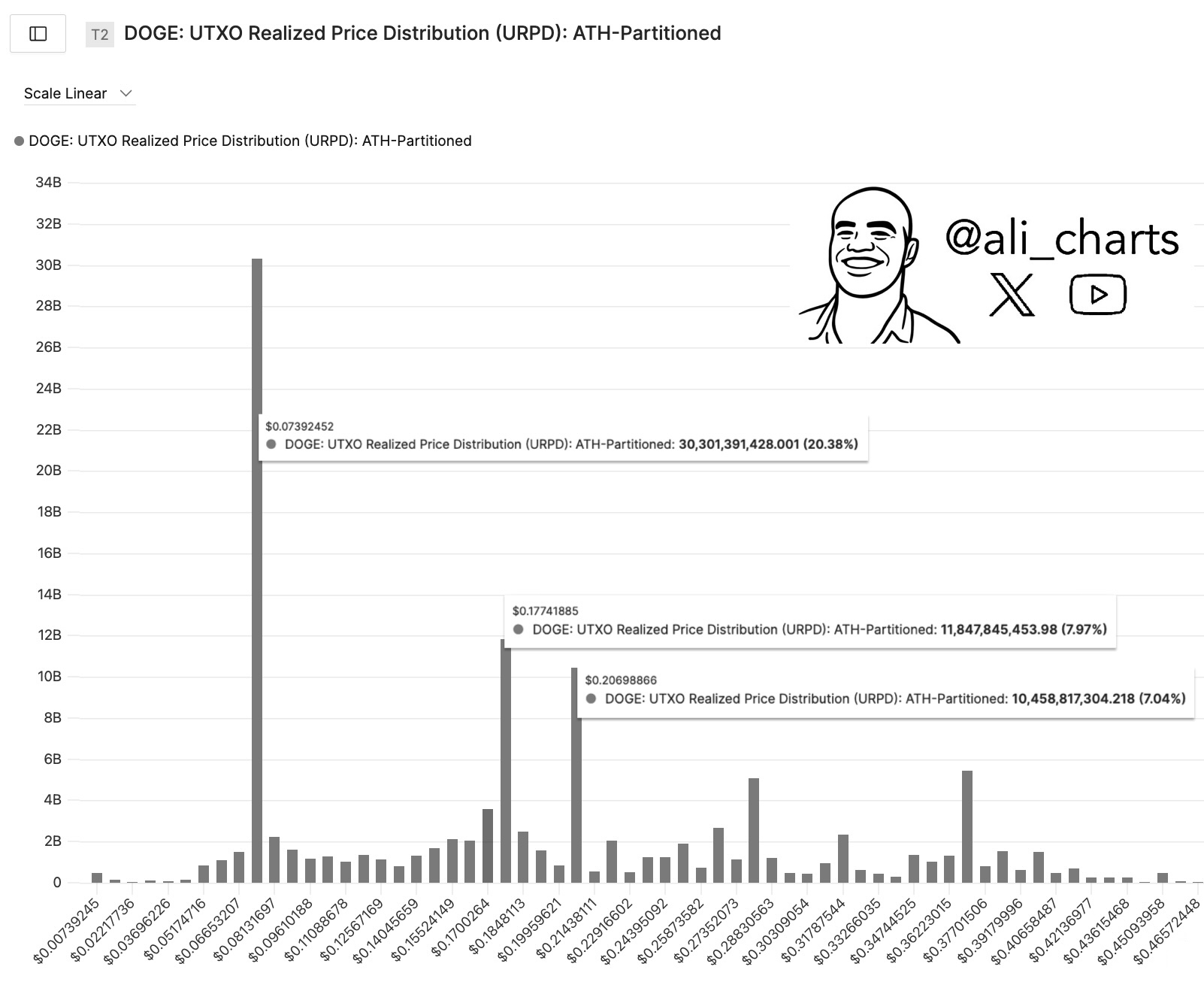

In the latest episode of ‘The Crypto Chronicles,’ analyst Ali Martinez has graciously pointed out where the mighty Dogecoin might face some resistance. And, for those who are curious, it all boils down to a little thing called the UTXO Realized Price Distribution (URPD). No, it’s not a new dance move, though the acronym might suggest otherwise. It’s a metric created by Glassnode, one of those analytics firms with an affinity for cryptic charts that make you question your life choices.

In layman’s terms, the URPD tells us where Dogecoin’s supply was last transacted. When a coin changes hands, the URPD marks the price at which it was last sold, essentially creating a map of where investors bought in. This, my friends, is how you uncover the mysterious terrain Dogecoin must traverse on its quest for a profitable future.

And now, behold the chart that has stirred the masses:

If you take a good look (and maybe squint a little), you’ll see that Dogecoin’s biggest supply wall sits around the $0.07 mark. That’s where more than 20% of the current supply last exchanged hands. Considering Dogecoin is now trading well above that price, this could be the sweet spot where investors feel a warm glow of profit. The question is, will they sell off, or will they double down on the meme dream?

Here’s where things get a bit philosophical: when Dogecoin’s price revisits levels where people bought at a profit, some investors start feeling optimistic. They see a potential ‘dip’ and think, “Hey, why not buy more? It worked last time, right?” But, of course, if the price falls back down, some will likely panic and try to escape with their dignity—and investment—intact. Ah, the eternal tug-of-war between greed and fear.

Now, if we shift our gaze toward the higher end of the spectrum, two other levels are particularly noteworthy: $0.18 and $0.21. Around 8% of Dogecoin’s supply was acquired at $0.18, and 7% at $0.21. These could serve as formidable barriers, because, well, people tend to sell when they see a chance to make a profit. The tension is palpable.

But here’s the kicker—if Dogecoin can break through both of these levels, it could set the stage for a real bull run. No, I’m not promising the moon, but one can dream. And, in the world of crypto, who’s to say a little dream won’t fuel an absurd rally? As analyst Martinez notes, “Breaking through both could be the catalyst for the next major bull rally.” Bold words indeed.

The Current Dogecoin Drama

As for Dogecoin’s current price? It had a fleeting attempt at recovery last week but has since returned to its natural habitat around the $0.17 mark. Perhaps the memecoin needs to take a breather after all that excitement.

Read More

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Peter Facinelli Reveals Surprising Parenting Lessons from His New Movie

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2025-04-02 09:42