In the shadowy alleys of cryptocurrency, where fortunes are made and lost faster than a magician’s trick, our dear analyst and trader, Ali Martinez, has donned his crystal ball. He proclaims, with the gravitas of a soothsayer, that Ethereum (ETH) is poised to take a nosedive of epic proportions against Bitcoin (BTC). Oh, the drama! 🎭

Martinez, with a following of 134,700 on the social media platform X (formerly known as Twitter, but who’s counting?), has declared that Ethereum is weaving a bearish tapestry against Bitcoin on the monthly chart. One can almost hear the ominous music playing in the background.

According to our oracle, Ethereum could plummet by a staggering 91% from its current lofty perch. Yes, you heard that right! A veritable freefall that would make even the most seasoned skydiver clutch their parachute in fear.

With the finesse of a painter, he suggests that the ETH/BTC pair is forming a double-top pattern, or as he whimsically calls it, an M pattern. A double-top, dear reader, is not a delightful pastry but a bearish reversal pattern. Who knew finance could be so deliciously ironic?

“From this angle, the ETH/BTC trading pair could be heading to 0.0020 BTC!” he quips, as if predicting the next great tragedy of our time.

As of this very moment, Ethereum is trading at 0.02205 BTC ($1,866), a price that might soon be a mere memory.

In a twist worthy of a Dostoevsky novel, Martinez cites data from the crypto analytics platform Santiment, revealing that Ethereum whales have sold a staggering 760,000 ETH, worth approximately $1.42 billion. That’s a lot of fish leaving the sea, folks! 🐋

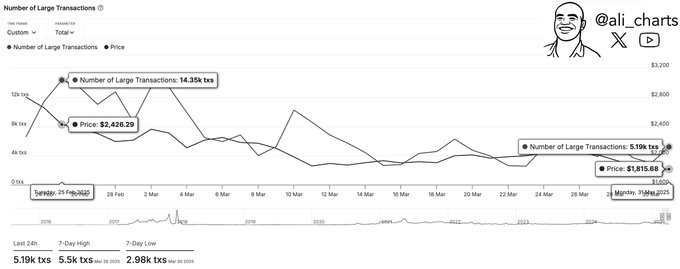

But wait, there’s more! Our intrepid analyst notes that whale activity on the Ethereum network has plummeted like a lead balloon. “Since February 25th, the number of large Ethereum transactions has declined by 63.8%, signaling a drop in whale activity on the network.” It seems the big fish have decided to take a vacation.

Now, turning our gaze to the mighty Bitcoin, Martinez warns that after the crypto king took a tumble below the 200-day and 50-day moving averages, these averages are now acting as formidable resistance levels. It’s like trying to push a boulder uphill, only to find it’s a boulder made of lead.

“Bitcoin faces the 200-day MA at $86,200 and the 50-day MA at $88,300 as key resistance ahead! A break above these levels could shift momentum back to the bulls.” Ah, the eternal struggle between bulls and bears, a tale as old as time.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2025-04-03 15:02