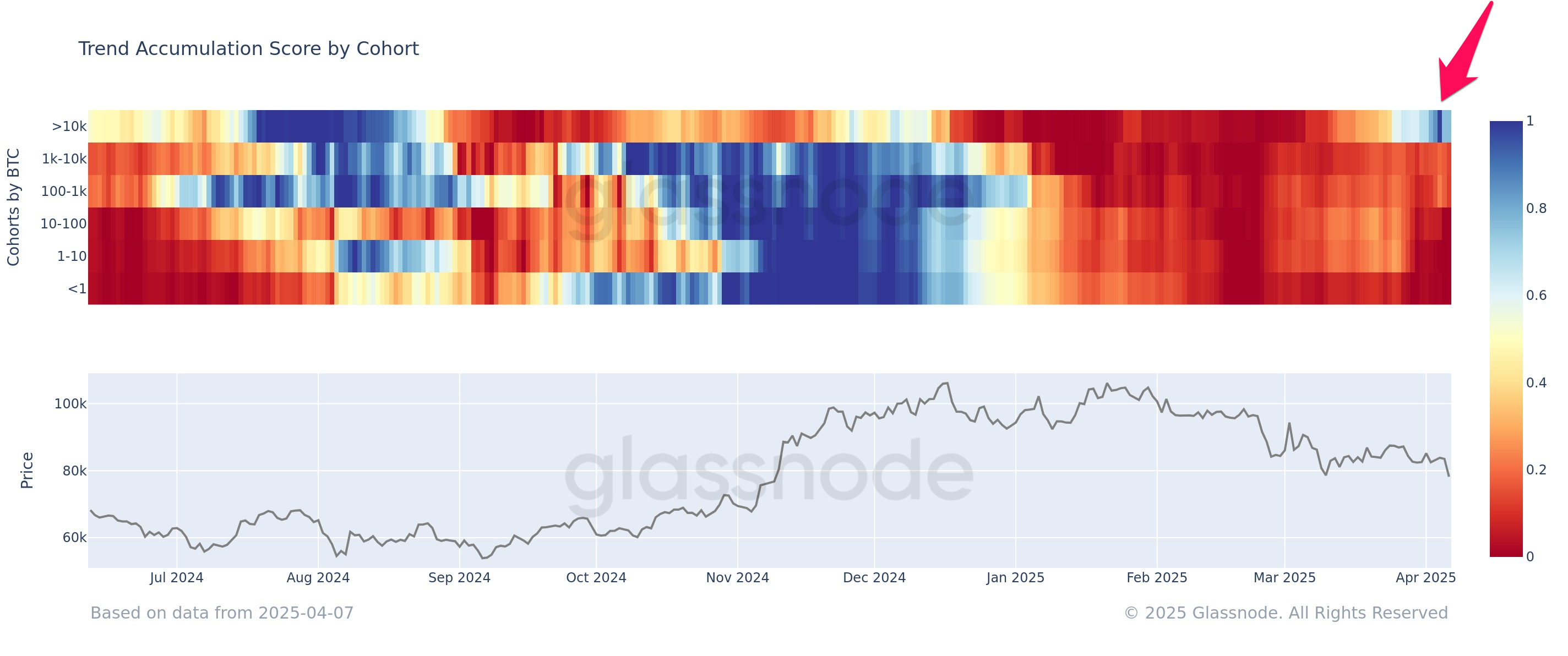

According to the ever-watchful Glassnode, Bitcoin whales—those monumental entities clutching more than 10,000 BTC like they’re the last hotcakes at a buffet—managed to achieve an impressively high accumulation score of approximately 1.0 earlier this month. Talk about a feeding frenzy! 🐋💰

But hold onto your hats, because this score signifies a rather grand departure from the panicked behavior of the little folks, who seem more inclined to shove their coins out the door faster than you can say “market crash.” 😬

Why Bitcoin Whales Are Gobbling Up While Smaller Holders Flee

As the cryptic glass of X (formerly known as Twitter, for the uninitiated) indicated, we have a little bit of a dichotomy brewing:

“Whales holding >10,000 BTC briefly hit a perfect accumulation score (~1.0) at the turn of the month,” proclaimed Glassnode from the lofty heights of relational data analysis.

This score showed an unrelenting 15-day spree of buying—that’s right, these behemoths gorged themselves for two solid weeks. But alas, like all good things, that score recently dipped to around 0.65. Moderation, it seems, is the name of the game now, while large holders continue their relentless accumulation. 🐳

Meanwhile, those not-so-mighty Bitcoin holders, with their paltry stash of less than 1 to 100 BTC, have decided it’s time to hit the eject button. On-chain data suggests these folks have become exceptionally active on the selling front, with their accumulation scores spiraling downwards to between 0.1 and 0.2. Panic stations, anyone? 🚨

“This divergence shows the bigger players are still accumulating, while smaller holders are selling. Market sentiment remains split,” a deeply insightful user proclaimed on X.

The widening gap between the big fish and the guppies paints a vivid picture of the market’s psyche. The whales seem to be going all in on Bitcoin’s future growth while the smaller players cautiously rummage through their pockets, preparing for gloomy days ahead. 🧐

This tug-of-war comes at a time when geopolitical tensions and trade war jitters have ignited a bonfire of concerns, leading some analysts to suggest Bitcoin might just be the fluffy safety blanket everyone desperately craves. Enter industry sage, Will Clemente:

//beincrypto.com/wp-content/uploads/2025/04/Screenshot-2025-04-08-at-1.40.58 PM.png”/>

But oh dear, the price dip has turned into quite the thorn for public companies holding hefty Bitcoin reserves, as many of these corporations now find their crypto fortunes nestled firmly below acquisition costs. Strategy, sensing the impending doom, even decided to hit the brakes on further Bitcoin purchases—true caution in an uncertain market! 😳

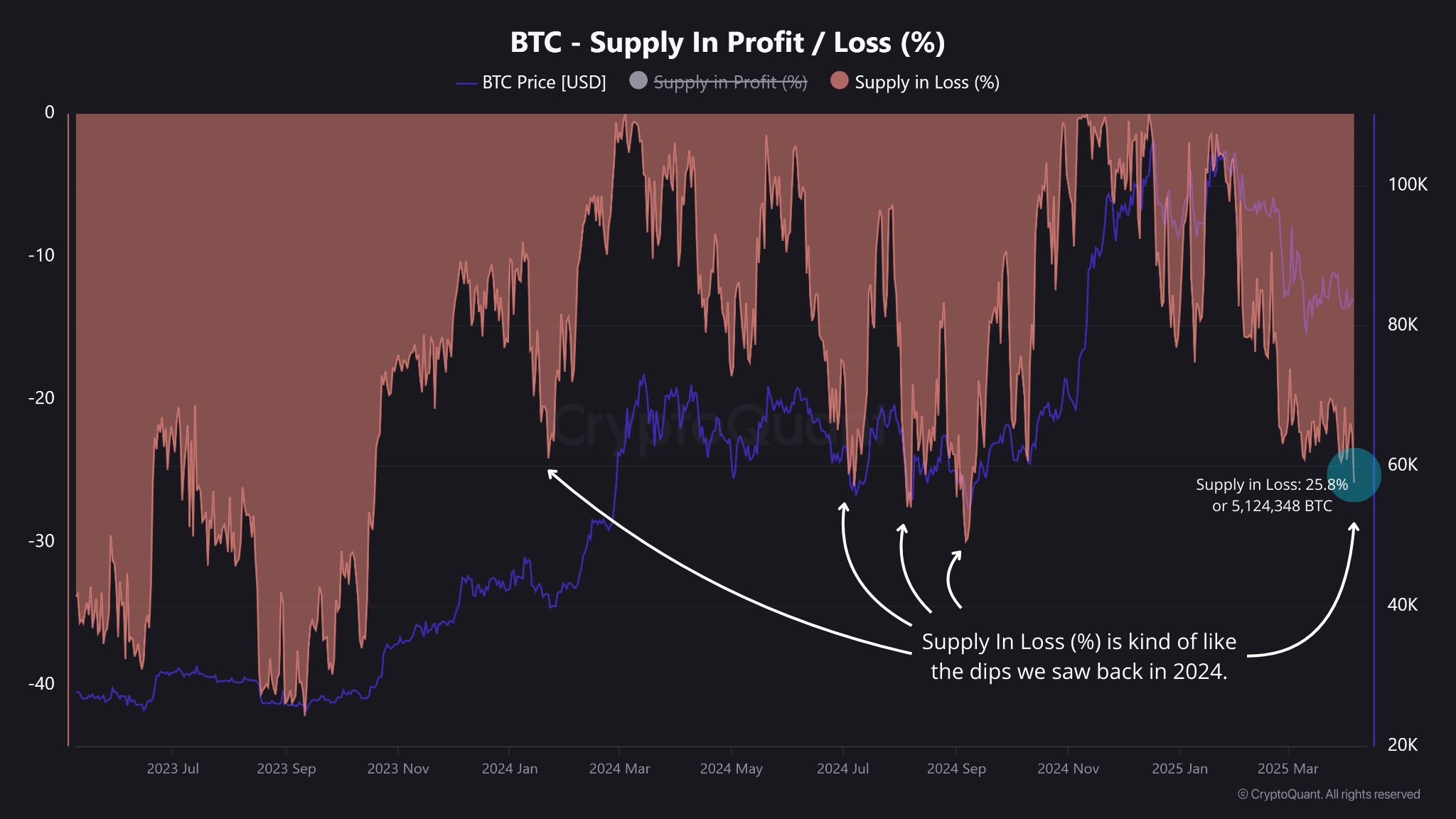

Adding to the woe, data from CryptoQuant disclosed that a staggering 25.8% of total Bitcoin supply is currently marked as a loss. Talk about a slump! 💔

“While it might seem alarming, it’s not unprecedented,” the post noted with a reassuring tone—like a cozy hug, if you will.

CryptoQuant further elaborated that similar scenarios have unfolded throughout 2024, with a chunk of Bitcoin also swimming in the deep waters of loss. For instance, earlier this year in January, 24.1% of the circulating Bitcoin was under water. By September, nearly a third was floundering! 📉

Clearly, these fluctuations are a normal part of the chaotic circus that is Bitcoin, where price corrections toss around a hefty share like it’s a beach ball at a summer party.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2025-04-08 16:00