Over the last 12 days, there’s been a significant increase in Bitcoin deposits into Binance. With the upcoming release of today’s Consumer Price Index (CPI) data, could it be that investors are preparing to offload their assets?

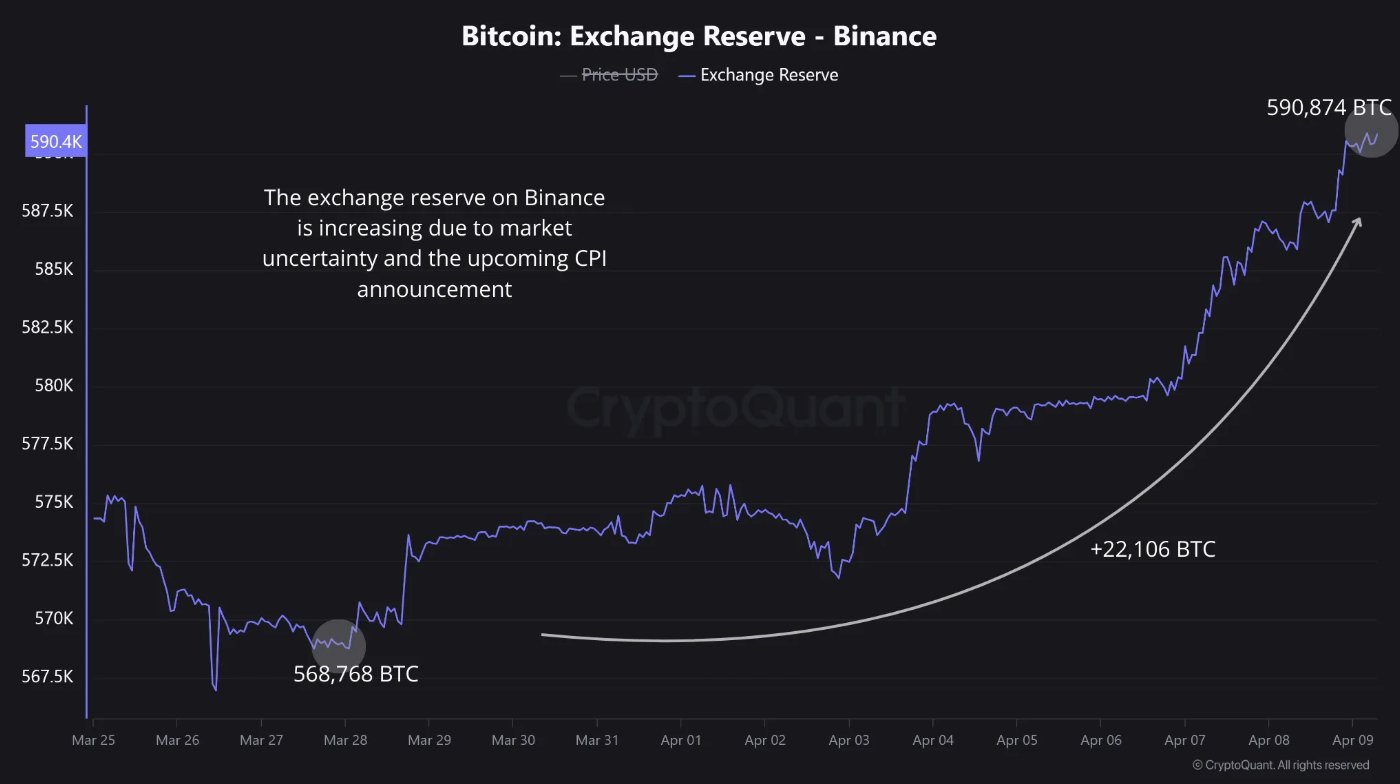

In his latest blog post about X, Maarten Regterschot from CryptoQuant noted that more than 22,000 Bitcoins, valued at approximately $1.82 billion, were moved to Binance within the last twelve days. This increase has brought Binance’s Bitcoin holdings up to around 590,874 BTC.

This indicates a significant increase in Bitcoin deposits into Binance, as stated by Regterschot. It’s plausible that investors are transferring their funds to Binance, possibly due to broader market uncertainties and in anticipation of the forthcoming Consumer Price Index (CPI) announcement.

As a crypto investor, I’m keeping a close eye on today’s release of the Consumer Price Index (CPI) report, scheduled for April 10. The general consensus is that the year-on-year increase will be around 2.6%, but economists surveyed by Reuters predict a modest 0.1% month-on-month rise. This suggested slowdown in inflation could be due to lower energy prices and the waning effects of early-year price hikes, as February’s CPI only rose 0.2%.

If the predicted CPI growth remains as suggested – a monthly rise of 0.1% and an annual rate of 2.6% – it could boost buyers’ optimism that inflation is diminishing, which might alleviate the Federal Reserve’s need to enforce strict monetary policies. This favorable outlook for the Fed’s stance could benefit risky assets such as Bitcoin.

In this situation, a rise in Bitcoin transfers to Binance doesn’t automatically suggest an upcoming selling frenzy, but could be a sign of strategic maneuvering instead. Traders might be shifting their BTC to Binance in expectation of market fluctuations, planning to swiftly execute spot or derivative trades following a positive CPI report. As reported by Pav Hundal, the lead analyst at Swyftx and interviewed by Cointelegraph, these inflows could simply represent Binance moving assets into its active wallets to cater to the expanding user base.

Even if Consumer Price Index (CPI) turns out to be lower than expected, the inflows could indicate that some investors are hedging their bets. This is because they might be anticipating a “sell the news” event – a situation where even a positive CPI report could already be factored into market prices, following Trump’s tariff pause and subsequent market reactions. Currently, Bitcoin stands at $89,636, experiencing an increase of more than 7% within the last 24 hours.

Despite the CPI data suggesting otherwise, it seems there’s more to the tale about Binance Bitcoin inflows. User Alex Metric pointed out that the actual inflow amount is quite small compared to other metrics. In fact, over the past month, Binance has seen a net outflow of 888.9 Bitcoins, according to him. He argued that excessive focus on the inflow figure alone might be misleading, as he put it, “you are only highlighting the last part with a magnifying glass.

The assessment presented appears to be skewed towards negativity, undersized, and over a 30-day period, there was an outflow (-888.9 BTC) from Binance, which you’ve focused on particularly closely without providing much context about the overall situation.

The review seems biased and negative, it covers only a small amount of time, and during that period, Bitcoin was withdrawn from Binance (-888.9 BTC). You’re focusing on this detail very specifically without giving us much information about what else is happening.

— Alex Metric 丰⚡ (@AlexMetricBTC) April 10, 2025

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Here’s What the Dance Moms Cast Is Up to Now

2025-04-10 16:05