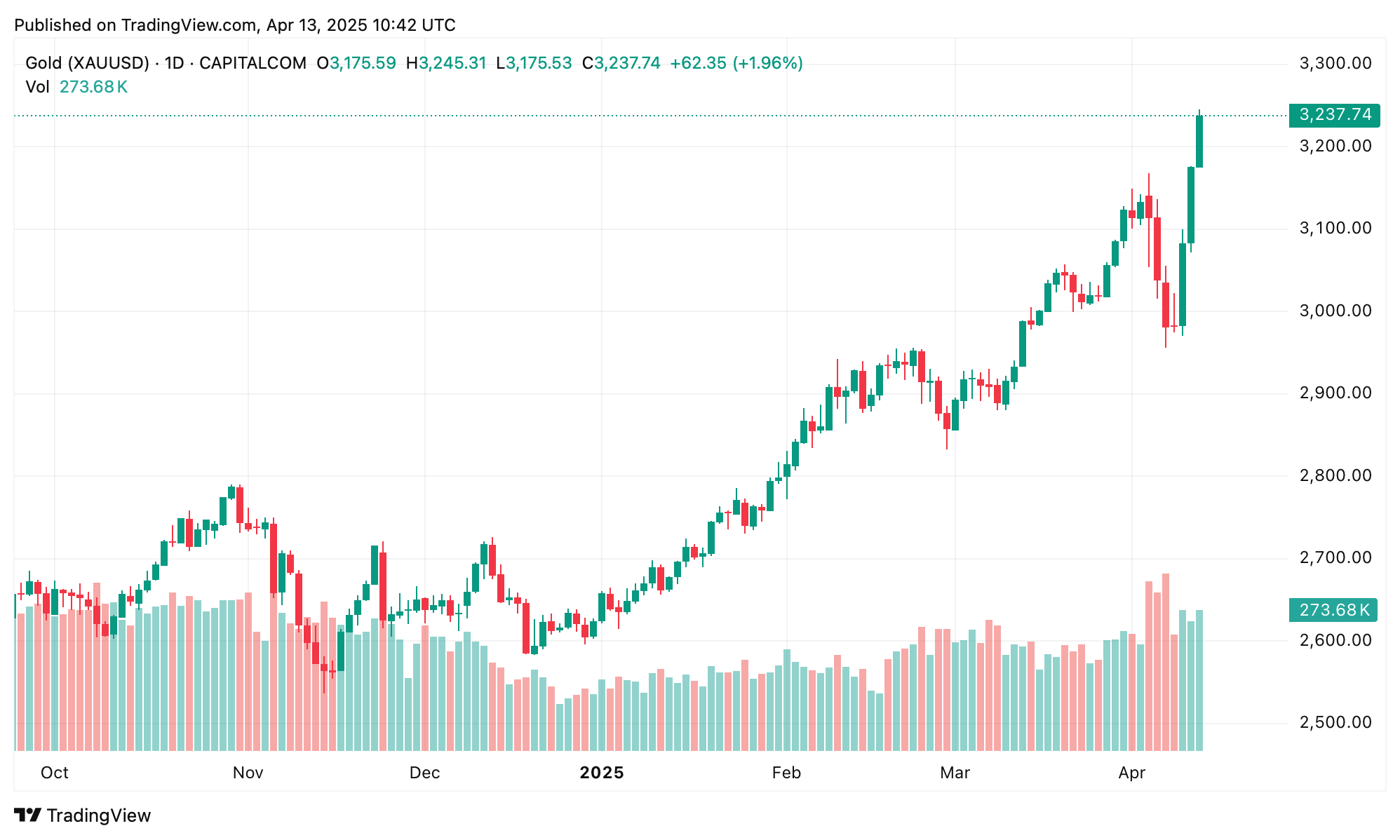

Well, it happened. Gold prices have jumped a jaw-dropping 36% over the past year, hitting a new high of $3,237 per ounce as of April 13, 2025. Why, you ask? Central banks are hoarding it, geopolitical chaos is everywhere, and monetary policies are, well, a mess. Who knew shiny rocks could cause this much drama?

Gold’s 2025 Rally: The $3,200 Ride Nobody Expected

Gold prices have been on a tear, breaking records like a toddler in a candy store. As of April 13, 2025, the shiny metal hit $3,237 per ounce, which is up 36% from April 2024. And no, this isn’t a joke. According to market data, this gold rush is a result of all sorts of economic drama happening around the world. Who needs a stable economy when you can have gold, right?

Let’s give a round of applause to the central banks, shall we? In 2024, they bought over 1,000 tonnes of gold for the third year in a row. The People’s Bank of China (PBOC) got back into the game, adding 15 tonnes in late 2024. Meanwhile, Poland decided it was time to bulk up their gold stash, now holding a hearty 20% of its total reserves. Like, okay, Poland. Flex on us.

Analysts have linked this whole gold rush to de-dollarization (say that three times fast), especially after Western sanctions on Russia in 2022 made central banks go wild for gold. Plus, with all the trade spats and tariff wars, gold is basically the economy’s way of screaming, “I’m too precious for this!” The U.S.-China trade wars? Yep, they’re still going strong, and they’ve been pushing the price of gold even higher in 2025. Gold’s definitely the hottest thing in international relationships right now, right after the awkward “who’s going to pay for dinner” debate.

Analysts have linked this whole gold rush to de-dollarization (say that three times fast), especially after Western sanctions on Russia in 2022 made central banks go wild for gold. Plus, with all the trade spats and tariff wars, gold is basically the economy’s way of screaming, “I’m too precious for this!” The U.S.-China trade wars? Yep, they’re still going strong, and they’ve been pushing the price of gold even higher in 2025. Gold’s definitely the hottest thing in international relationships right now, right after the awkward “who’s going to pay for dinner” debate.

And let’s not forget the Ukraine-Russia conflict. It’s like a recurring nightmare that just keeps giving gold more reasons to shine. The ongoing instability has only made gold look more appealing as a “safe haven” asset. Plus, with the Federal Reserve talking about rate cuts, holding non-yielding gold is suddenly way more fun and less of a financial burden. So, we’re all just out here holding gold and pretending like we understand monetary policy. Cool, cool.

UBS Global is out here saying that lower interest rates could lead to $6 trillion flowing from money market funds straight into gold-backed ETFs, which currently hold 3,235 tonnes of gold globally. Inflation fears and those pesky rising fiscal deficits aren’t helping either. Asia’s been eating up gold like it’s the latest TikTok challenge, with a huge surge in consumer and institutional demand.

India, being the cool kid on the block, slashed its gold import duties from 15% to 6%, and now APAC gold ETFs are growing faster than your grandmother’s collection of porcelain cats. Since 2005, these ETFs grew from 3 to 128, pulling in over $23 billion. China’s stimulus measures didn’t hurt either—retail investment in gold has been on the rise. If there’s one thing we know, it’s that people love gold almost as much as they love avoiding taxes.

But wait, before you start dreaming of all your gold investments paying off, some analysts are over here dropping cold water on the party. According to Business Insider reports, mining and recycling could cause gold prices to dip by up to 40%. But for now, let’s just sit back and watch the gold train keep chugging along, shall we?

Gold’s not just a shiny object to be hoarded by central banks. It’s basically a centuries-old VIP pass to financial security. Ancient civilizations had it right, and now, even in the face of global crises, gold’s still the go-to asset for people who prefer to play it safe. It’s the rock star of investments—always in style, never out of touch. Gold’s durability, scarcity, and ability to act as an inflation hedge make it the go-to asset during uncertain times. And by uncertain times, I mean, well, just about every time.

The 2025 rally proves that gold is more than just a fancy metal in your grandmother’s jewelry box. It’s the historical hero of global instability. As investors try to make sense of de-dollarization, fiscal messes, and whatever else 2025 has in store, gold’s not just a market trend—it’s the ultimate lifeline. The golden ticket to navigating an unpredictable world. Or, at the very least, it’ll look really pretty in your portfolio.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2025-04-13 21:27