Ah, Ethereum (ETH), that capricious creature of the digital realm, appears to be shedding its cloak of misfortune, having gallantly rallied a staggering 18% from its previous weekly nadir. But, dear reader, does this herald the dawn of a new era, or merely a fleeting mirage? Let us delve into three delightful reasons why ETH might yet plunge into the abyss once more.

3 Reasons Why Ethereum Price Could Continue its Descent

Ethereum has flirted with the 2018 ATH of $1,385, leading many to believe they have stumbled upon the fabled bottom. Yet, I present to you three compelling reasons why a further descent into the depths of despair may be on the horizon for our dear ETH.

Reason 1: Weekly Price Chart Shows Key Resistance Level

Behold the 1-week TradingView chart, where Ethereum is once again courting the $1,630 mark, the highest volume traded level since the days of yore—February 2021, to be precise. Alas, the recent crash has cast ETH below this lofty perch, and it is now up to the bulls to transform this formidable barrier into a supportive embrace. Until this resistance crumbles, the chances of ETH’s value continuing its tragic decline remain ever so high.

Furthermore, the intermediate demand zone at $1,280 stands ready to absorb the inevitable selling pressure. This zone, forged in the fires of December 2022, witnessed ETH soaring over 40% in mere weeks, without so much as a backward glance. A return to this enchanted realm seems all but certain.

The ultimate key support or demand zone stretches from $890 to $715, a veritable treasure trove of buy-side imbalance that once led to a near 50% weekly candlestick. Oh, the drama! 🎭

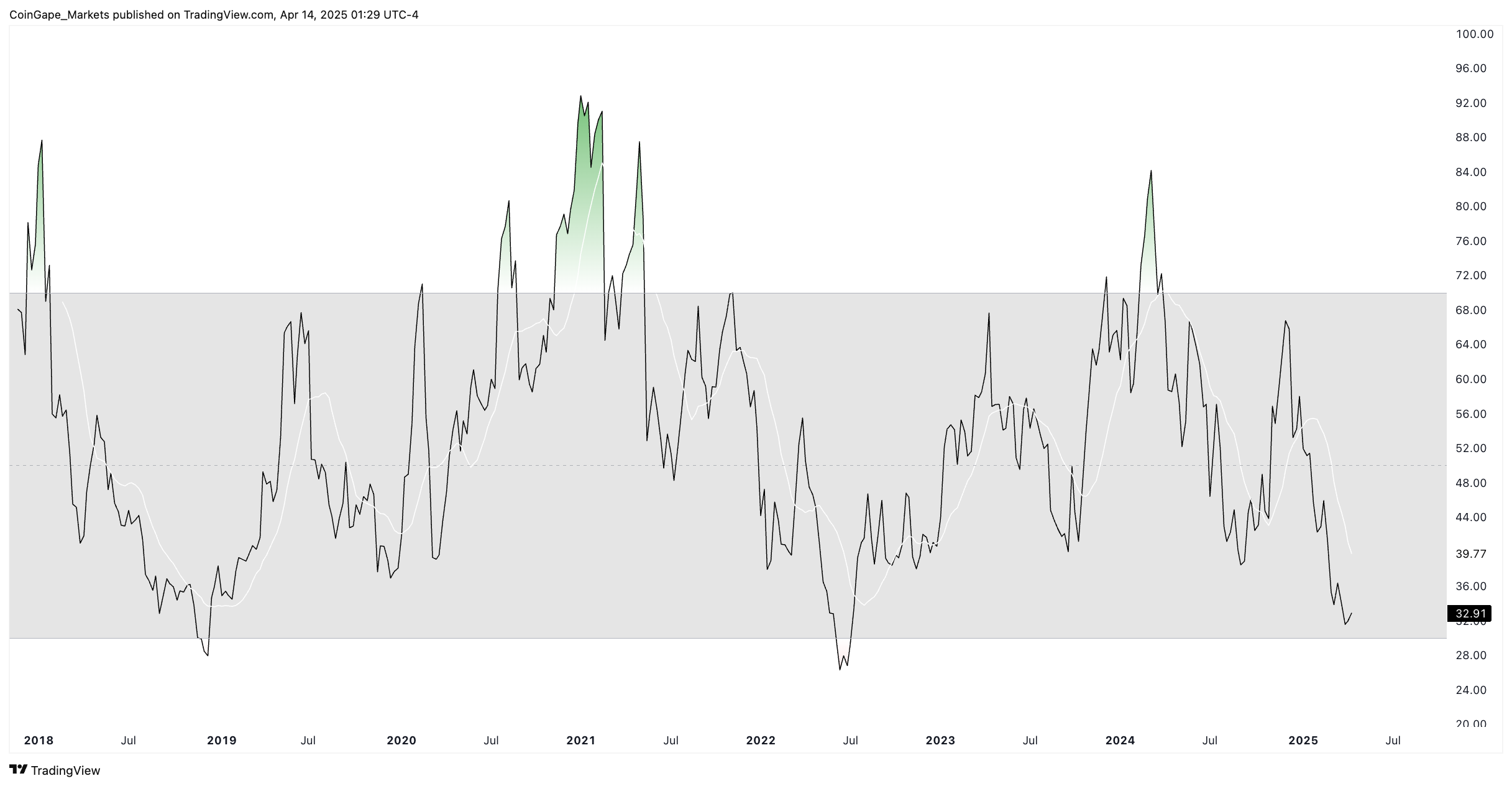

Reason 2: RSI Yet to be Oversold

On the grand stage of the weekly chart, the Relative Strength Index (RSI) has yet to embrace the oversold territory. Historically, all major rallies for Ethereum have commenced only after the RSI has taken a dip into the depths of despair. Thus, the likelihood of a further drop into the $1,280 to $1,160 and $890 to $715 zones remains tantalizingly high.

Reason 3: Uncertain Macroeconomic Conditions

From the lofty heights of macroeconomic analysis, we observe the tumultuous trade war between the illustrious Trump and Xi, which has cast a shadow of volatility over both stock and crypto markets. This has left Ethereum’s price prediction shrouded in bearish gloom, as fears of recession loom large.

Moreover, this week promises two major spectacles: the grandiloquent speech of Fed Chair Powell and the much-anticipated March inflation announcement. The outcomes of these events could very well unleash a tempest of volatility, potentially igniting a chaotic collapse. 🎢

In conclusion, the outlook for Ethereum price remains a curious blend of neutrality and bearishness. Investors, I implore you, tread carefully as you navigate the treacherous waters of the impending events amidst the Trump-Xi trade war. After all, fortune favors the bold, but wisdom favors the cautious! 😏

Read More

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Gold Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Superman Rumor Teases “Major Casting Surprise” (Is It Tom Cruise or Chris Pratt?)

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

2025-04-14 10:04