In the grand theater of cryptocurrencies, there exists a peculiar player—bitcoin (BTC)—now dancing in the limelight, performing a dramatic act between $84,969 and $85,171, after a whirlwind 24 hours of uncertainty. One moment, it was tangoing around $83,197, and the next, it spun up to $85,315, leaving spectators breathless. With a daily trading spectacle worth $30.74 billion and a market cap strutting at $1.68 trillion, this digital coin is holding on, albeit amid a cacophony of mixed signals that could confuse even the wisest sage.

Bitcoin

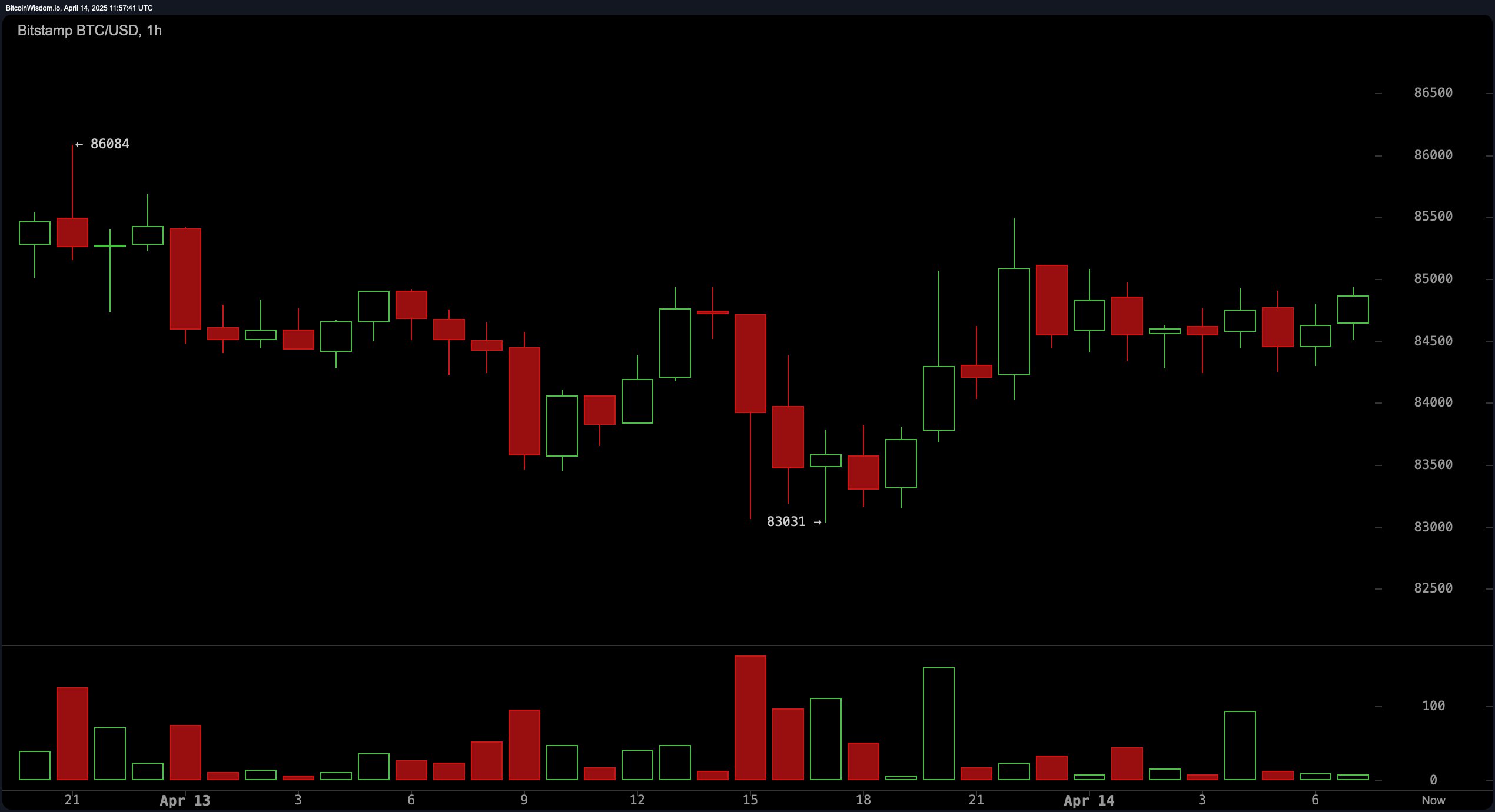

The market dynamics on this fateful April 14, 2025, paint a portrait rich in cautious optimism. The 1-hour chart is like a soap opera, showcasing a saga of consolidation between $83,000 and $85,000. Just recently, bitcoin rebounded from a dramatic fall to $83,031, asserting its short-term integrity like a failed actor seeking redemption. However, ominous red volume spikes whisper of potential pullbacks, illustrating a market in the throes of indecision. Ah, but a hopeful bounce in the $83,500 to $84,000 range could offer a golden ticket, while a tragic drop below $83,000 may summon the grim specter of downside risk.

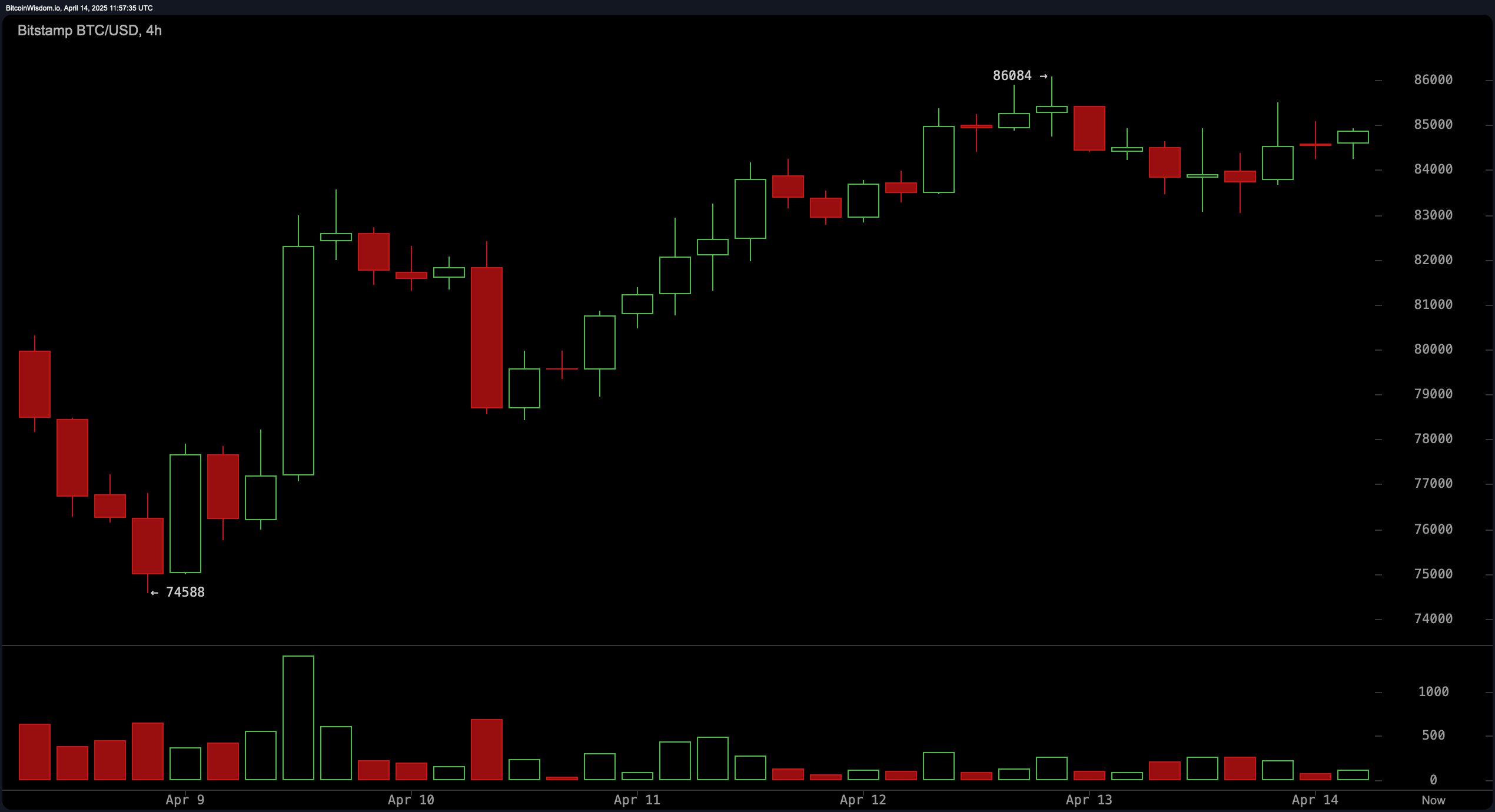

The 4-hour chart reveals a more uplifting narrative, resembling an epic tale wherein bitcoin has risen from the depths of despair, from about $74,588 to the summit of $86,084. The story unfolds with orderly pullbacks, a graceful pirouette followed by a triumphant leap, though the recent candles appear feeble, lacking the vibrancy of earlier scenes—perhaps a sign of buyer exhaustion or mere consolidation? Should bitcoin reclaim its throne above $85,500 on a swell of volume, it could pave the way for a glorious encore at $86,000 or perhaps even loftier heights. On the contrary, if it falters beneath $83,000, a lament might echo toward $80,000.

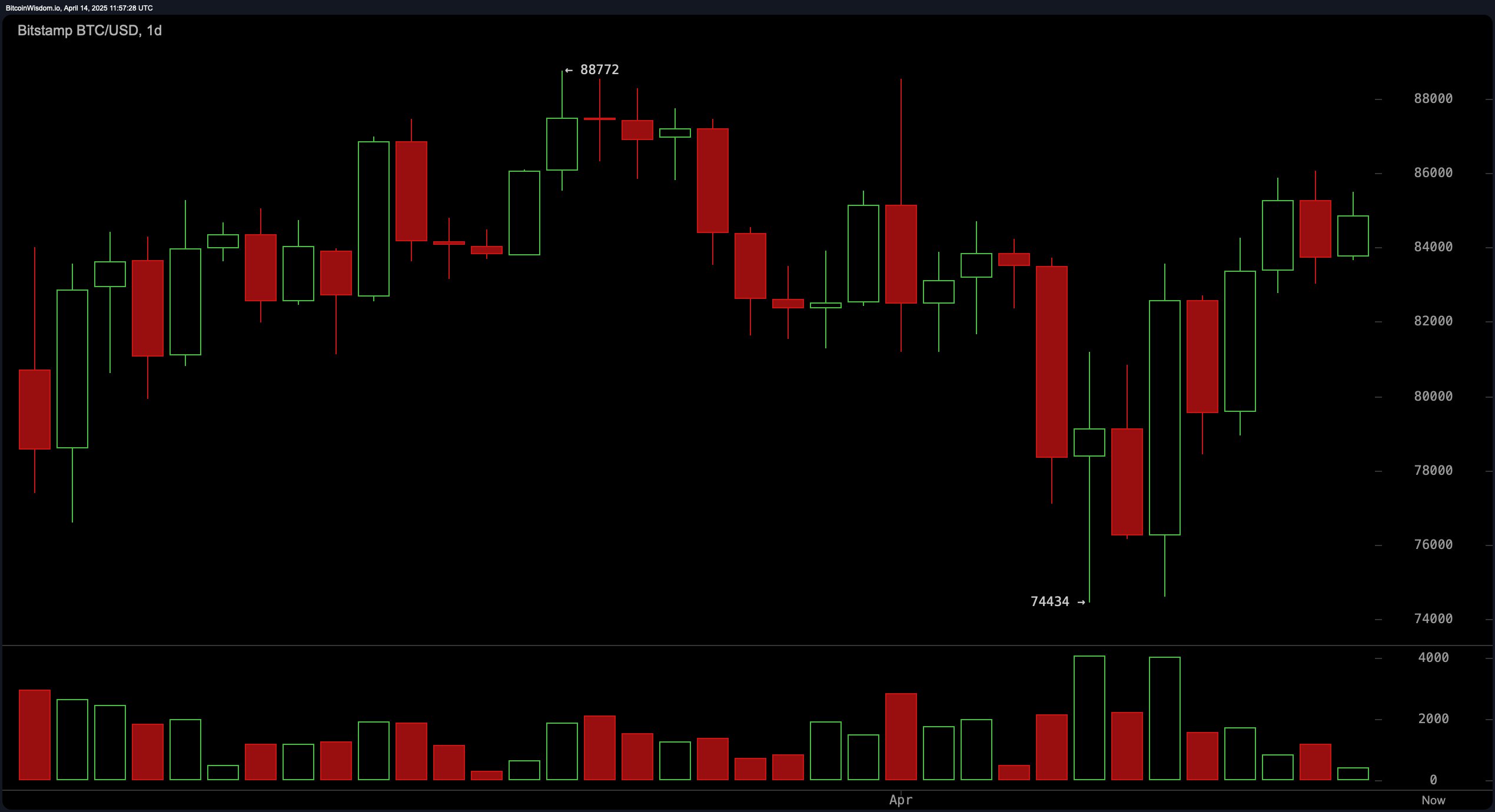

On the stage of daily charts, bitcoin appears to be on the path to recovery, emerging heroically from its support zone at $74,434. Long bullish candlesticks, reminiscent of hopeful aspirations, accompanied by a swell of volume, suggest a burgeoning interest. Yet, despite this optimism, the broader scene remains ensnared in a lower-high formation—a reflection of the nagging macro uncertainties haunting the market. A daily closure above $85,000, bolstered by robust volume, could signal a breakout—a potential foray towards resistance near $88,000. However, until that moment arrives, our hero must tread carefully near crucial support levels.

Technical indicators, reminiscent of oracles, present a predominately neutral yet cautiously bullish tableau. Oscillators like the relative strength index (RSI), Stochastic, and others offer vague signals—like a crystal ball that could use an upgrade. However, whispers of momentum suggest a potential buy, and the moving average convergence divergence (MACD) is also cheering on the buy side, despite bearing the scars of a negative level of -606. Such mixed signals only reinforce the narrative of a market in transformation, rather than one marching in unison.

The ever-watchful moving averages add a layer of nuance. Short-term trends flash positivity, with exponential and simple moving averages for 10, 20, and 30 periods recommending buys. Yet, the longer-term outlook presents a curious contradiction—the 50-period EMA waves a flag of warning while the 50-period SMA remains optimistic. Meanwhile, the 100- and 200-period charts echo a collective sell signal, ominously suggesting that the road ahead remains fraught with challenges. Such nuances remind us that only with validation through volume can bitcoin hope to stage a rally beyond the $88,000 threshold.

Bull Verdict:

If bitcoin sustains its support above $83,000 and boldly breaks past $85,500 on a surge of volume, it may well ride the wave of momentum toward the fabled $88,000 and perhaps even further. The encouraging hints from short-term moving averages and bullish indicators lend weight to this uphill journey.

Bear Verdict:

Yet, should bitcoin stumble and fail to cling to the $83,000 mark, particularly under an onslaught of selling pressure, our tale may devolve into a deeper descent toward $80,000 or lower. The bearish signals from lengthy moving averages, tied with neutral oscillators, anchor the notion that the prospect for upward movement remains fragile and precariously poised for reversal.

Read More

- OM/USD

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Solo Leveling Season 3: What You NEED to Know!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- Beyond Paradise Season 3 Release Date Revealed – Fans Can’t Wait!

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

- Moo Deng’s Adorable Encounter with White Lotus Stars Will Melt Your Heart!

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

2025-04-14 16:28