What to know:

Bitcoin (BTC) persists in outpacing global economic unrest, moving steadily towards re-establishing $86,000. Currently, it stands just about 3% from its “Liberation Day” peak. To provide some context, the dominance of bitcoin – a measure representing BTC’s portion within the overall cryptocurrency market cap – is almost reaching 64%, a level not observed since early January 2021.

Conversely, the Nasdaq 100 remains about 5% below its peak on Liberation Day, suggesting that Bitcoin has been performing stronger compared to U.S. stocks. In simpler terms, the Nasdaq 100 hasn’t reached its highest point since Liberation Day yet, while Bitcoin seems to be outperforming US equities during this timeframe.

As per Cheddar Flow’s analysis, the S&P 500 recently created what’s known as a “death cross” – a pattern that typically indicates a downtrend, occurring when the short-term moving average drops below the long-term moving average. The last time this happened was on March 15, 2022, and it led to an initial 11% increase in the S&P 500 over the next week, followed by a steep drop of around 20%. The pessimistic outlook is also seen in the options market, with investors reportedly purchasing high volumes of NVDA puts, which suggests they expect prices to fall.

During an interview with Bloomberg on Monday, Treasury Secretary Janet Yellen expressed assurance in the stability of the U.S. bond market, disputing rumors suggesting that other countries are unloading U.S. Treasuries.

Bessent stated that there isn’t a massive sell-off of U.S. Treasuries at present. He added that the U.S. Treasury possesses numerous strategies, but we are far from requiring them just yet. Moreover, he highlighted the continued dominance of the U.S. dollar as the global reserve currency, despite a decline in the DXY index, which assesses the dollar’s worth against significant trading partners, dipping below 100 and falling by over 10% during recent weeks.

Additionally, Bessent mentioned that the current administration under Trump intends to find a new Federal Reserve Chair to succeed Jerome Powell, with selection processes slated for later this year. In conclusion, he hinted that the VIX (a measure of S&P 500 volatility) might have reached its highest point following the biggest single-day percentage decline in its history the previous week. Keep a close eye!

Token Talk

By Shaurya Malwa

- Story Protocol’s IP tokens experienced a 20% drop and recovery within hours during an unusual trading session on Monday.

- Trading volume surged on exchanges including Binance and OKX Spot, with $138 million recorded after the price rebound.

- The sudden price movement was isolated from broader market trends, sparking speculation about insider activity or coordinated selling.

- Also on Monday, MANTRA’s OM token plummeted over 90% in hours, dropping from around $6.30 to as low as 37 cents and wiping out over $5 billion in market capitalization.

- The token has since rebounded slightly to trade around 63 cents.

- Laser Digital, a Nomura-backed investor, was initially flagged for depositing $41 million in OM to OKX, but the company denied selling, clarifying it was collateral return from a financing trade. Shorooq Investors also denied selling.

Derivatives Positioning

- BTC shorts have been liquidated on most exchanges in the past 24 hours, excluding BitMEX and Gate.io, according Coinglass. The opposite is the case in ETH.

- XRP‘s perpetual futures open interest has dropped from 544.7 million XRP to 480 million XRP, diverging from the price recovery seen since Monday last week.

- SUI, ONDO, ADA and APT have seen a notable increase in futures open interest in the past 24 hours. Of those, XMR is the only one with the positive OI-adjusted cumulative volume delta, representing net buying pressure.

- On Deribit, short-dated BTC and ETH options continue to show a bias for protective puts, suggesting cautious sentiment.

- Flows on OTC desk Paradigm have been mixed with both calls and puts bought in the April expiry.

Market Movements:

- BTC is up 1.19% from 4 p.m. ET Monday at $85,877.18 (24hrs: +1.35%)

- ETH is up 0.59% at $1,645.30 (24hrs: -1.97%)

- CoinDesk 20 is up 0.99% at 2,519.69 (24hrs: +0.19%)

- Ether CESR Composite Staking Rate is up 18 bps at 3.18%

- BTC funding rate is at 0.0184% (6.7003% annualized) on Binance

- DXY is unchanged at 99.70

- Gold is up 1.26% at $3,245.30/oz

- Silver is up 0.81% at $32.35/oz

- Nikkei 225 closed +0.84% at 34,267.54

- Hang Seng closed +0.23% at 21,466.27

- FTSE is up 0.92% at 8,209.04

- Euro Stoxx 50 is up 0.82% at 4,951.51

- DJIA closed on Tuesday +0.78% at 40,524.79

- S&P 500 closed +0.79% at 5,405.97

- Nasdaq closed +0.64% at 16,831.48

- S&P/TSX Composite Index closed +1.18% at 23,866.50

- S&P 40 Latin America closed +1.8% at 2,340.02

- U.S. 10-year Treasury rate is up 1 bp at 4.39%

- E-mini S&P 500 futures are up 0.12% at 5,447.25

- E-mini Nasdaq-100 futures are up 0.26% at 18,983.25

- E-mini Dow Jones Industrial Average Index futures are unchanged at 40,750.00

Bitcoin Stats:

- BTC Dominance: 63.80 (0.16%)

- Ethereum to bitcoin ratio: 0.01913 (-0.31%)

- Hashrate (seven-day moving average): 896 EH/s

- Hashprice (spot): $44.1 PH/s

- Total Fees: 6.33 BTC / $536,017

- CME Futures Open Interest: 134,730

- BTC priced in gold: 26.6 oz

- BTC vs gold market cap: 7.56%

Technical Analysis

- On Monday, the bitcoin cash-bitcoin (BCH/BTC) ratio failed to penetrate the trendline characterizing the 12-month bear market.

- A potential move above the trendline could see breakout traders join the market, lifting BCH higher.

Crypto Equities

- Strategy (MSTR): closed on Monday at $311.45 (+3.82%), up 0.62% at $313.38 in pre-market

- Coinbase Global (COIN): closed at $176.58 (+0.62%), up 1.28% at $178.84

- Galaxy Digital Holdings (GLXY): closed at C$15.81 (+3.47%)

- MARA Holdings (MARA): closed at $12.95 (+3.52%), up 1.24% at $13.11

- Riot Platforms (RIOT): closed at $7.01 (-0.71%), up 0.71% at $7.06

- Core Scientific (CORZ): closed at $7.06 (-0.14%)

- CleanSpark (CLSK): closed at $7.78 (+3.73%), up 1.29% at $7.88

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $12.70 (+1.44%), up 1.44% at $12.90

- Semler Scientific (SMLR): closed at $34.26 (+1.48%)

- Exodus Movement (EXOD): closed at $39.43 (-10.55%), unchanged in pre-market

ETF Flows

Spot BTC ETFs:

- Daily net flow: $1.5 million

- Cumulative net flows: $35.46 billion

- Total BTC holdings ~1.11 million

Spot ETH ETFs

- Daily net flow: -$6 million

- Cumulative net flows: $2.28 billion

- Total ETH holdings ~3.36 million

Overnight Flows

Chart of the Day

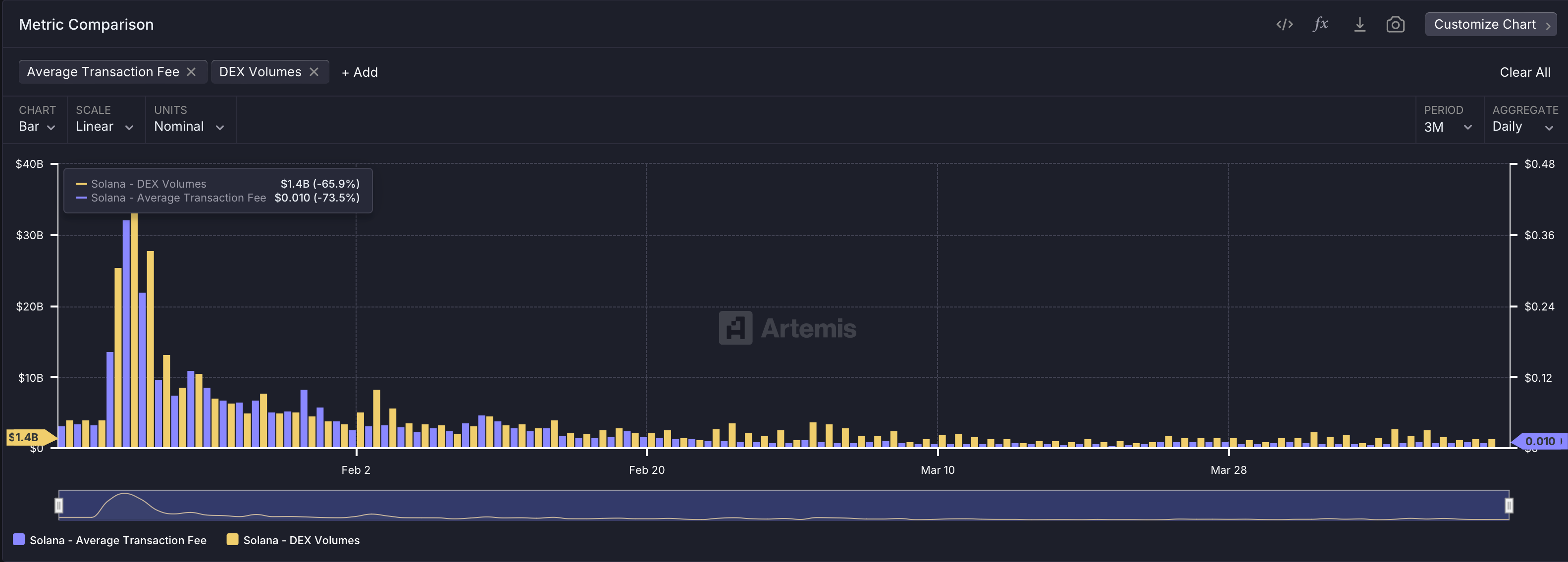

- The chart shows the demand for the Solana network has cooled significantly from the heady days of January.

- Both the DEX volumes and the average transaction fee have crashed, validating the decline in the SOL token price.

In the Ether

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-04-15 14:26