The recent fall of Mantra raises concerns not only about the future of the project, but also about potential risks of low liquidity that may affect other decentralized finance (DeFi) platforms in the near future.

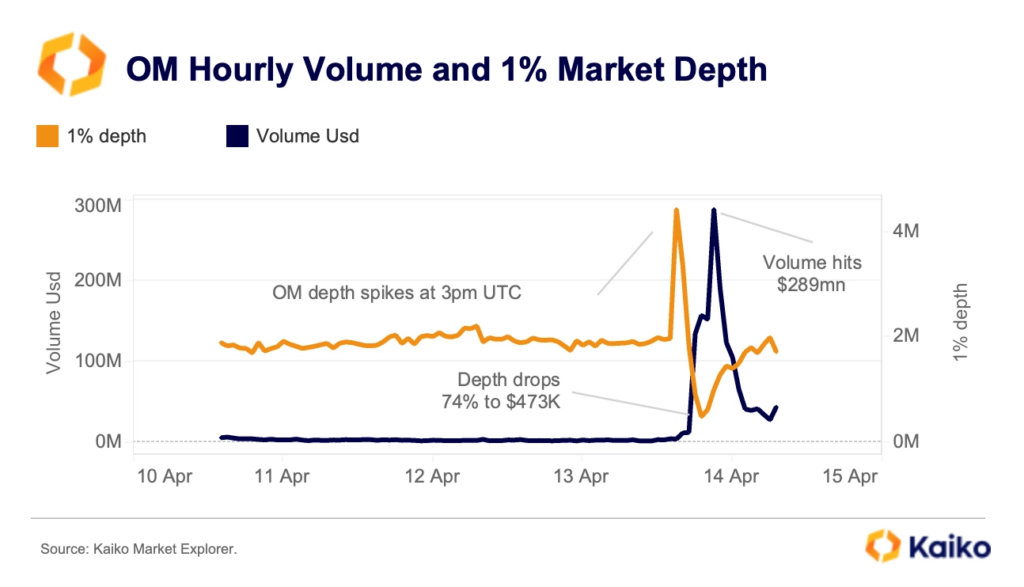

Experts are currently investigating the sudden downfall of the Mantra token, a fall that erased approximately $5 billion of its market value. A fresh analysis by Kaiko, released on April 14, delves into the liquidity factors responsible for triggering this crash.

Based on Kaiko’s analysis, it appears that insufficient trading volume (low liquidity) and prolonged sell-offs (long liquidations) might have played significant roles in triggering the market crash. A massive price plummet caused a dramatic shrinkage of market activity from approximately $290 million to merely $473,000.

Essentially, there weren’t enough people buying to balance out the selling, making the price drop more severe. The situation worsened when people had to sell their holdings (liquidations), which added to the downward trend. On OKX alone, these liquidations totaled $21 million, adding to the selling pressure in the market.

Did insiders dump their Mantra tokens?

It’s still unclear what the exact reason is, but Kaiko suggests a possible explanation: significant internal sell-offs could be the culprit. Furthermore, multiple independent analysts agree with this theory. One blockchain investigator, Max Brown, asserts that the team had control over approximately 90% of the token supply, allegedly manipulating the token’s availability artificially to give the impression of greater abundance.

According to OddEyeResearch, the crash was likely due to an attempt at market manipulation. They suggested that there were significant transfers from cryptocurrency exchanges to untraceable wallets, which they think may have been controlled by Mantra itself.

1/ The Mantra Chain Foundation claims no involvement in the recent dumping of $OM tokens, but we suspect them of participating in a coordinated market manipulation scheme. Our findings suggest that the sell-off may have been instigated by a betrayal within their ranks.

Here is our investigation summary.

— OddEyeResearch (@OddEyeResearch) April 15, 2025

According to OddEyeResearch, the incident occurred when a team member allegedly undermined the plan. They further explained that this could have been due to either a deliberate sale or compulsory seizures. Regardless of the cause, the ensuing market drop in low liquidity led others to start selling frantically.

Specifically, the CEO of Mantra, JP Mullin, attributed the market crash to compulsory Centralized Exchange (CEX) liquidations. Yet, due to the fact that exchange trades are not straightforward to track on a blockchain, independent investigators find it challenging to confirm these events.

To put it simply, Mantra’s value hasn’t even approached its previous levels yet. As of April 15, OM was trading at around $0.8213, a slight recovery from its previous day’s low of $0.4823. However, this is still significantly lower than its high of $7.09 from last week, representing approximately a 90% drop.

Read More

- OM/USD

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Solo Leveling Season 3: What You NEED to Know!

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Moo Deng’s Adorable Encounter with White Lotus Stars Will Melt Your Heart!

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

2025-04-15 20:16