- Canary Capital has filed for a staked TRX ETF with the SEC.

- Despite the ETF filing, Tron is facing strong bearish sentiment.

Well, well, well. It seems Canary Capital is trying to work its magic again, this time with a proposal for a staked TRX ETF. Yes, you heard that right—an ETF that holds Tron’s native token TRX. And you thought you’d seen everything in crypto, huh? The ETF is called the Canary Staked TRX ETF. I know, catchy, right?

The idea behind this? Simple. Hold spot TRX, stake it, and voilà—generate some yield. With this shiny new product, investors would get the oh-so-regulated access to staking rewards and market exposure. Sounds like the perfect recipe for success, doesn’t it?

If the SEC decides to give this a green light (which is a bit like trying to get a stamp of approval from a picky cat), Canary Capital will be the ones managing the whole show, overseeing ETF operations and performance. We’ll see how that goes.

Now, here’s where it gets interesting. Over the past four months, the SEC has been flooded with submissions for crypto ETFs—because who wouldn’t want a piece of that sweet, sweet regulatory approval, right? It’s like a crypto buffet. In this frenzy, Canary’s been busy filing for ETFs across a spectrum of altcoins: Litecoin, XRP, Hedera, Sui, and even Pudgy Penguins (yes, you read that last one correctly). Someone’s been busy.

Will an ETF Save TRX or Just Let It Sink Further?

So, an ETF should normally be a big win for the price, right? I mean, it’s got all the hallmarks of good news: a shiny new product, more access, more regulation, and all that jazz. But… surprise! TRX doesn’t seem to be feeling the love.

As of this very moment, TRX is trading at a cool $0.24. Not exactly the kind of spike you’d expect from ETF news. In fact, it’s down 1.28% on the daily charts and a worrisome 2.8% on the weekly. Talk about a damp squib.

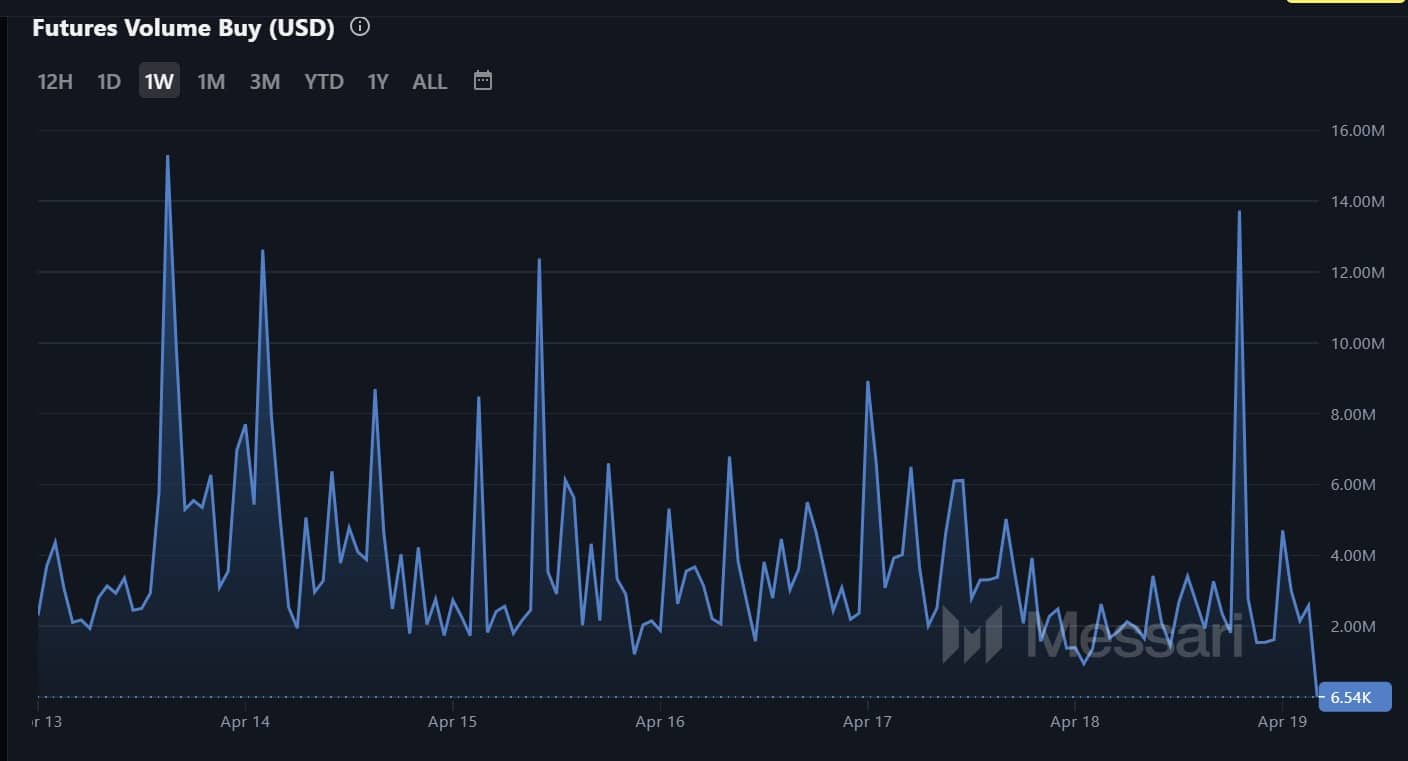

And here’s the kicker: demand for TRX is practically vanishing into thin air. The buyers? They’ve almost disappeared. Futures buy volume has nosedived to a weekly low of just $6.5k. Ouch. Looks like nobody’s betting on an uptrend anytime soon. Not even the faintest glimmer of bullish conviction in sight.

Even worse? The Funding Rate (Volume Weighted) is in full-on panic mode, staying at a monthly low in negative territory. Translation: investors are shorting Tron like there’s no tomorrow, betting on a further price decline. And who could blame them?

So, what would it take for an ETF to turn this ship around? Well, for starters, it might need to convince institutional investors to jump on board. With more institutional adoption, we could see higher demand for TRX. A price boost to $0.259 isn’t entirely out of the question… but if the mood in the market doesn’t improve soon, expect TRX to slip down to $0.23 faster than you can say “bear market.” Yikes.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

2025-04-19 13:15