Behold! The unstoppable force that is Bitcoin has shattered the $90,000 mark on a crisp Tuesday morning, as both traditional markets and the realm of crypto dared to rise above the turmoil—despite Trump’s rather theatrical bungling of a trade deal with Japan. Ah, such is the world we live in.

BTC Rallies Against All Odds, Soars to $90K

Markets, you might say, are like a chaotic tempest lately—storming with unresolved tariff worries—but still, like a lone hero emerging from the fray, the stock indices, crypto world, and especially Bitcoin, decided to do something radical: they surged. Bitcoin, of course, galloped beyond the magical $90,000 barrier.

Market Metrics at a Glance

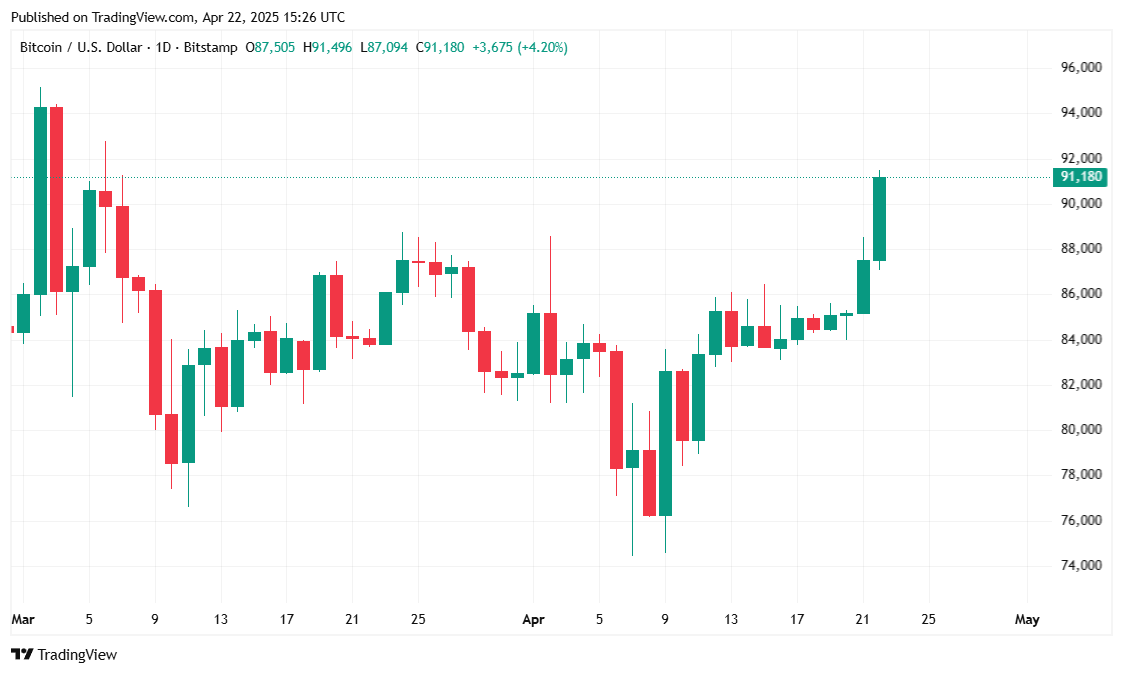

Ah, but let us get into the delightful details: Bitcoin shot up to a new local high on Tuesday, reaching an awe-inspiring $91,463.81 at the peak of the 24-hour window, only to settle slightly lower at $91,245.60 at the moment we record this. A 3.47% rise in one day? Not too shabby, right? And over the week, it’s up 6.86%, showing its refusal to bow down to any dip. Who knew $83K last week was merely a pause before this majestic ascent?

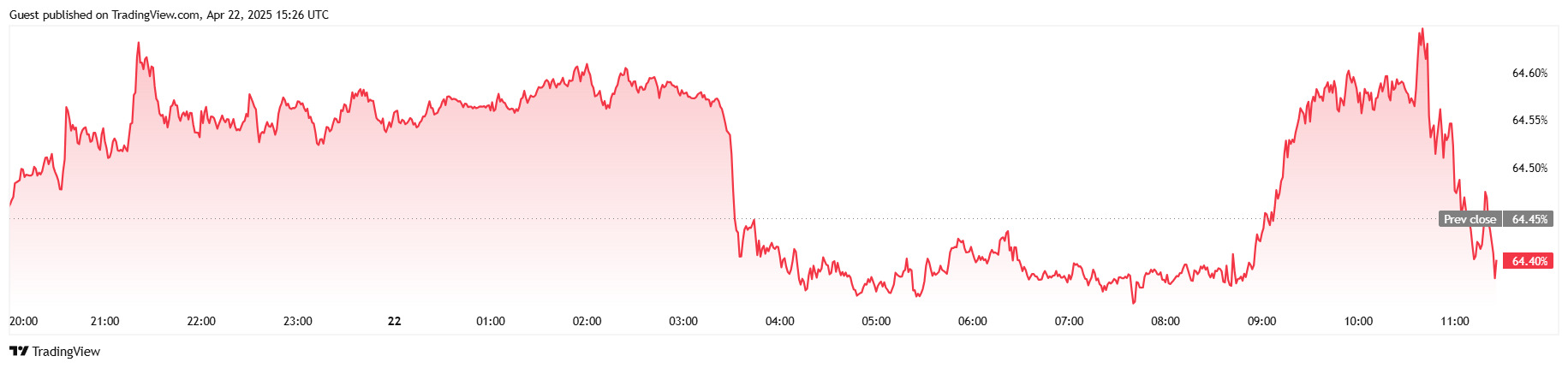

Trade volume? Oh, it jumped a delightful 25.20% over the last 24 hours, hitting $43.27 billion—because, why not? Bitcoin’s market cap is now a staggering $1.8 trillion, up 3.18% since yesterday. As for BTC dominance, it slightly slipped by a mere 0.12%, settling at 64.40%. Altcoins, it seems, are in the mood to show a bit more leg—well, in comparison. But Bitcoin is still the undoubted leader of this circus.

And let’s not forget the futures market, which is always full of drama. The total open interest in BTC futures soared 10.82% to $68.59 billion, as speculation on Bitcoin’s future value runs rampant. As Coinglass reports, $38 million in liquidations occurred in the past 24 hours. Most of the losses? Oh, they were borne by the short sellers, who probably thought they had a winning hand—until they didn’t. The poor bears, so often wrong but so confident.

“Ninety Deals in 90 Days” Becomes a Punchline

The Trump administration had grand dreams—90 trade deals in 90 days, they said, right after taking a “pause” on tariffs. Japan was one of the first to step into this romantic tango, with the president boasting how their negotiations were going swimmingly. But alas, reality intervened, and the deal crumbled like a poorly baked soufflé. The Minister of Economic Revitalization from Japan even told the media, “I made clear to the U.S. that we feel the tariff measures are extremely regrettable. I strongly urged them to reconsider these policies.”

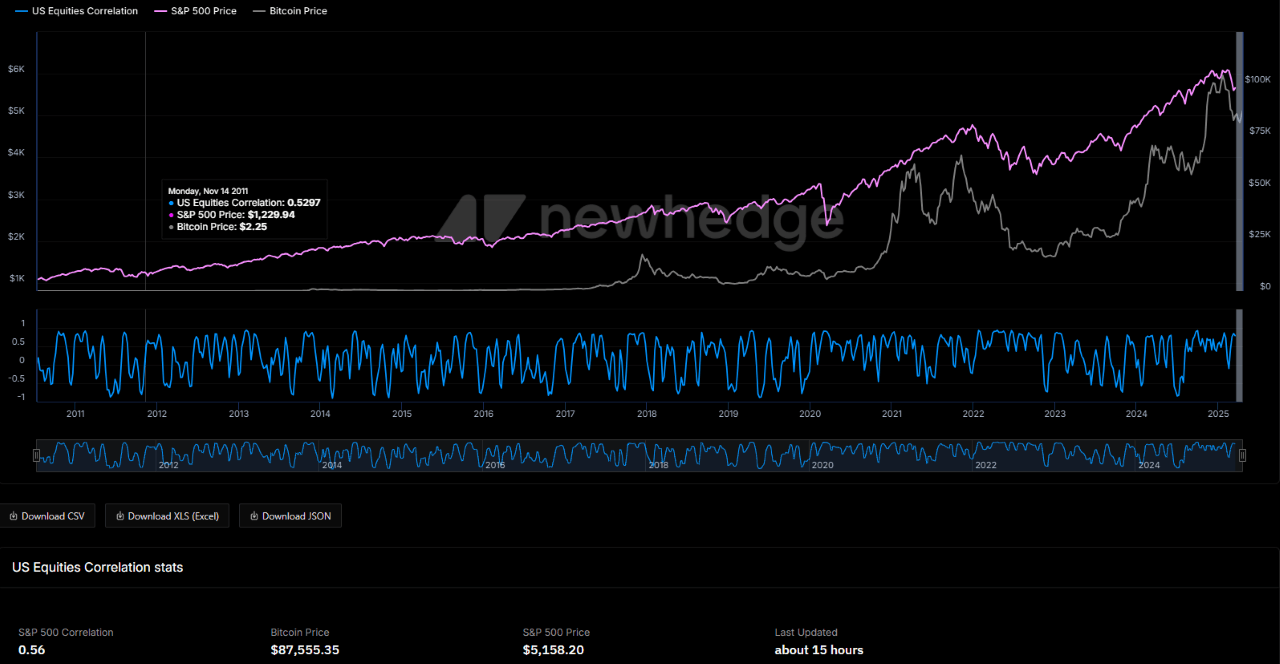

Despite all of this, the S&P 500, Dow, and Nasdaq are all enjoying gains of more than 2% as of this moment. And Bitcoin? Oh, Bitcoin has been gallivanting past $91K. While Bitcoin still shares a tender bond with stocks at about 56% correlation, that relationship is starting to fray. A full decoupling by year-end? Well, let’s see if the stars align.

Read More

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Oblivion Remastered – Ring of Namira Quest Guide

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Solo Leveling Arise Amamiya Mirei Guide

- Serena Williams’ Husband’s Jaw-Dropping Reaction to Her Halftime Show!

- Avowed Update 1.3 Brings Huge Changes and Community Features!

- Ryan Reynolds Calls Justin Baldoni a ‘Predator’ in Explosive Legal Feud!

2025-04-22 19:30