Alright, gather ‘round for your daily dose of crypto chaos, served piping hot with a splash of skepticism.

So Strategy—yeah, the company formerly known as MicroStrategy, like some kind of crypto witness protection program—is at it again. They just snagged 15,355 more bitcoins. Because what else do you do when you have piles and piles of digital gold? You buy more, like it’s a Black Friday sale at a Bitcoin Trader’s thrift store.

Strategy Hoards $1.42 Billion in Bitcoin Like It’s Bodega Snacks

Last week, Strategy forked over $1.42 billion at a casual $92,737 a pop. They now supposedly own over half a million bitcoins—553,555 to be exact—which is apparently worth $52.7 billion. And their “unrealized profit”? A casual $14.8 billion. Unrealized profit sounds like a fancy way of saying “we’re gonna brag about money we haven’t touched yet.” Classic.

“By growing its Bitcoin stash, the company keeps flexing as a crypto heavyweight, attracting eyeballs from investors and analysts alike,” says Phoenix, sounding like a guy who just found out the new iPhone costs $1,000. “Also, Strategy’s a Nasdaq 100 stock, so you know they wear suits and probably drink fancy espresso.”

Meanwhile, 21 Capital, Jack Mallers’ baby, is doing its best viral TikTok dance trying to get other companies to jump on the BTC bandwagon. They scraped together $3 billion from SoftBank and friends. So now we’ve got these two gladiators duking it out: Strategy, the old guard hoarder, and 21 Capital, the new kid who thinks size doesn’t matter… or at least the bitcoins per share kinda does.

BitStrategy, a Strategy shareholder, piped up on X (that’s Twitter, if you’re living under a rock without a phone) to throw shade at 21 Capital. Spoiler: It wasn’t friendly.

Bitcoin Treasury Drama: More Tense Than a Family Dinner

BitStrategy basically said, “Look, these guys are biting at our heels, thinking they can out-Bitcoin us. Good luck with that!”

“They’re trying to highlight some weakness in our fortress while showing off how great *they* think they are, hoping to steal the spotlight and investment dollars,” BitStrategy snarked.

Strategy put out these nifty performance measures: BTC Gain and BTC $ Gain, like some sort of crypto KPIs. Bitcoin Gain is basically “how many bitcoins did you *really* make,” and Bitcoin $ Gain converts that to dollars because apparently “in Bitcoin we trust” is only good for tattoo ideas.

They’re basically saying, “You can fake a decent BTC yield metric, but you can’t fake the real gains.” It’s like bragging you read a lot of books but nobody cares unless you can quote something.

But enter analyst KenjiKoshu, the guy who’s thought more about this than you probably have. He argues that despite Strategy’s mountains of Bitcoin, smaller outfits like 21 Capital might appear shinier in Bitcoin-per-share terms, and shareholders kinda like shiny.

“Yeah, Strategy’s got the goods, but when you slice it up per share, smaller companies can look like the prom queen,” he quipped.

BitStrategy responded that looking at the whole company’s Bitcoin load is more important than nitpicking per share—sort of like judging a pizza by the whole pie, not just one slice.

And there’s zero consensus on what to use to value Bitcoin companies, so everyone’s kinda guessing… like trying to read tea leaves while blindfolded.

Mid-drama, BeInCrypto snagged a quote from Max Keiser—the guy who helped El Salvador slap Bitcoin on its monetary mixtape:

“Corporate survival means you’ve gotta ‘Saylorize’—that’s Strategy’s playbook—or you’re toast,” Keiser declared, presumably with a “Deal with it” smirk.

Basically, fiat currency is on the naughty step, stablecoins are holding the door open just barely, and Bitcoin’s the new sheriff in town. Whether you like it or not.

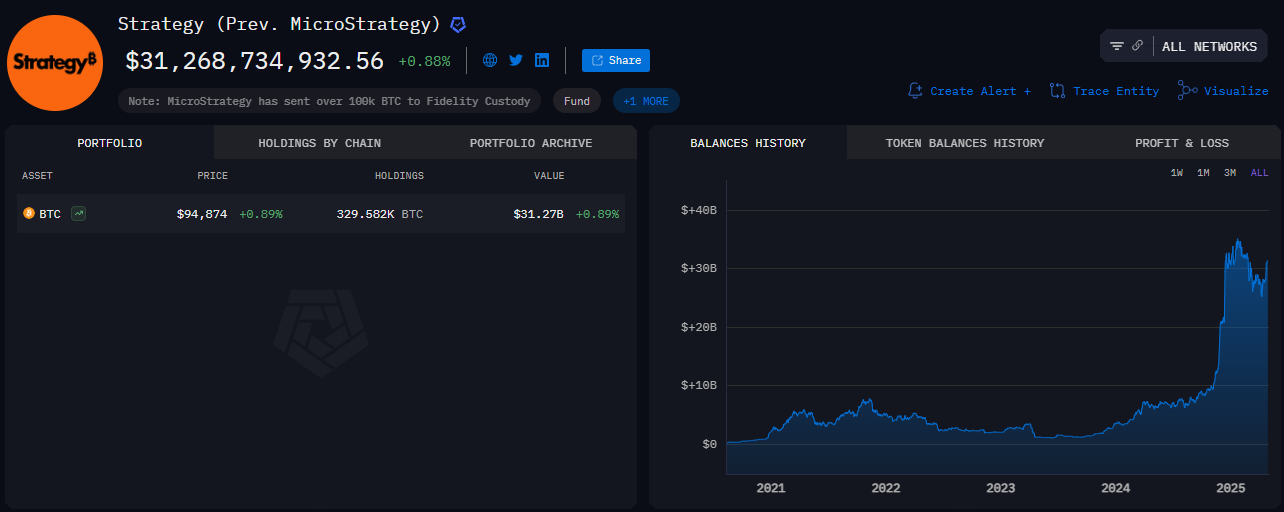

Chart of the Day

Crypto Equities Pre-Market Overview

| Company | At the Close of April 25 | Pre-Market Overview |

| Strategy (MSTR) | $368.71 | $373.50 (+1.30%) |

| Coinbase Global (COIN) | $209.64 | $208.71 (-0.44%) |

| Galaxy Digital Holdings (GLXY.TO) | $20.63 | $20.54 (-0.44%) |

| MARA Holdings (MARA) | $14.30 | $14.41 (+0.77%) |

| Riot Platforms (RIOT) | $7.77 | $7.84 (+0.90%) |

| Core Scientific (CORZ) | $8.31 | $8.37 (+0.72%) |

Read More

2025-04-28 17:38