Last week, digital asset funds swallowed a whopping $3.4 billion in inflows—third largest ever—because apparently, when tariffs get spicy, people go hunting for shiny internet money.

Bitcoin and Ethereum Throw a Party, Everyone’s Invited

According to Coinshares’ fund flows report, digital assets didn’t just have a good week—they had a blockbuster, with $3.4 billion strolling into the party like it owns the place. The culprit? Investors treating cryptocurrencies as their new “safe place”—the kind you usually find behind grandma’s basement door during a family spat.

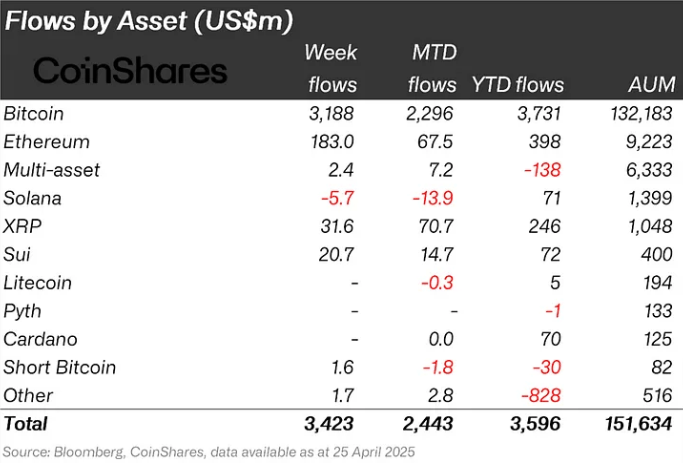

Bitcoin hogged the attention like that one cousin who always shows up with cash—$3.18 billion worth, pushing total crypto assets to $132 billion. That’s a figure not seen since February 2025, which feels like yesterday but also kind of like before the invention of sliced bread.

Meanwhile, Ethereum decided to rejoin the party after ghosting for eight weeks, netting a modest $183 million inflow. Altcoins? Mostly wallflowers. Solana was that one guy who left early, coughing up $5.7 million, while XRP and Sui bounced in with $31.6 million and $20.7 million like they actually wanted to be noticed.

On the international stage, U.S. investors acted like overachievers, throwing in $3.3 billion, with Germany and Switzerland tagging along politely. Blockchain equities got a gentle boost too—$17.4 million on bitcoin mining ETFs, because mining for cryptos is apparently the new gold rush, minus the pickaxes and questionable hygiene.

All in all, this crypto frenzy seems to confirm one thing: when the economy gets messy, people would rather gamble on digital coins than, say, a stable savings account. Because who needs predictability when you have memes and moonshots?

Secure your internet browsing with a NordVPN subscription. [Learn more](https://pollinations.ai/redirect/432264)

Read More

2025-04-29 00:08