It seems the corporate world has suddenly developed a fondness for Bitcoin. Not a passing infatuation, mind you, but a full-blown frenzy, akin to a toddler discovering the joys of sticky sweets.

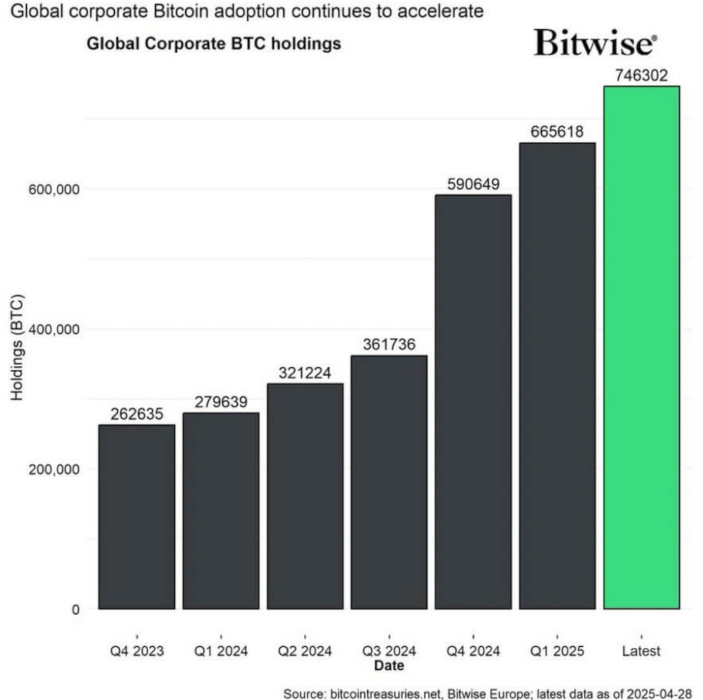

In a move that would make your grandmother’s knitting club jealous, companies have gone on a buying spree of such proportions that the total Bitcoin stashed away by corporate entities has now ballooned to a mind-boggling 746,302 BTC. This, my dear Watson, is more than what the entire herd of corporations managed to accumulate during the combined quarterly dance between Q4 2024 and Q1 2025. Who needs a diversified portfolio when you’ve got Bitcoin, eh?

Corporate Bitcoin Reserves: Now in the “We’ve Tripled in a Year” Club

Hold onto your monocles, because here’s the kicker: in the month of April alone, corporate bigwigs managed to snatch up a whopping 96,000 BTC. Not to be outdone by the mere plebs, another 13,600 BTC made its way into circulation courtesy of mining rewards. In total, we’re looking at over 100,000 BTC getting added to corporate treasure chests. Surely the treasure hunt has reached fever pitch!

Now, you may be wondering, “What’s the big deal?” Well, back in the golden days of Q1 2024, corporate Bitcoin holdings were a humble 279,639 BTC. Fast forward just over a year, and these numbers have more than tripled, leaving us with a tale of corporate Bitcoin adoption that’s moving faster than a butler fleeing a dinner party.

Dragosch, a rather astute observer of corporate shenanigans, has chimed in, saying that Bitcoin adoption among corporations is accelerating faster than a jet-powered squirrel on a mission. A “transformative shift” in institutional strategy, he calls it. I say, it’s just a case of everyone jumping on the same wagon before it gets too crowded!

Read More

2025-04-29 23:55