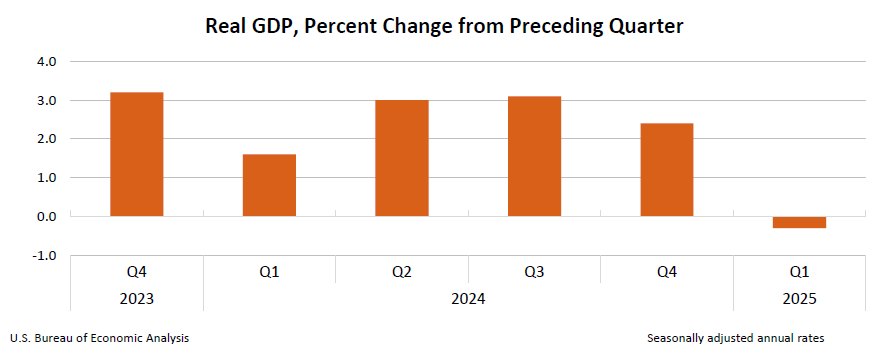

Well, well, well. The U.S. economy shrank by a modest 0.3% in the first quarter of 2025, all thanks to companies scrambling to import goods like a kid in a candy store after Trump’s global trade war shook up the market.

Bitcoin Shrugs Off US Economy’s Faint Heartbeat

The world’s largest economy has gone on a little diet, shrinking by 0.3% during the first quarter of the year, according to the U.S. Department of Commerce’s latest “oopsie” report. Naturally, economists are pointing fingers at President Donald Trump—who else would they blame, right?

It turns out that companies, in their infinite wisdom, decided to go on a shopping spree, front-running Trump’s controversial tariffs. Imports surged like a stampede of caffeinated squirrels, and, well, GDP took a hit. Because, as we all know, imports subtract from GDP like an overzealous librarian taking books off the shelf before anyone’s done reading them.

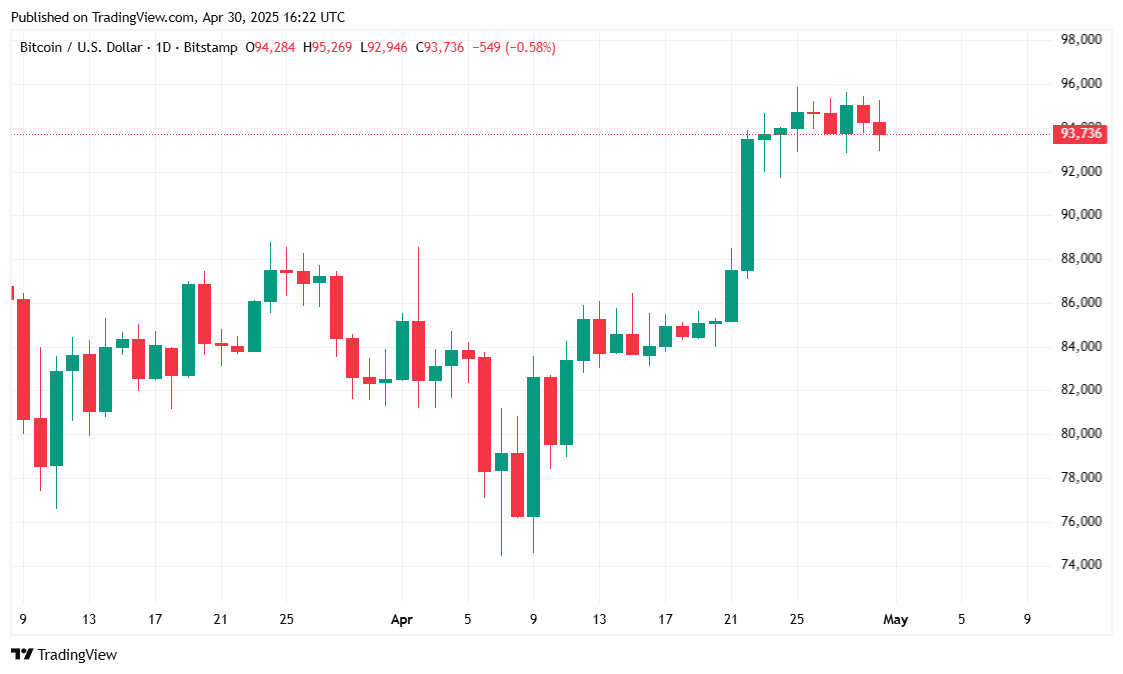

Meanwhile, traditional markets had a little freak-out. The S&P 500, Nasdaq, and Dow Jones Industrial Average all took a dive, dropping 0.91%, 1.27%, and 0.61%, respectively. But, oh, Bitcoin? It just kind of stood there, casually hovering around $94K, like that friend who refuses to get stressed even when everyone else is in a panic.

Trump, ever the optimist, blamed the whole thing on his predecessor. Because why not? It’s tradition.

“We have to get rid of the Biden overhang,” said Trump, in what is clearly the best advice for any bad situation. “It’s going to take time, but when the boom begins, it will be like no other. Just be patient.” Sure, because patience has always been America’s strong suit, right?

Market Metrics: The Good, the Bad, and the Slightly Confused

Bitcoin is sitting pretty at $93,721.16, according to Coinmarketcap. Sure, it took a modest dip of 1.48% over the past 24 hours, but it’s still up by 0.75% over the week. It’s like the tortoise in a race, just moving at its own pace and refusing to acknowledge anyone else’s drama. The price has been bouncing between $92,979.64 and $95,485.41 all day—stubbornly ignoring the chaos around it.

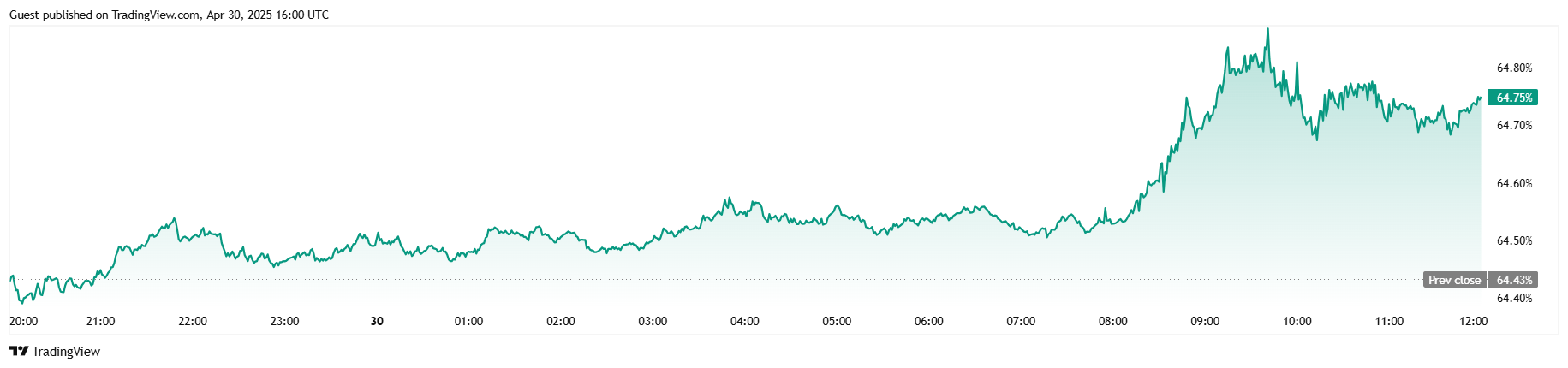

Despite the slight dip in price, Bitcoin’s trading volume has been positively bustling, up 26.22% to $30.67 billion. However, market capitalization dipped by 1.03% to $1.86 trillion. And yet, Bitcoin’s dominance over the crypto market crept up by 0.50 percentage points to 64.75%. So, you know, just casually ruling the world.

In the world of derivatives, Coinglass data shows that total Bitcoin futures open interest hit $62.48 billion, creeping up by a minuscule 0.02%. Liquidation activity was almost nonexistent—only $276,630, with long and short positions split like an uncomfortable family reunion. This balance of liquidations suggests that traders are as confused as ever, waiting for a clearer sign from the cryptocurrency gods before making their next big move.

Read More

- PI PREDICTION. PI cryptocurrency

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How to Get to Frostcrag Spire in Oblivion Remastered

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Is the HP OMEN 35L the Ultimate Gaming PC You’ve Been Waiting For?

- Whale That Sold TRUMP Coins Now Regrets It, Pays Double to Buy Back

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

2025-04-30 20:02