- U.S. Senate advances stablecoin regulation with GENIUS and STABLE Acts under the Trump administration. Marvel at the brilliance!

- Stablecoin activity surges, signaling potential market rebound amid growing regulatory clarity. Or is it?

In a move that has, no doubt, sent shockwaves through the world of crypto enthusiasts and conspiracy theorists alike, Senate Majority Leader John Thune – the man whose name sounds like it was plucked straight out of a bad sci-fi novel – has decided to push forward with stablecoin regulation. How very bold of him, right? A move to be applauded by many and ridiculed by just as many as the world braces for the upcoming Memorial Day holiday.

U.S. lawmakers target Stablecoins

As reported by Politico (who, by the way, never misses an opportunity to dive deep into legislative dramas), Thune revealed during a private meeting with his fellow Republicans that the Senate will soon discuss the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act. Genius indeed. No, not a typo, we are indeed living in a time where legislation has “GENIUS” as its catchy acronym. A far cry from the days of dry, boring names.

The GENIUS Act, introduced in February by Senator Bill Hagerty – yes, that’s right, another Bill in the mix – has already been passed by the Senate Banking Committee. What a whirlwind!

But don’t get too excited. While this move seems to offer some hope for clarity, it’s all part of a much larger, more ominous push within the U.S. government to tame the beast that is the stablecoin market. With digital assets gaining global traction, both inside and outside the U.S., it’s almost as if Washington had no choice but to get involved. Finally. Welcome to the party, folks.

Thune, a man of few words when it comes to crypto, has remained mostly tight-lipped about anything directly involving crypto since Trump’s first 100 days in office. That said, behind the closed doors of power, things are stirring. Trump, ever the executive order enthusiast, has made some not-so-secret moves: a national crypto reserve and regulatory framework for stablecoins. Ah, yes, the sweet smell of policy in the making. It’s almost poetic.

One of Trump’s early orders, issued on January 23rd, kicked off a working group tasked with exploring this brave new world. The crypto future is upon us! Or is it?

Details of the bill

And what do we have here? Two complementary bills: the GENIUS Act and the STABLE Act. Ah yes, two acts, one noble cause. If the GENIUS Act becomes law, the issuance of payment stablecoins will be controlled, limited to only those approved entities. Big Brother is watching! And not just any Big Brother, but one who comes with a shiny bill and a clipboard.

Meanwhile, in a curious twist, Trump’s possible connection to World Liberty Financial – the company responsible for the launch of the USD1 stablecoin – has sparked political worries. Could it be that the President’s latest financial interest in the crypto world is a little more… self-serving? Could there be conflicts of interest lurking in the shadows? The mind boggles.

Nevertheless, despite all this, stablecoins are on the rise. How charming, how timely!

Stablecoins current status

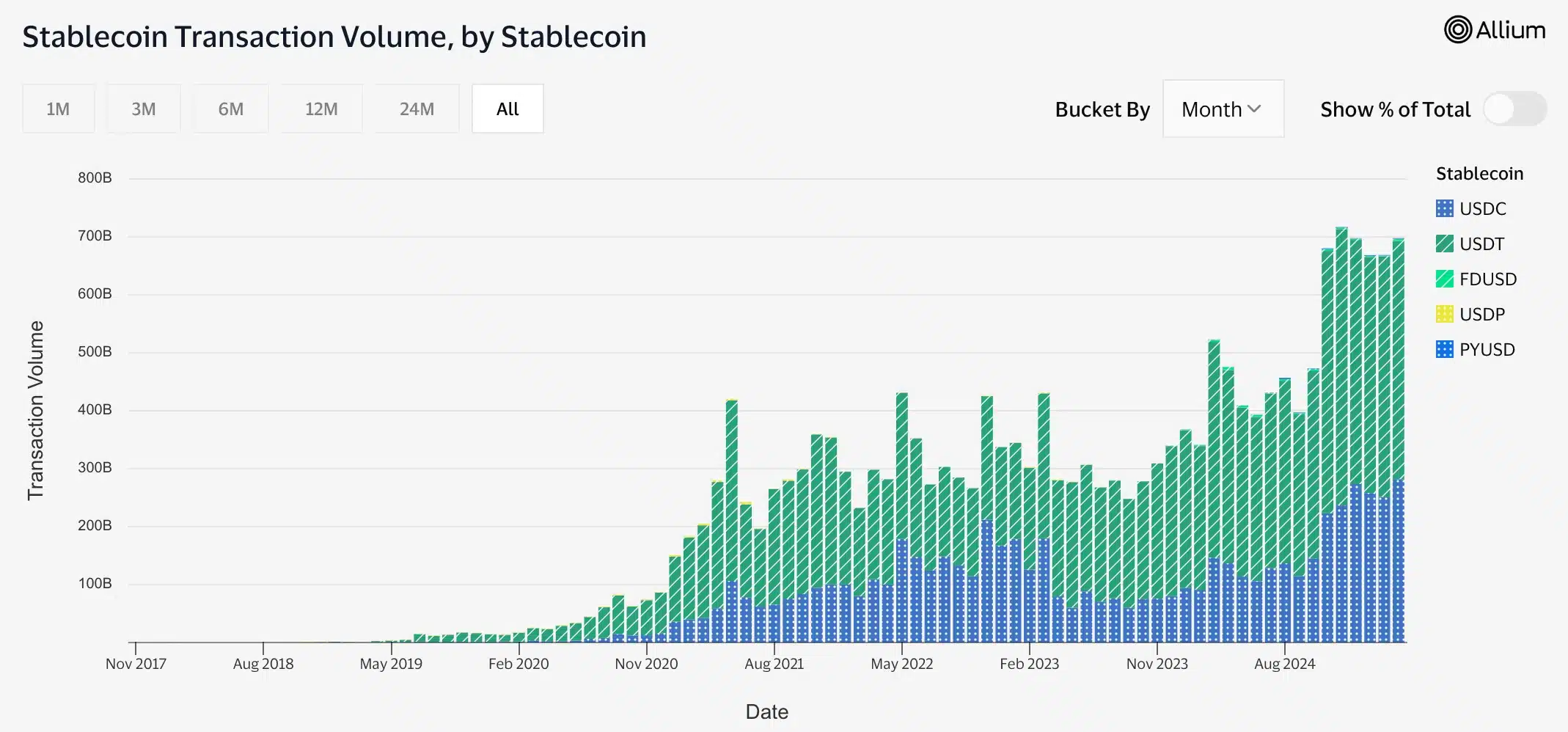

Hold on tight, folks – the data is about to blow your mind. According to VisaOnChainAnalytics (that sounds official, right?), stablecoins recorded a jaw-dropping $697.69 billion in transaction volume in April alone. Tether’s USDT and Circle’s USDC are leading the charge. Oh, how the mighty have risen.

But wait, there’s more: USDT reserves on Binance have been growing. Don’t worry, experienced traders know what this means. It’s a subtle signal of market activity returning, with the same old patterns. You know the drill – more buying activity and, who knows, maybe even a broader crypto market recovery.

So, while the market sits on its cautious little perch, the quiet hum of potential growth builds beneath the surface. Both regulation and capital readiness are quietly fueling this rise. Stay tuned for the next chapter in this epic saga, where financial innovation meets regulation. Or does it?

Read More

- Gold Rate Forecast

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- OM PREDICTION. OM cryptocurrency

- Kanye West Praises Wife Bianca’s Daring Naked Dress Amid Grammys Backlash

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- Meet the Stars of The Wheel of Time!

- Why Gabriel Macht Says Life Abroad Saved His Relationship With Family

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- EUR PKR PREDICTION

2025-05-01 04:16